[ad_1]

Shinsegae Group Vice President Jeong Yong-jin (center) will come to Naver headquarters to meet Naver GIO Lee Hae-jin on the 28th. Naver CEO Han Seong-suk (left) comes and guides Vice President Jeong. Reporter Chu In-young

Naver and Shinsegae Group join hands. Considering the fact that the two companies have been competing for the online shopping market, it can be said that it is “sleeping with the enemy”. On the 28th, Shinsegae Group Vice President Jeong Yong-jin met with Lee Hae-jin, Naver’s Global Investment Manager (GIO) at Naver’s headquarters in Seongnam, Gyeonggi-do, to discuss specific cooperation plans. . Kang Hee-seok, CEO of E-Mart, and others were present at this event.

Shinsegae and Naver launch online collaboration

Vice President Jeong Visits Naver Headquarters

Discussion of cooperation as a stock exchange and strategic alliance.

Cortex fluctuations in the online shopping market

A trade official said: “(Naver) decided to establish a strong relationship with Shinsegae and cooperate in the online shopping market, be it similar to the CJ Logistics stock exchange or a strategic alliance.” Naver joined CJ Logistics, the number one logistics company, in October last year through a stock exchange.

Lee Haejin

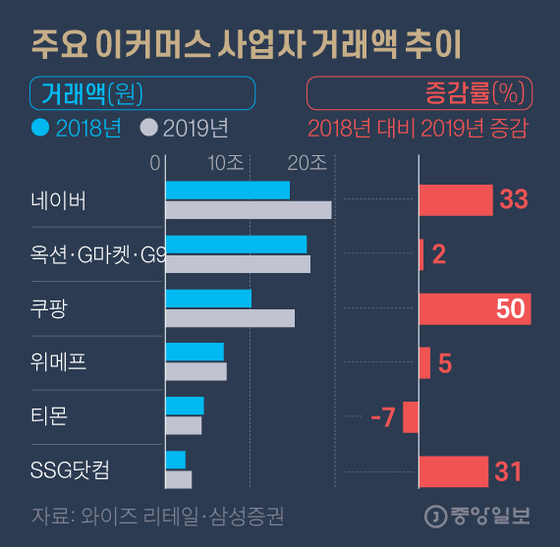

The national online shopping market is changing rapidly. The market size, estimated at 135 trillion won in 2019, is expected to exceed 150 trillion won last year. Naver is currently the number one player in the online shopping market. Naver is showing consistent results by expanding its smart store, an open market for ‘C2C’ (consumer-to-consumer transactions). At the end of September last year, the number of sellers (merchants) in smart stores exceeded 380,000. Naver Pay, a simple payment service, is also a powerful weapon. However, Naver’s ability to directly purchase products such as Lotte or Shinsegae is poor. As of 2019, Shinsegae Group’s trading volume exceeded 40 trillion won, according to the distribution industry. It’s Naver’s double.

Transactions of the main e-commerce companies. Graphic = Reporter Kim Young-ok [email protected]

Naver recently signed a business alliance with BGF Retail, which operates CU, the number one convenience store industry, to jointly promote a business platform that connects online and offline. Coupang is promoting the initial public offering and listing on the stock market this year. When the listing is successful, Coupang is expected to conduct aggressive marketing to expand its market share based on its financial power. It’s also a burden on Naver that the 11th, affiliated with SK Group, which ranks third in the business world, has partnered with Amazon, the world’s largest e-commerce company.

Shinsegae Group is focusing its capabilities on SSG.com, but it is still not enough to catch up with Naver or Coupang. Last year’s transaction amount from SSG.com is estimated at a little over 4 trillion won. When the online and offline sales channels of Naver and Shinsegae are linked, it becomes even stronger.

If the Naver and Shinsegae Group alliance emerges at the forefront of the distribution market, Lotte Group may also be in a position to join other companies. At Lotte, Chairman Shin Dong-bin has stepped forward, but has yet to achieve such results in the online shopping market.

Seongnam = Reporter Lee Soo-ki and Chu In-young [email protected]

[ad_2]