[ad_1]

‘Generational Conflict’ Over the US Stock Market

Charlie Munger noted that “stocks are not a game”

Robin Hood Refutes “Times Have Changed”

Richard Bernstein / Photo = Reuters

Richard Bernstein, a veteran Wall Street investor, criticized the investment behavior of America’s ‘Robin Hood ants’, which recently soared. It is noted that most of them are marketed at the gambling level. On social media like Reddit, there is a rebuttal that “the old big players can’t recognize that times have changed.”

According to Bloomberg News on the 3rd (local time), Bernstein noted in a report by Richard Bernstein Advisor, an asset manager he founded, that “there is a risk that so-called Robin Hood traders will destroy enormous wealth in the stock market. . ”

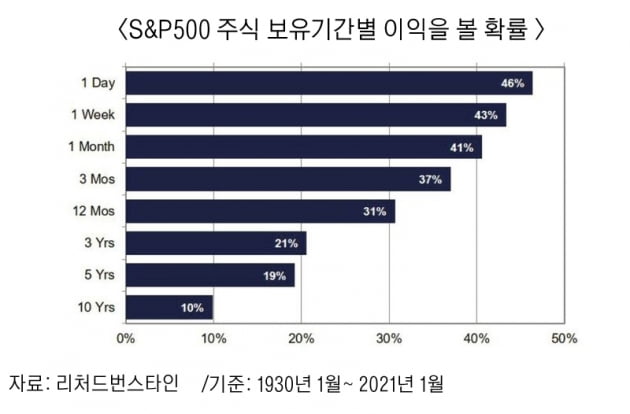

Bernstein said: “The chances of success in intraday trading are only slightly higher than the odds of winning a bet up or down with a coin flip. “It was,” he wrote in the report.

Bernstein also said last week’s Vice President Charlie Munger, Buckshire Hathaway, was right about the investment craze. Vice President Munger is a longtime partner and investor friend of Warren Buffett, Chairman of Buckshire Hathaway.

Vice President Munger said on the 24th of last month: “Some of the investment cultures these days that are cheering each other on in the online community while considering stocks to be gambling like horse racing are really stupid.”

At the time, Vice President Munger said, “Newbie investors who are misled by securities companies claiming free commissions like Robin Hood will regret it,” he said. “Especially those who are excited about buying stocks with debt will not end well.”

Bernstein wrote: “Some laughed at Munger’s point as ‘the words of an old man who doesn’t understand the stock market these days,’ but the history of the stock market shows that Mr. Munger’s words are correct.” It is noted that it is easy to lose money if you make short-term investments primarily due to rising stocks.

“Excluding investments in gold and commodities, investing time is an effective way to reduce investment risk,” Bernstein explained. “Long-term investments reduce the chances of losing money in the market.”

In recent years, well-established and well-known investors in the United States have made comments that they are concerned about the business madness of inexperienced individual investors.

On the other hand, Robin Hood and others are refuting that the single online investment culture is changing. Robin Hood previously commented on Munger’s criticism as “a comment that established investors have overlooked the recent investment culture shift among individual investors.” He then argued that “comparing investors who have entered the stock market to horse racing bettors reflects the ‘elitism’ of established investors.”

Reporter Sun Han-gyeol [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution