[ad_1]

When the government announced that it would contain incentives for the participation of the general public in the New Deal funds of a political nature, it is worth noting whether the stagnant market for public offering funds will regain vitality.

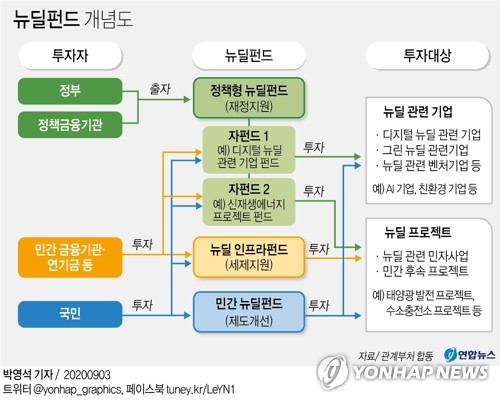

According to related government ministries on the 6th, the general public can invest in a policy-type New Deal Fund through a private public offering fund, or join a New Deal Infrastructure Fund or a private New Deal Fund.

When selecting a secondary fund manager for a policy-type New Deal Fund, it is planned to give preference to managers who suggested participating in private public offering funds.

It is a policy that government finance first make subordinate investments so that ordinary investors get the effect of guaranteeing the principal up to 10% of losses.

In the case of the ‘New Deal Infrastructure Fund’, in order to induce the expansion of public offering methods in the infrastructure fund market, which focuses on private equity funds, it was decided to provide a separate tax benefit low rate (9%) only to public offering funds.

Specialized venture capital funds have a minimum investment of 100 million to 300 million won, which makes it difficult for ordinary investors who are not high-value assets to access, and the regulations that apply in asset management are lower than those. of public offering funds.

Thus, asset managers are interpreted to have prepared various incentives to design public offering funds so that many ordinary investors can invest in New Deal funds with relative safety.

The government expects the participation of the general public to reach a maximum of 1 trillion won in the political-type New Deal Fund worth 20 trillion won.

The key is how well the New Deal Fund will succeed with ordinary investors.

In the case of a policy-type New Deal Fund, investors seeking security are assessed as attractive enough as promoted by the government, since “in fact, it has a primary guarantee effect.”

The policy-type New Deal Fund is a structure in which the government and political financial institutions invest 35% on average to equal 65% of private funds, and about 10% of government finances are subordinated to absorb risks.

For ordinary investors, even if the rate of return drops to -10%, the capital can be guaranteed.

Finance Committee Chairman Eun Seong-soo emphasized in a briefing on the 3rd, “It is not guaranteed to be the principal, but it has the effect of guaranteeing the principal.”

Unlike private equity funds that have recently lost market confidence due to illegal activities and the massive insolvency of some asset managers, policy-type New Deal funds are funds created by the government and managed by policy finance institutions. so there is no expectation that the possibility of financial accidents or illegal activities is small. It’s possible.

Hwang Se-woon, a researcher at the Capital Markets Research Institute, said: “Since the policy-type New Deal Fund is very safe, it is highly likely to be successful even if the expected return is in the mid-range of 2%. “.

On the other hand, concerns about whether the New Deal Fund is attractive enough to absorb market liquidity or whether it will be able to generate profits adequately are also unpleasant.

Together with the government, the Democratic Party initially planned to establish a political-type New Deal Fund with a “principal guarantee + a yield of about 3% per annum,” but criticism slightly lowered the target as of today.

In a briefing, President Eun said: “It is difficult to say in advance what the target rate of return is, but the policy-type New Deal Fund is expected to seek a higher rate of return than the interest on Treasuries. “.

Currently, the interest rate on 1-year term deposits is 0.94%, and the 3-year Treasury bond and 10-year Treasury bonds are 0.92% and 1.52%, respectively. .

It is pointed out that even if security is guaranteed, it is difficult to attract investors’ attention if the rate of return is too low.

Due to the nature of the New Deal sector, uncertainties are high and the investment period is long, which can be a factor in making investments hesitant.

This is because it is difficult for ordinary investors who do not have many additional funds to keep their money around the neck for a long time.

The government has suggested hydrogen charging stations, hydrogen and electric vehicle development projects, and green and renewable energy facilities as targets for the fund’s investment, but it is assessed as an area that requires a certain amount of time to generate profits.

Right now, the party government is pushing vigorously for the New Deal Fund, but there is no doubt that if the regime changes, it will become languid like the ‘Green Fund’ of the Lee Myung-bak administration or the ‘Fund of Unification ‘of the Park Geun-hye administration.

Furthermore, it cannot be ruled out that the policy-type New Deal Fund loses more than 10% beyond the government’s loss-absorbing range.

“The government mainly absorbs losses, not profits,” said Shin Seong-hwan, a professor of business administration at Hongik University. “If the fund is managed with a political mindset rather than a private investment mind, it can turn into money blind and without any profit.” said.

Meanwhile, experts predict that even if the New Deal Fund succeeds, it will be difficult to lead to the vitalization of the entire collapsed public offering fund market.

According to the Financial Investment Association, the amount of public offering funds was set from 204 trillion out of 2.654 billion won at the end of 2014 to 237 trillion out of 200 billion won at the end of 2019, only growing by 16.1%. in the last five years.

During the same period, the amount set for private equity increased by 138.4% from 177.3 trillion won to 412 trillion of 49 billion won.

Professor Shin said: “The performance of public offering funds is low, and they have appeared in many convenient alternative markets such as exchange-traded funds (ETFs).” I will.”

Researcher Hwang also predicted: “The New Deal Fund is a fund that can be quite popular, but there is a high limit for its domino effect to show up in other public offering funds” and “the rest of the market for fund public offering continues to contract. “

/ yunhap news