[ad_1]

Photo = Getty Image Bank

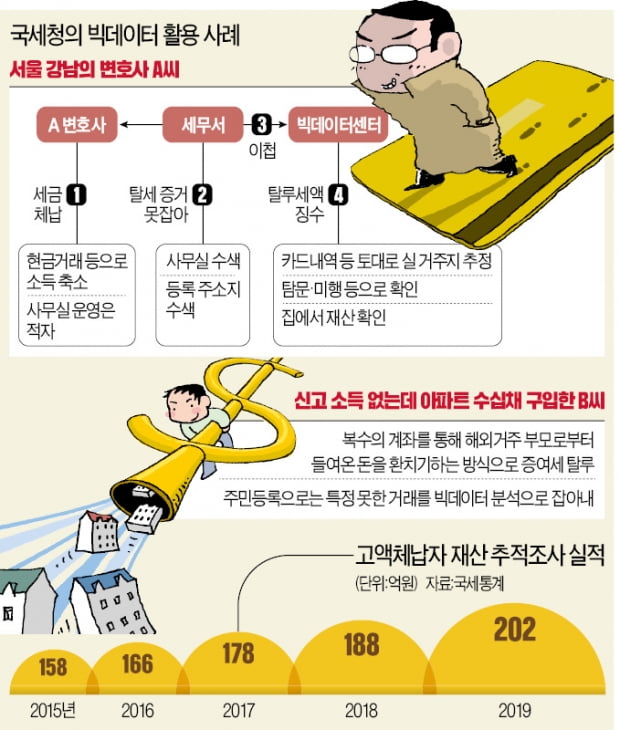

Mr. A is a lawyer with a private office in Gangnam, Seoul. You have not paid any taxes properly, including property taxes for several years. The reason was that “we are seeing a deficit due to the operation of the office.” The IRS and local tax offices have been watching Mr. A for a long time, but there was no way to prove Mr. A’s actual income and wealth. This is because, in the investigation of the apartments that were reported that they moved in, the concealment circumstances of the property could not be found. However, the Big Data Center of the National Tax Service played a role. Analysis of tax bills, cash receipts and credit card payment details revealed that there is a high possibility of living in a multi-use apartment in Bundang, Seongnam, Gyeonggi province. Finally, after further investigations such as questioning, the IRS investigation team revealed that Mr. A resides in a large 290m2 type of dwelling in the complex. The investigation team seized a hidden property worth 200 million won, including 36 million won in cash.

○ Hit rate of 85% to find residence for those who do not pay

Tax evasion techniques are becoming increasingly sophisticated, such as taking domestic assets abroad and bringing them back. As real estate prices rise and the issue of gift and inheritance tax rises, front-line tax offices are also struggling to classify evasion suspects. The Big Data Center of the National Tax Service was launched in June 2019 to deal with such changes. Based on various data secured by the National Tax Service, it is giving results in a short time. The return on tax evasion collection by tracking property from high payers increased from 17.8 billion won in 2017 to 18.8 billion won in 2018 and 20.2 billion won in 2019 .

The field that shows the most power is the determination of the actual residence of a criminal like Mr. A. There were many cases in which the front-line tax offices could not find defaulters even though they were aware of the fact that arrears, so they were unable to pay their taxes. The Big Data Center of the National Tax Service uses a variety of data to find the real residence of criminals with a high hit rate. According to the results of a pilot survey of 28 long-term offenders, 24 residences were found, with a hit rate of 85%.

In the same way, the family of Mr. B, who was living in the province, was also found on the resident registration certificate. The Big Data Center of the National Revenue Service, which judged there was no sign of living in the house where they were reported to have moved, designated an expensive apartment in Seoul as their royal residence. The National Revenue Service collected 500 million won in arrears, including 100 million won in cash.

○ Money transactions abroad are also carried out with big data

Even freelancers who evade VAT by transferring their name have a hard time escaping the surveillance network of big data. Self-employed persons are classified as simple taxpayers when their annual sales are less than 48 million won, and their tax burden is greatly reduced compared to general taxpayers who generate more sales.

Mr. C was an example of abuse of such tax laws. Whenever their annual sales exceed 48 million won, they register a business in the name of a relative or acquaintance, and then report the sales generated in their own store in the name of another store. In this way, they were able to maintain their status as simple taxpayers and receive preferential tax treatment. The Big Data Center of the National Tax Service has detected a breakthrough based on business changes and income details of the people around C.

Kang Jong-hoon, head of the Big Data Center of the National Tax Service, said: “It is a system that allows computers to select targets for evasion by entering important patterns of tax evasion that occurred in the past and inserting recent data.” , He said. “We are gradually increasing the scope of application of big data technology.”

Big data analysis also opens up the possibility of investigating areas that were not possible in the past. The representatives are Koreans who have opened overseas accounts with separate identification cards, such as passports, and foreigners working in Korea. Investigations of fund transactions and tax payments were conducted based on resident registration numbers, making it difficult to access issues outside of this category. However, the National Tax Service is developing a technology to discover the relationship between foreign accounts and a specific person through the analysis of patterns through big data.

However, it is explained that the general public should not worry about big data analytics targeting high earners and frequent backlogs. A National Revenue Service official said, “Big data only tells us how far we need to analyze, but the actual research needs to be scrutinized by IRS staff. There is a limit to the general application of verification of tax payment.”

Reporter Noh Gyeong-mok [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution