[ad_1]

After the collapse due to the crisis of the crown, it recovered quickly … NASDAQ annual 44% ↑, S & P500 16% ↑

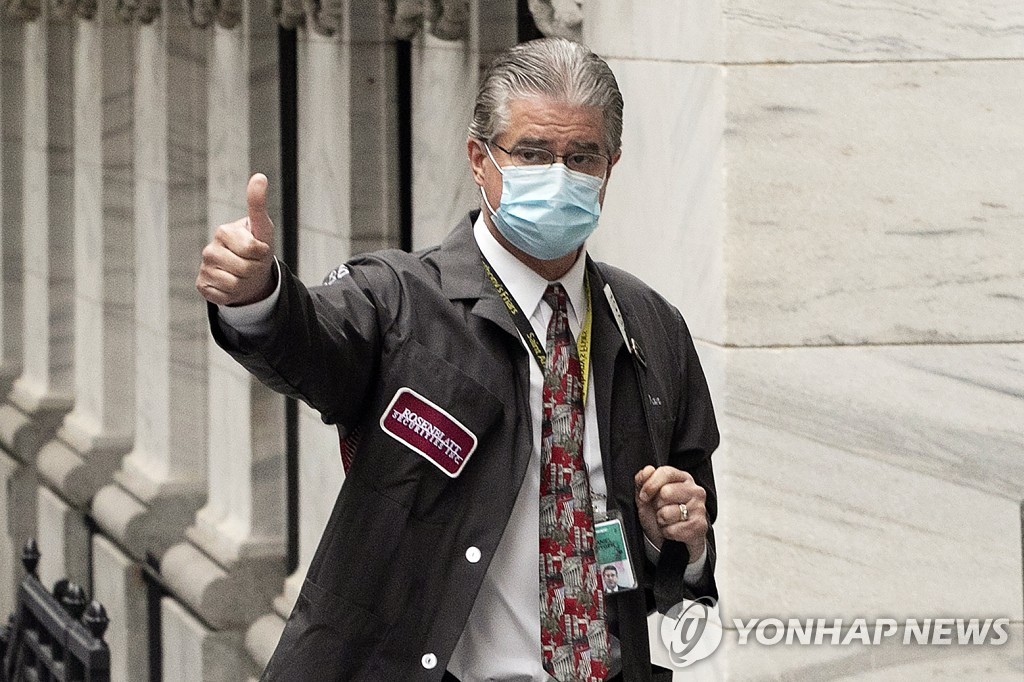

The US Stock Exchange in New York rewrote a record on the 31st (local time), marking the spectacular finale of 2020.

The year ended with a record-breaking rebound just months after the collapse of the new coronavirus infection pandemic (Corona 19).

On this day, the Dow Jones 30 Industrial Average on the New York Stock Exchange closed at 30,606.48, 196.92 points (0.65%) higher than the battlefield.

The Standard & Poor’s (S&P) 500 Index rose 24.03 points (0.64%) to 3,756.07, and the NASDAQ index oriented to technology stocks rose 18.28 points (0.14%) to 12,888.28, respectively. .

The Dow and S&P 500 indices have sharpened their highs, and the Nasdaq index is close to the all-time highs set a few days ago based on the closing price.

Although the Republican Party stalled the increase in subsidies to the public in the Senate, there was strong expectation that an additional fiscal stimulus plan would eventually pass, and the number of new unemployment benefits announced last week that were announced on the same day. it fell below market forecasts, which had a positive impact on investor sentiment.

Overall this year, the NASDAQ index jumped 43.6%, the highest since 2009, and the Dow and S&P 500 indices rose 7.3% and 16.3%, respectively.

In particular, the S&P 500 Index set a record 30% decline in the shortest period of March due to the Corona 19 incident and, as a result, posted a large annual rate of increase.

Compared to the annual low on March 23, it increased more than 66%.

The New York Stock Exchange, which fell unaided from February to March when Corona 19 began to expand internationally, rebounded at a rapid pace thanks to large-scale stimulus measures and hype from big tech stocks.

In March-April, the US Congress passed a huge fiscal stimulus bill of over $ 2 trillion, and the central bank, the Federal Reserve System (Fed), also released tremendous liquidity into the market. , and the investment sentiment began to revive.

As a result, major IT companies that were relatively less affected by various “shutdown” measures, or rather enjoyed reflective benefits, drove the stock market recovery by absorbing their investments.

As a result, annually, 81% of Apple, 76% of Amazon, 41% of Microsoft and 33% of Facebook have exploded, CNBC Broadcasting said.

In winter, the corona19 situation worsened again, but as vaccination began and additional stimulus negotiations concluded, major year-end indices broke new highs every day.

The general expectation on Wall Street is that if the real economy recovers in earnest and the vaccine is traded, the stock market is likely to continue to rally next year.

However, the prevailing view is that it is difficult to increase as much as this year, and some are putting forward the “bubble theory” that the share price is rising excessively.

/ yunhap news