[ad_1]

Seojun Kim, CEO of Hashed (Photo = Hashed)

“This year, the market price of bitcoins is expected to challenge $ 100,000 (approximately 18.57 million won). For the first time in history, the Bitcoin Listed Index Fund (ETF) will be approved and the price of Ethereum will also break all-time highs. “

Seo-joon Kim, the largest virtual asset (cryptocurrency) in Korea, leader in hash capital (VC)(Photo)On the 2nd, 2nd, he published the data of ‘2021 Blockchain & Cryptocurrency Market Forecast’ and presented 10 predictions related to the virtual asset (cryptocurrency) market this year.

“The virtual asset market will continue to grow in 2021,” he said. “Starting in February 2020, institutional investors began withdrawing large amounts from exchanges for the purpose of long-term holdings of bitcoins. Liquidity crisis with no sales volume of bitcoins. As the liquidity crisis intensifies the On the sell side, it’s causing the market to go up. “

Even in late 2019, △ The market price of Bitcoin will reach a record in 2020 △ The market for virtual assets, such as banks, will start to enter the market △ A bitcoin fund will be launched in the form of individual participation He has published 10 predictions, including. Most of the predictions at the time were correct so I am interested in whether or not this prediction will also apply.

“Bitcoin ETF approved this year and challenged the price of $ 100,000”

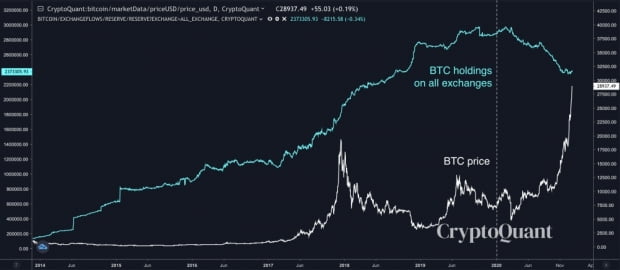

Exchange bitcoin holdings gradually decrease (photo = cryptoquant)

As a basis for predicting that this year’s bitcoin price will hit $ 100,000, CEO Kim heard that the amount of bitcoin on virtual asset exchanges has been declining since February 2020. For the price of bitcoin to go down, it is necessary sell bitcoins on the exchange, but as institutions withdraw the bitcoins from the exchange for long-term holdings, the sales volume gradually decreases.

“This trend is accelerating since mid-2020,” he predicted. “In 2021, bitcoin holdings on virtual asset exchanges will continue to decline,” he predicted.

“One of the biggest buyers of bitcoin among institutional investors is Grayscale. The total amount of the Grayscale Trust, which started at $ 2 billion (about 2,171.4 billion won) in early 2020, is $ 20 billion ( about 21 billion won) at the end of 2020. It amounts to 71.4 trillion won), “he said.” Most of these assets are concentrated in bitcoins, and we hope to do so in the future. “

He also noted that the Bitcoin ETF will be approved later this year as a factor for the rise of Bitcoin. “As a hedge against quantitative easing by central banks, buying bitcoins by listed companies like MicroStrategy will become a bigger trend. In 2021, there is a possibility that a country will emerge that buys bitcoins as a reserve asset. Kim said. There is also ”, he hoped.

The Ethereum market price is also forecast to break the all-time high ($ 1,448) this year.

CEO Kim said: “The media paid attention mainly to the price of bitcoin, but in fact, looking at the price change since the beginning of the year in 2020, Ethereum has risen more than Bitcoin. Next year, institutional investors will enter Ethereum following Bitcoin. It will be time. “It is a good sign that Ethereum futures trading has started on the Chicago Merchandise Exchange (CME).”

“A company will emerge that issues some of its shares in the form of tokens”

Jay Clayton, former president of the Securities and Exchange Commission (SEC) (Photo = AP)

CEO Kim predicted that starting this year, companies will emerge that issue some of their shares in the form of a security token (STO). This is because by converting existing values into token form, authentication and management are easy and transaction costs can be reduced.

“In the long term, all the shares will be absorbed in the form of security tokens,” he said. “If only the regulatory environment is supported, it is superior to traditional stocks in every respect. J. Clayton, former chairman of the Securities and Exchange Commission (SEC),” he said.(Photo)Also, in a conversation with the Director of the Monetary Supervision Service (OCC), he said: “It is likely that all stocks will be digitized.”

Technology that implements a “ protocol economy (economic ecosystem based on neutral rules in which market participants can interact independently and independently) ”, since it is possible to distribute rewards for contributions in a transparent and fair way to participants platform as the security token is activated. He stressed that the foundation could be created.

CEO Kim said: “The Ministry of SMEs and Startups has also announced that it will follow such a policy in 2021. In 2021, regulations and guidelines will be established to support the issuance and distribution of security tokens in a wider variety of countries. and sectors. I’m going to. “

“The promotion of mergers and acquisitions and the list of blockchain companies will be activated”

Coinbase, the largest virtual asset exchange in the US promoting the IPO (Photo = Coinbase)

He also predicted that there will be cases of large-scale mergers and acquisitions and listings between blockchain companies.

CEO Kim said: “In addition to the growth and maturation of the blockchain industry and the visibility of the initial public offering of Coinbase, the largest cryptocurrency exchange in the United States, the largest institutional investors will participate and induce intercompany mergers and acquisitions. blockchain. In addition, several attempts will be made to promote the listing. “

In particular, the case of the merger between DeFi (decentralized finance) projects will arise. It will happen, but the efforts of developers and projects that overcome each problem quickly will fill the gap and grow steadily and rapidly. “

Furthermore, the total deposit amount (TVL) in the DeFi ecosystem will reach 100 billion USD (approximately 108 trillion 57.3 billion won). “TVL is increasing while the market capitalization of mainnet tokens that do not have DeFi operating at scale stagnates or will decline and will be pushed out of the top spots.”

Below are the top 10 virtual asset market predictions in 2021 by CEO Seo-joon Kim.

(1) Bitcoin ETF to be approved for the first time in history

(2) Bitcoin price will challenge $ 100,000

(3) Ethereum price will hit an all-time high

(4) The total issuance of stablecoins (currency value peg) on the public blockchain will increase to more than 100 billion USD (approximately 108 trillion 57.3 billion won).

(5) The total amount of DeFi deposits (TVL) will also challenge the 100 billion dollar scale (approximately 108 trillion 57.3 billion won)

(6) Among the top 50 virtual assets in market capitalization by the end of 2021, DeFi tokens will account for 13 or more

(7) Decentralized exchange (Dex) trading volume in 2021 will grow to more than $ 500 billion (approximately $ 542.865 billion)

(8) The companies that issue some of their shares in the form of security tokens should appear.

(9) There should be cases of mergers and acquisitions between blockchain companies seriously. Cases of merger between DeFi projects will also arise.

(10) As a single non-replaceable token (NFT), a token with a value of more than $ 300,000 (approximately 3,571 million won) will appear.

Reporter Kim San-ha Hankyung.com [email protected]

Article Reports and Press Releases [email protected]