[ad_1]

Medytox(197,600 ↑ 30.00%)And Daewoong Pharmaceutical(157,500 + 15.81%)The ‘Botox Dispute’ which has been in the United States for six years was settled. It is an analysis that this agreement is positive for both companies. Domestic equity prices raised their ratings and price targets for Medytox and Daewoong Pharmaceutical.

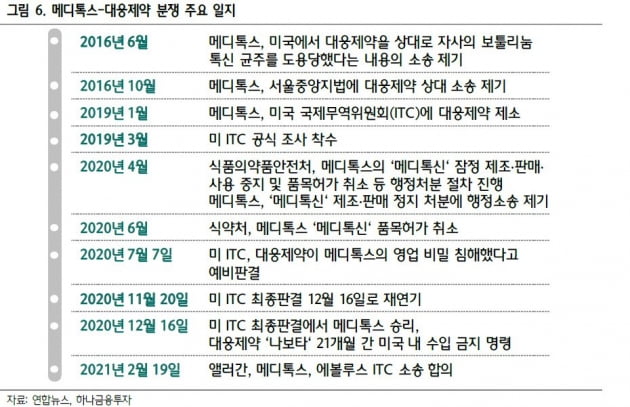

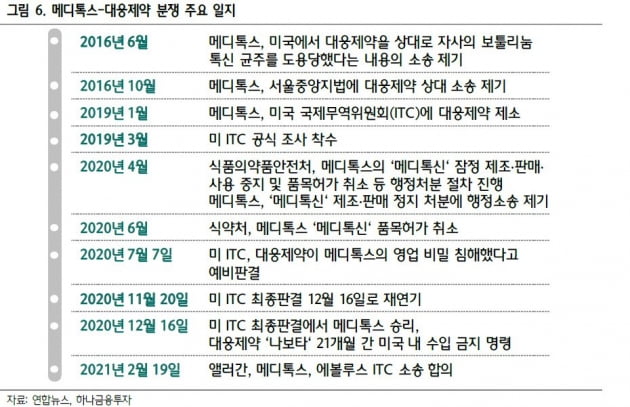

According to Medytox and others, on the 22nd, the 19th (local time), Medytox and Allergan settled a lawsuit with Ebolus, a local Nabota distributor, a botulinum toxin formulation from Daewoong Pharmaceutical, and the US International Trade Commission. USA (ITC). Following the agreement, Ebolus will be able to sell Nabota in the United States. Previously, ITC ruled on Nabota’s 21-month ban on imports into the United States.

Ebolus pays $ 35 million (approximately 38.8 billion won) over two years to Allergan and Medytox in exchange for the deal. In addition, the two companies must be paid as ordinary technology use fees (royalties) based on Nabota sales. The payment ratio between Allergan and Medytox was not disclosed.

In addition, Ebolus issues 6.67 million consecutive shares to Medytox. Medytox will have a 16.7% stake in Ebolus and will become the second largest shareholder in Ebolus.

Hana Financial Investment raised Medytox’s price target from 400,000 won to 420,000 won.

Hana financial investment researcher Seon Min-jeong said: “After ITC’s final decision, Medytox was not profitable, so the market reaction was cold. However, we hope that this deal with Ebolus will generate considerable earnings. “

Korea Investment & Securities raised Medytox’s rating to ‘Buy’ and presented a price target of KRW 300,000.

The stock market decided that this deal was good news for Daewoong Pharmaceutical. Korea Investment & Securities raised Daewoong Pharmaceutical’s price target from 115,000 won to 190,000 won.

Jin Hong-guk, a researcher at Korea Investment & Securities Co., said, “This deal has cleared up uncertainties about Nabota’s sales in the US and Europe,” and said, “We expect huge earnings growth this year.”

KTB Investments and Securities(4,500 0.00%)Raised Daewoong Pharmaceutical’s price target from KRW 130,000 to KRW 210,000.

Lee Hye-rin, a researcher at KTB Investment & Securities, said: “Nabota’s exports to the US, which were expected to be absent for a year or two, resumed and the burden of litigation costs was eased.” . on.”

Meanwhile, on the 19th (local time), when the news of the agreement was announced, Ebolus’ share price shot up 71.65% compared to the previous day to close at $ 12.29.

Reporter Park In-hyuk [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution