[ad_1]

Coupang, an e-commerce company, made a splendid debut on the New York Stock Exchange (NYSE). The public offering, which exceeded the expected maximum price ($ 32 ~ 34), entered the market at $ 35 and ended the first day with a jump of more than 40%. Bum-Seok Kim de Coupang, chairman of the board of directors, poses in front of the exchange. / Photo = AP

Coupang, an e-commerce company, made a splendid debut on the New York Stock Exchange (NYSE) on the 11th (local time). Coupang successfully entered the first day with a share price soaring more than 40%, with a public offering that broke the expected price cap ($ 32 ~ 34) and entered $ 35. Market capitalization amounted to $ 8,850 million (approximately 1,044 trillion won) based on the closing price, making it the second highest rescue price after Samsung Electronics (market total of 489 trillion won) among nationally listed companies.

Photo = AP

NYSC investors warmly welcomed the Unicorn Coupang, which embodies the “future of distribution.”

Coupang shares, which are listed on the New York Stock Exchange (NYSE) on the same day under the ticker code ‘CPNG’, ended at $ 49.52, 41.49% ($ 14.52) more than the sale price ($ 35).

Coupang’s initial price started at $ 63.5, 81.4% higher than the public offering price. Consequently, the market capitalization once soared to $ 9.97 billion (about 111 trillion won), exceeding $ 100 billion. However, after that, the stock price gradually decreased and fell below $ 50 in the last minute.

According to Yahoo Finance, Coupang’s market capitalization was estimated at $ 8.85 billion (about 10.04 trillion won) based on the closing price. In terms of the public offering price ($ 63 billion, about 72 trillion won), it fell below SK Hynix (about 99 trillion won), but was immediately surpassed on the first day. Among the publicly traded companies in Korea, only Samsung Electronics (market capitalization 489 trillion won) has a higher market capitalization than Coupang.

Coupang will have 5 billion won in live ammunition per listing. Earlier, Coupang announced that it would issue 130 million shares (Class A common shares) of 130 million shares (Class A common shares), more than originally planned (120 million shares), by disclosing the offering price ($ 35) . Consequently, the listing will raise new funds of $ 4.55 billion (about 5.7 trillion won).

Coupang beat the record for dating app (operating program) Bumble ($ 2.15 billion) last month based on the size of the public offering, becoming the largest initial public offering on the U.S. stock market this year. . It is also the largest foreign company since the listing of Chinese information technology company Alibaba ($ 168 billion) in 2014.

Founder Kim Bum-seok Rings the Opening Bell … “Continue Investing in Innovation”

Coupang shares, which were listed on the New York Stock Exchange (NYSE) on the 11th, ended at $ 49.52, up 41.49% ($ 14.52) from the public offering price of $ 35. . Photo = AP

Coupang founder Kim Bum-seok, chairman of the board of directors, rang the opening bell for the New York Stock Exchange that day and said, “We will continue to invest in innovations such as early morning delivery.”

In an interview with CNBC that day, President Kim said, “Korean creativity has done the ‘Han River miracle'” and “I am very excited that we have become a small part of this incredible story.”

He said: “It is the largest initial public offering of foreign companies since Alibaba. This is a testament to Korea’s success story,” he said. “Korea was one of the poorest countries in the world, but today it has become the 10th largest economy in the world.”

“We will continue to invest in innovations such as early morning delivery,” said President Kim. “We will continue to invest in the Korean regional economy to create good jobs and continue to invest in technology,” said President Kim.

When asked if Coupang’s ‘Rocket Delivery’ service, which has been developed even for same-day delivery, is possible in countries other than Korea, President Kim revealed the possibility of moving forward to the country, saying: ” We have expanded this not only to areas with high population density, but also to rural areas. ”

However, Coupang is expected to focus on the domestic market for now. In an online conference with Korean correspondents in the US, President Kim said, “I can’t tell you that I don’t have that long-term dream.” There are many (for the national market) that I will dedicate to, “he said.

Regarding the timing of the change, which is attracting attention in the distribution industry, President Kim responded: “We believe it is an investment rather than a deficit” and “I will continue to invest aggressively, continuously and intentionally in the future.”

Also, the reason for listing on the New York Stock Exchange was not due to differential voting rights.

President Kim suggested that “the main reason (for listing on the New York Stock Exchange) is large-scale financing” and that “global companies go to New York, the largest market to ensure global competitiveness.” not by the differential vote.

President Kim rang the opening bell announcing the opening of the NYSE on this day. Coupang CEO Kang Seung and Park Dae-joon and Chief Financial Officer (CFO) Gerab Anand Coupang attended the event to celebrate Coupang’s listing. On the wall of the New York Stock Exchange, next to the American flag, a banner was hung celebrating the list of Taegeukgi and Coupang.

Son Jung-eui laughed … Softbank Employees ‘Jackpot’

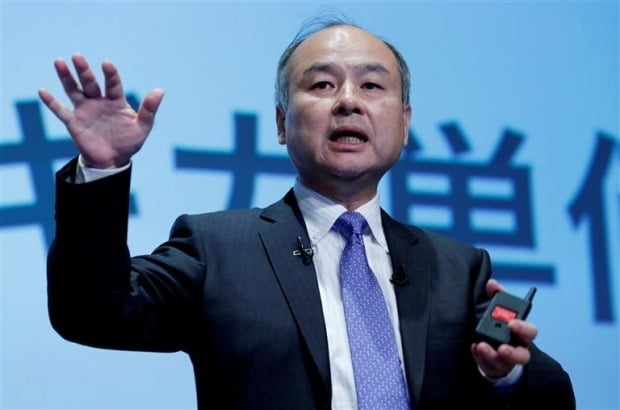

Jeong-eui Son, President of Softbank Group / Photo = Reuters

The big news is expected to continue both inside and outside Coupang. Most notable is the SoftBank Vision Fund (hereinafter SoftBank) of the Softbank Group of Japan, led by Chairman Son Jeong-eui. Softbank invested $ 3 billion in Coupang in both 2015 and 2018, and has a 33.1% stake (based on the sum of classes A and B).

In the past, Coupang’s massive shortfall at the time of investment was criticized for “ pouring water into the bottomless poison, ” but is now seen as a successful initial investment case.

After listing, considering Class A and B common shares, SoftBank 33.1%, Greenox 16.6%, Neil Meta 16.6% and founder Kim Bum-seok, Chairman of the Board of Directors, 10.2%.

Founder Kim Bum-seok, chairman of the board of directors, also took the jackpot. Based solely on the sale price ($ 35), President Kim’s stake is estimated at 7 trillion won.

Employee stock option stocks are also cause for concern. According to Coupang’s application to be listed on the U.S. Securities and Exchange Commission (SEC), Coupang’s stock option shares amounted to 65.7 million, 3,982 shares, with an average exercise price of just $ 1.95 (about 2,200 won). For example, Tuan Pam, Uber’s chief technology officer (CTO), who was hired last year, received a stock option worth $ 27.44 million.

However, among Coupang employees, the joys are expected to differ. It is reported that among the employees who joined Coupang in the early stages of the company’s founding, there are not many employees left in the company, and many employees who recently joined the company received cash instead of stock options as incentives. .

On the other hand, Coupang equates to 2 million won per person for Coupang delivery employees, regular employees of distribution centers, and regular and contract employees of Levels 1-3 who have not been granted inventory. from 5 to 5 days at Coupang and its subsidiaries. Company stock distribution plans. However, 50% of the stock is delivered if you work for one year from the date of receipt, and the remaining 50% if you work for two years.

Coupang’s advance to ‘secure live ammunition’ … Maritime war intensifies

Photo = Yonhap News

The distribution industry is paying attention to the wave of Coupangbal, which made a brilliant debut. This is because the distribution price war is expected to intensify further as plans for the construction of a distribution center, new hires and new business expansion are presented as financing for the listing. There are observations that merger and acquisition (M&A) markets like ‘Yogiyo’ and ‘eBay Korea’ may also be in trouble.

First, Coupang will secure a 3.3 million square meter (approximately 1 million pyeong) logistics site and make aggressive additional investments in transportation and logistics capabilities and IT development manpower.

Coupang plans to sequentially operate six distribution centers, including the Daegu Mega Logistics Center, from this year to 2023. Coupang said publicly: “We will invest $ 870 million to build seven regional full-registration centers in a few years.” It is a story that the expanded Coupang rocket delivery service area to Jeju Island will be more densely extended.

Additionally, Coupang is expected to be more aggressive in protecting IT developers. Last year, a dedicated developer office was established in Pangyo, but recently, an executive from the artificial intelligence (AI) division of Samsung Electronics’ wireless division moved to Coupang and it became a hot topic.

Nam Nam-hyun, a researcher at Hanwha Investment & Securities, diagnosed: “Coupang has completed the establishment of a logistics network that can respond to the entire country and its effects will be revealed.”

In the M&A market, it is worrying whether Coupang will launch into the acquisition of the second national delivery application (operations program), Yogiyo, which has been for sale. The market is paying attention to the fact that if Coupang acquires Yogiyo, a synergy may occur with Coupang Itz, a newcomer currently in operation. This is because Coupang-Itsu’s delivery service area is limited to some areas of the metropolitan area, and if Yogiyo is acquired, the applicable areas can be expanded nationwide.

Coupang’s listing on the New York Stock Exchange is expected to have an impact on the acquisition of another property, eBay Korea. Coupang’s listing affects the calculation of the corporate value of eBay Korea, the ‘Big 3’ e-commerce industry that operates Gmarket, G9 and auctions, and some have also observed participation prior to the acquisition.

Reporter Oh Jung-min Hankyung.com [email protected]