[ad_1]

Concerns about real and financial gaps are growing … After the storm you have to be well prepared.

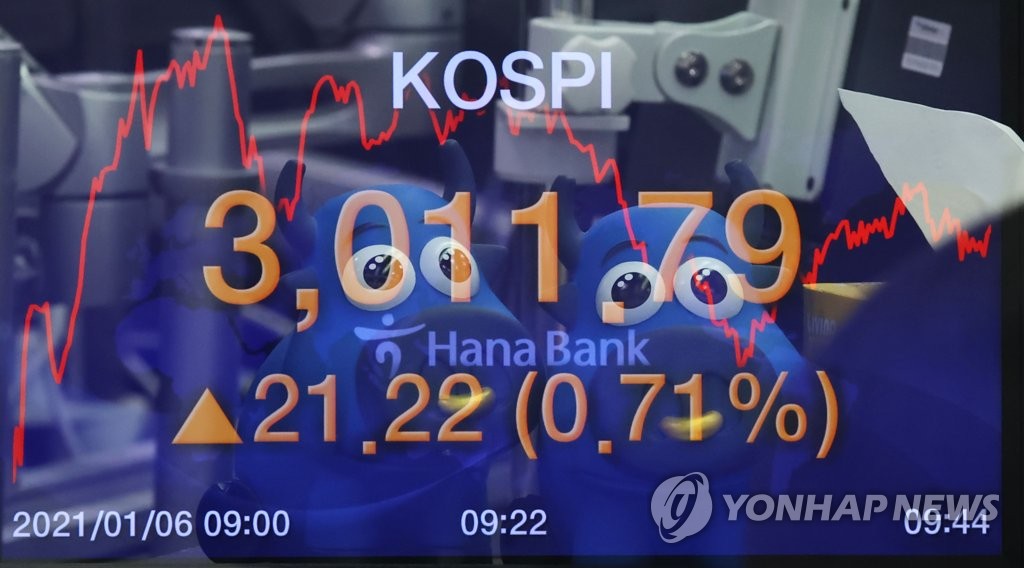

On the 6th, when the KOSPI broke the 3,000 mark for the first time in history, a grant project appeared for small businesses and the underprivileged class that suffered from the reproliferation of Corona 19.

The more the gap between the dying real economy and the fiery financial market widens, the higher the price our economy has to pay.

On this day, the government announced an emergency blood transfusion of up to 3 million won in support funds for a total of 2.8 million small business owners, including industries that banned and restricted meetings and those with annual sales of less than 400 million won, which decreased last year compared to the previous year.

It has been decided to cede up to 1 million won to 700,000 disadvantaged workers whose income has declined due to the prolonged COVID-19, such as special type (special high school) workers and self-employed.

The government, which has started the process of paying the support funds with a project announcement, will send a text message to the target audience and pay them from the 11th.

This grant is the third after the first disaster grant awarded to the general public in May last year, and the second disaster grant awarded to victims, such as small businesses and the underprivileged, before Chuseok, when the 19th Crown returned. to proliferate.

The reason the government invests huge amounts of money to pay cash is because the victims are concentrated in a “borderline situation.”

The situation is not so good that it is difficult to sufficiently alleviate the damage by indirect means other than direct cash payment.

In fact, as Corona 19 continued throughout the year and missed the end of the year, the damage from the self-employed snowballed.

Even freelancers who have quietly followed the government’s quarantine measures, such as bans and restrictions on community gatherings, such as gym operators protesting as a group, are showing some signs of reaction, saying, ‘It’s hard enough. to resist’.

It’s ironic that the KOSPI climbed Hill 3000 and erupted in celebration as the self-employed and the underprivileged were led to the edge of a cliff.

Rising stock markets are often seen as an indicator of economic growth, but this time the situation is different.

It is true that the rise of some industries, such as bio and semiconductors, which enjoyed direct and indirect specialty due to the Corona 19 incident, had an impact on the rise in the stock market.

However, to reduce the difficulties of the real economy and the damage to the vulnerable, the massive fiscal and policy financing that the government has invested at the expense of an increase in the national debt and the low interest rate accelerated by a successive cut from the base rate, the stock market exploded into the asset market. The side that raised it is large.

There is also an analysis that the advancement of individual investors trying to offset even with stocks amid the tough economy was reflected in the stock market.

The government has already issued several warnings about the gap between the real and the finances symbolized by ‘disaster subsidies’ and ‘KOSPI 3,000’.

Vice Premier Hong Nam-ki and the Minister of Strategy and Finance said the previous day: “The financial market showed a stable and stable appearance despite the Corona 19 crisis, but concerns about the gap between real and financial are growing. ” “I have to do it.”

He added that “the government will also carefully manage liquidity in the market, paying particular attention to the possibility that liquidity that has rapidly increased in the process of responding to the crisis will cause a shift to the asset market or an increase in debt.” .

Bank of Korea Governor Lee Joo-yeol also said: “We need to have a high level of vigilance as potential risks are expected to be seriously revealed this year, such as the supply of liquidity from policy authorities and sectors. financial and deferred interest payment measures “.

He stressed that “especially in a state where the level of debt is high and the real-financial gap widens, the market can be severely affected by even a small shock, so we need to take a closer look at the vulnerable areas of the system. financial.

The government is expected to prepare related measures to prevent the gap between the real and financial markets from returning to an unbearable sequel in the future.

However, there are concerns that it will be difficult to estimate the damage to the Korean economy if sufficient countermeasures are not prepared in a timely manner.

/ yunhap news