[ad_1]

As banks cut credit loans to new homes at the end of the year, office workers and the self-employed in need of an emergency find it difficult to finance. On the 23rd, the personal loan window of a commercial bank was empty. Reporter Kim Youngwoo [email protected]

As banks cut credit loans to new homes at the end of the year, office workers and the self-employed in need of an emergency find it difficult to finance. On the 23rd, the personal loan window of a commercial bank was empty. Reporter Kim Youngwoo [email protected]

Kim, 61, who runs a chicken restaurant in Gwancheol-dong, Seoul, looks forward to the new year. This is because the main bank said: “It is difficult to make a loan until the end of the year” and asked to see you again at the beginning of the year. Mr. Kim’s customers were cut off, but more than 2 million won was lost on the savings book due to monthly rent of 1.87 million won and gas and electricity bills. It has been a long time since the 10 million won, which was prepared as a secondary loan for Corona 19, a small business owner last July. Mr. Kim confided, “I look forward to the loan company flyers that are strewn on the store door every morning, but I’m saving them.”

The middle class and ordinary people are being pushed over the “loan cliff.” This is because banks suddenly raised the threshold for family loans. Commercial banks such as Shinhan Kookmin Hana Woori are demanding that new personal credit loans be blocked from the middle of the month or that they pay between 10% and 20% of the principal if the maturity is extended. Kakao Bank and K-Bank are also raising their loan interest rates or lowering their loan limits. The financial authorities are pushing to reduce the total amount of loans.

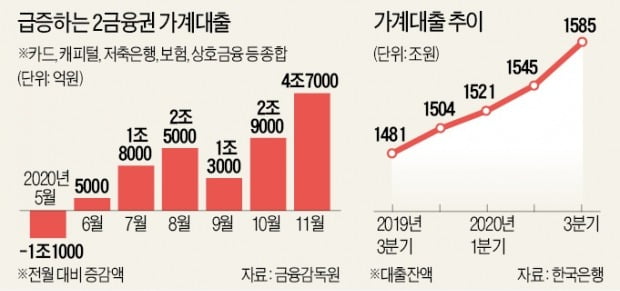

The self-employed and ordinary people, whose financing has been difficult, are paying high interest rates and turning to the second financial sector and illegal private financing. According to the Financial Supervision Service on the 25th, household loans in the second financial sector, including capital savings card insurance, and other financial sectors increased last month by 4.4 trillion won compared to the previous month, registering the largest increase in history.

As bank loans tighten, the “balloon effect” of finding new sources is expected to intensify. The problem is that the “loan confusion” will continue into the next year, which can drain the finances of ordinary people. This is because the financial authorities are restricting household loans to banks. The Financial Supervision Service demanded that large banks increase the proportion of corporate loans to 50-60%. The share of corporate loans from the top five banks is 45.3% to 48.7%. It is an analysis that there is no choice but to curb home loans.

A commercial bank official said: “Household loan terms are unlikely to improve next year.” It is noted that the government is trying to prevent the rise in house prices, caused by the failure of real estate policies, with loan regulations, and that the common people of Aman are suffering damage because their money lines are blocked.

‘Loan Cliffs’ resonates with ordinary people

Banks fight to tighten government regulations

Mr. Lee, a 30-year-old office worker, is struggling because he could not find an office. I am researching company loans and savings banks, and I am going to open my hands to my parents. This is because the bank received a call to repay 30 million won of the 130 million won of principal or to repay other credit loans a month before the loan loan matures. Mr. Lee protested, “Suddenly, where to get the money from”, but had to hear that “there is no help because government regulations are strengthened.”

As banks take intensive measures, such as “ stop all personal credit lending, ” people are being driven to the “ lending cliff. ” It seems that government regulation on the total amount of loans to block the financing lines of high-income families is being extended to the general public, including office workers and small business owners. Government measures to fix house prices are causing fires in the affected population.

The general public and small businesses are also in ‘credit loan crisis’

According to the financial sector on the 25th, there are a number of people who have recently been informed by the banks that they will extend the maturity by repaying part of the principal of the loan. In the Internet office worker community, you can easily find articles on banks and governments. There are many extreme cases, such as ‘received to repay 30% of the principal’ or ‘it was said that it could only be extended for 6 months’. The manager of a branch of a commercial bank said: “The government has taken a step forward to fully introduce the DSR regulation next year.” I recommend writing them down or checking the negative bank book from the other bank. “

Small entrepreneurs faced greater difficulties than office workers. As the novel coronavirus (Corona 19) infection situation drags on, companies whose sales have deteriorated are being asked to pay off some of them from banks or are denied additional loans. A bank official said: “The government is telling us not to cut off loans to small business owners, but the Corona 19 crisis may end, but we cannot recklessly postpone or lend more money.” Of course, small business owners received several guarantee loans with funds prepared by the government through the additional budget. COVID-19 first and second loans executed for more than 20 trillion won are often declined when △ the procedure from application to execution is complicated, △ the limit for each individual is extremely small, and △ a low credit rating. In the midst of this, small business owners tremble with anxiety as credit loans, once the “bottom line,” tighten up. Im Mo, who runs a meat restaurant in Yeongdeungpo, Seoul, said, “I have already used all the loans and credit loans for small business owners.”

The bank only excuses ‘it cannot be avoided’

Banks are protesting that they cannot open more “sheds” due to the tightening of government regulations on loans. Financial authorities are closely monitoring the number of high-value credit loans of 100 million won or more for each bank. Most loan maturities are one year. When the maturity of the credit loans received at the beginning of the year begins to return at the beginning of the next year, it is expected that a large number of people who suffer the reduction of the limit will spill.

The new loan-to-deposit ratio regulations and the Basel III capital adequacy regulations, which were introduced earlier this year, are also factors that raise the threshold for bank family loans. Banks are required to keep the average monthly balance of the deposit-to-deposit ratio (the loan-to-deposit ratio) within 100%. A 115% weight is applied to home loans, so reducing the weight is inevitable. A bank official said: “In April, in the first days of Corona 19, the government relaxed the regulation of the loan-deposit ratio to 105% to expand the supply of funds. The loan is possible only when it is released. “

However, it is not clear whether there will be room for domestic loans, even if the regulation of the loan-to-deposit ratio is lifted. This is due to the “homework” received from the early introduction of Basel III, a new capital soundness capital regulation. The financial authorities demanded that the banks that introduced Basel III increase the proportion of corporate loans to the level of 50-60%. It is known that it was handed over to the bank. A commercial bank official said: “The banks that introduced Basel III had the effect of improving capital strength, but if they canceled midway, they couldn’t. did.

Loan conditions for ordinary people are expected to worsen next year. Financial Supervision Commissioner Yoon Seok-heon told a press conference on the 23rd that “the total amount of loans (to banks) should be regulated for the time being.” There is criticism that various loan control measures that do not comprehensively take into account the Corona 19 situation, the repayment capacity of each borrower and regulations on the soundness of banks’ capital are drying the blood of the finances of ordinary people.

Reporters Jeong So-ram / Kim Dae-hoon / Oh Hyun-ah [email protected]