[ad_1]

On the 28th, the Financial Services Commission announced that as a first step to strengthen the insurance’s personal safety net function, it will push forward a plan to ease the burden of the insurance premium for the deputy, an essential worker.

Currently, a substitute driver can subscribe to group or individual substitute driving insurance in the event of an accident that may occur while driving. However, even if the agency driver signed up for personal insurance, the agency driver could not confirm the fact, so there was a group insurance overlap issue. Also, group insurance can only be offset when driving by a specific company, so when using two agency companies, the burden of insurance premiums is increased by subscribing to two group insurance.

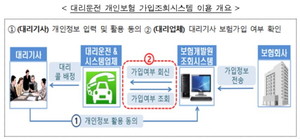

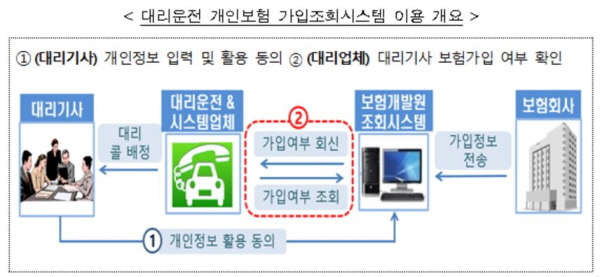

Consequently, as of the 29th, the government will open a consultation system that will confirm in real time the subscription of the agent’s personal insurance. If the agent who signs up for personal insurance accesses the system and agrees to the use of personal information and information, the agency checks if the agent has insurance coverage and assigns a proxy call.

Among surrogate driving system companies, companies and drivers using ‘Call Manor’ can access the system starting tomorrow and record personal information, and can receive a proxy call assignment starting on the 5th of next month. Rosie (Bananaple), ikonsoft and Kakao Mobility, which are proxy operating system companies, are scheduled to complete the computer connection in February and March.

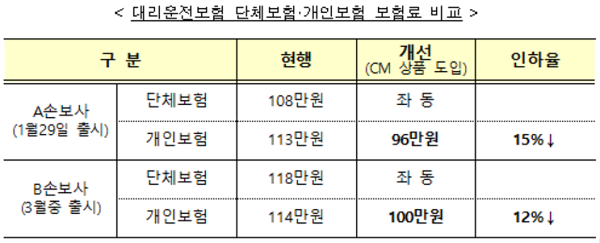

Plus, it’s also launching online-only personal insurance that reduces the premium burden. Insurance premiums are expected to be approximately 10% cheaper than current group insurance (approximately 1.1 million won per year) by reducing project costs. The personal insurance premium of an online exclusive agency of an insurance company, which will be released on the 29th, will be reduced by 15% from the current 1.13 million won to 960,000 won.

In addition, it plans to introduce a premium discount and premium system for the agency managing the personal insurance system to induce safe driving by agency drivers and further ease the burden of the insurance premium. If a substitute driver who signs up for personal insurance has an accident while driving, the premium will be added to next year’s insurance premium, conversely, the insurance premium will be discounted if there is no accident.

The management and supervision of unfair commercial practices by indirect drivers will also be strengthened. This is a response to criticism that some companies are forced to subscribe to their own group insurance and will not assign calls to drivers if they do not respond.

An official with the Financial Services Commission said: “The reorganization of the system is expected to greatly ease the burden of the insurance premium for substitute drivers who are special types of workers, and strengthen the safety of people who use the surrogate driving by inducing the safe driving of surrogate drivers. Improved business practices are expected to create a higher quality and safer proxy driving service environment. “