[ad_1]

The Director of the Export-Import Bank, Sang-gyu Bang (from left), the Minister of Lands, Infrastructure and Transport, Kim Hyun-mi, and the President Lee Dong-geol of the Industrial Bank, etc., spoke out after the ministerial meeting related to strengthening industrial competitiveness held at the Seoul Government Complex on the 11th. The government decided to resell Asiana Airlines after normalizing Asiana Airlines led by KDB and Mercury. / News 1

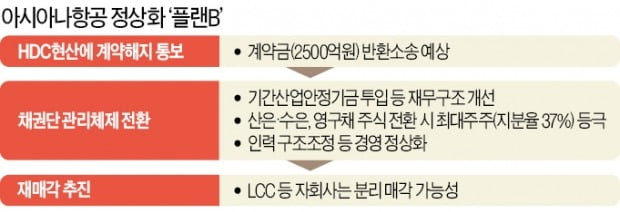

The government decided to normalize management by transfusing 2.4 trillion won from a key industry stabilization fund (initiative fund) to Asiana Airlines, and then promoting mergers and acquisitions (M&A) again. Asiana Airlines rejoins the creditor management system after six years. The M&A contract that Kumho Industrial decided to sell Asiana Airlines to HDC Hyundai Development Company was officially canceled.

The government held a ministerial meeting related to strengthening industrial competitiveness on the 11th and decided to put Asiana Airlines in the creditor management system in the form of a “self-contract”. Kumho Industrial notified HDC prefecture to terminate the contract. Asiana Airlines’ mergers and acquisitions, which began with the selection of HDC prefecture as the preferred negotiator in November last year, failed in 10 months.

On the same day, the Korean Development Bank held a deliberation committee on the operation of the preliminary fund and decided to provide 2.4 trillion won to Asiana Airlines. 80% (1.92 trillion won) of working capital loans and 20% (480 billion won) of permanent convertible bonds are provided.

Sang-eun Choi, Vice President of Saneun, said: “It is a scale that does not require additional support for a considerable period of time,” but said: “If Crown 19 is prolonged, additional measures can be prepared in consultation with the government.” .

The preliminary fund is a fund raised by the government in May to support large corporations that have struggled due to the Corona 19 crisis, and Asiana Airlines became the first beneficiary. Asiana Airlines posted an operating loss of 443.7 billion won last year and 2685 billion won in the first half of this year, with a debt ratio of 2291.3% (as of the end of June). Companies that have received the draft fund must promise and keep 90% of their employment for six months, banning dividends and banning executive salaries.

When the creditors, the Industrial and Export-Import Bank, convert the guaranteed permanent bonds into shares in the process of supporting Asiana Airlines, the participation will reach 37%, becoming the largest shareholder. The creditors plan to normalize the management of Asiana Airlines by adjusting routes, reducing costs and reorganizing, and then promoting resale. Asiana Airlines signed a voluntary agreement in the Kumho Group restructuring process in December 2009 and graduated in December 2014 after five years.

KDB also decided to provide additional support to Kumho Group, which has suffered severe financial difficulties due to the failure of mergers and acquisitions. The express bus operating division of Kumho Express was divided and insured as collateral, and it was decided to lend 120 billion won of insufficient funds by the end of this month.

2.4 兆 route entry / reduction … Asiana, resale procedure next year after restructuring

Asiana Airlines will become a creditor management system again after 6 years

The merger and acquisition (M&A) of Asiana Airlines, Musan, has placed a great burden on the airline industry and creditors. Creditors agree that they cannot have Asiana Airlines for as long as Daewoo Shipbuilding & Marine Engineering and Daewoo E&C. In particular, the airline industry has many contacts with consumers and must maintain a global network, but creditors do not have any operational knowledge. That is why there is an expectation that if only a certain level of candidates are available for the acquisition, the company will promote resale in the near future.

Until the draft fund meeting

Asiana Airlines’ existing M&A contract was canceled and the confirmation process for a new Plan B led by the government and creditors took place on the 11th. On the afternoon of that day, the government held a secret meeting of ministers related to strengthening industrial competitiveness, chaired by Vice Premier Hong Nam-ki and Minister of Strategy and Finance, and confirmed the plan to normalize Asiana Airlines. The meeting was attended by Hyeon-mi Kim, Minister of Land, Infrastructure and Transport, Seongsu Eun, Chairman of the Finance Committee, Ho-Seung Lee, Head of Economic Affairs of the Blue House, Seok-Heon Yoon, Chairman of the Oversight Service Finance, Korea Financial Supervision Service, Lee Dong-geol, President of Industrial Bank and President of Export-Import Bank Sang-Kyu Bang. Immediately after the meeting, the contracting entities Kumho Industrial and Asiana Airlines immediately informed their partner, HDC Hyundai Development, of the cancellation of the contract.

The Bank of Korea immediately opened the Basic Industry Stability Fund Management Deliberation Committee and decided on a proposal to provide a preliminary fund of 2.4 trillion won to Asiana Airlines. The committee members said: “If the mergers and acquisitions of Asiana Airlines fail, huge losses are expected, such as massive unemployment and a decline in the competitiveness of the domestic aviation industry.”

Of the 2.4 trillion won in the draft fund, Asiana Airlines will use 300 billion won to make up for the immediate shortage of funds. The remaining 2.1 trillion won is a reserve fund in case the credit rating goes down and claims to pay off debts spill over. The bank said: “We are prepared for this because we are more concerned about the situation that the credit rating will decline due to the failure of mergers and acquisitions. If the credit rating of Asiana Airlines is maintained, the size of the loan could be reduced considerably.”

“Resale from the first half of next year”

The Korea Development Bank and the Export-Import Bank will improve the financial structure of Asiana Airlines and then begin standardization work. When the permanent bonds of Asiana Airlines held by the state banks Saneun and Mercury are converted into shares, the stake reaches 37%, becoming the largest shareholder. It means that Asiana Airlines will temporarily become a “state-owned company”.

Sang-eun Choi, Vice President of Saneun, said: “Additional self-help plans will be route adjustment, internal cost reduction, organizational reorganization, etc.” and said: “The restructuring of the workforce is not urgent and will be considered in the future.” Companies that have received a blood transfusion from the preliminary fund are subject to the condition of maintaining 90% of employment for 6 months. Asiana Airlines has saved about 180 billion won in labor costs by the end of October through rotating leave and the return of executive salaries since the beginning of this year.

It is unknown that the issue has yet been confirmed, although the differential reduction of Asiana Airlines shares is being reviewed. There are many administrative matters to be carried out, such as the resolutions of the general shareholders’ meeting, to carry out the differential reduction. Vice Chairman Choi said: “We will thoroughly review the financial status of Asiana Airlines at the end of the year to determine whether existing shareholders will lose money,” he said. “At this stage, the statement is inappropriate.”

After the relationship with HDC County was nearly distorted, KDB made the decision to create a “candidate group” company through various channels, but has yet to make significant revenue. This means that there will be no conditions for immediate resale this year. Consequently, the resale is expected to take place from the first half of next year. Saneun said: “The possibility of separate sale of Air Seoul, Air Busan and resorts is open.”

Reporter Lim Hyun-woo / Lee Sang-eun [email protected]