[ad_1]

8.35% of national house prices last year ↑… Highest increase since 2006

“The price of the house is likely to increase due to the decrease in the number of occupants and the increase in the total price.”

“There will be no increase due to increased sales from multiple homeowners and various regulations.”

[앵커]

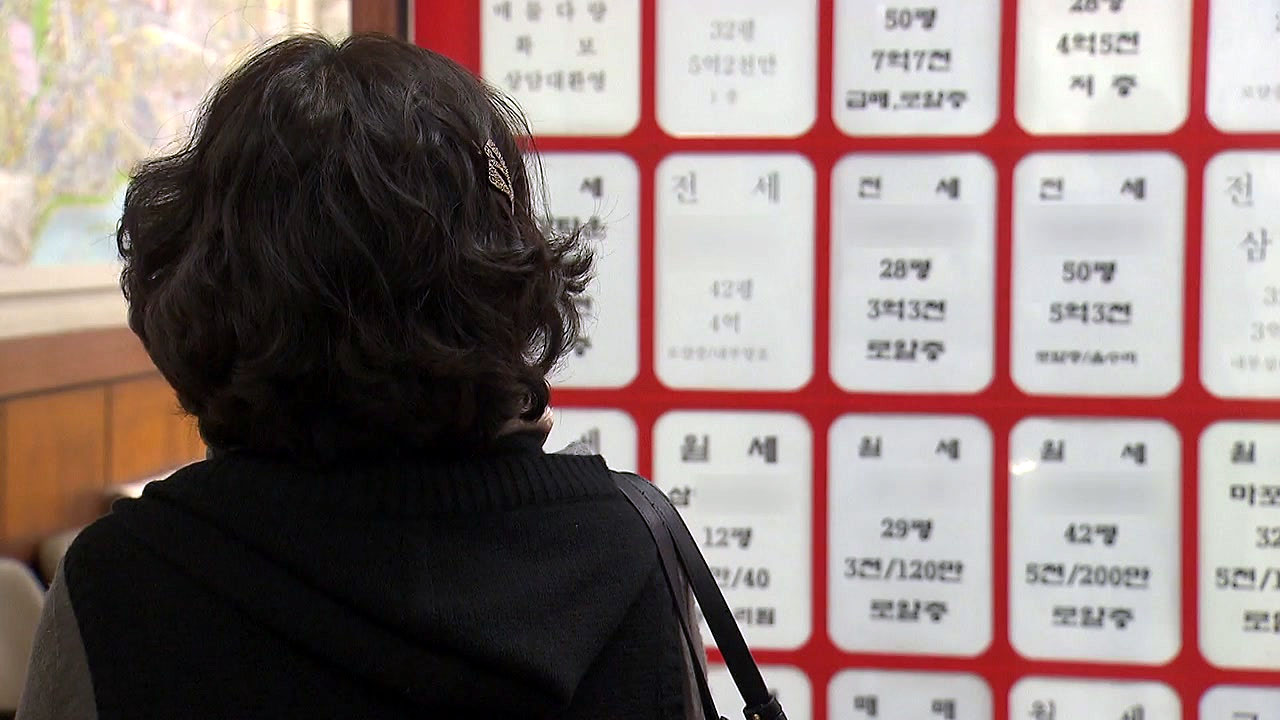

Given that national house prices rose sharply last year, attention is being paid to whether house prices will continue to rise this year. The prevailing outlook is that house prices will not fall if the shortage of occupants and high rental property prices continue. Reporter Shin Yoon-jung reports. Last year, national house prices rose more than 8%, registering the largest increase in 14 years. Vice Premier Hong Nam-ki apologized for the unrest in the property market and expressed expectations that this year will be different. The card that the government has prepared to stabilize the housing market this year is the expansion of supply. It was decided to supply 319,000 apartments across the country, including 45,000 in Seoul. The problem is that these numbers are objective, including public leases, so they are different from the perspectives of private companies. Real estate information companies predict that this year’s apartment occupancy volume will decline significantly from last year. Along with the scope of supply, the total set value is also an important variable. If the price of jeonse continues to rise, demand for jeonse can be turned into a purchase, and a “hole reversal” based on a high jeonse deposit can be facilitated to support the house price. In addition, the prospect of rising house prices predominates as it is expected to continue with abundant liquidity due to low interest rates. However, there is an analysis that there will be no sharp increase due to the fact that the multi-owner sale of the transfer tax reduction may occur in the first half of this year, and loan regulations have been further strengthened . Additionally, house prices are expected to be affected by additional supply plans and regulations issued by the newly headed Ministry of Lands, Infrastructure and Transportation. YTN Shin Yoon-jung[[email protected]]is.