[ad_1]

Intensive investment and operation in six major industries Up to 20 years … 20% loss paid by the government

Announcement of internal fundraising … Large-scale start in March next year

On the 23rd, the government announced specific fund management plans and incentives to revitalize private equity investment ahead of the launch of the ‘Political-Type New Deal Fund’ to be created on a 4 trillion won scale in March next year.

The incentives are provided by reducing the performance of the performance fees, which is typically 7%, up to 4%, and the fund management period can be extended to 20 years.

The government announced this policy at a regular briefing at the Emergency Economy Countermeasures Headquarters and the New Deal Ministers’ Meeting at the Seoul Government Complex.

◇ Create 4 trillion won next year … 20% loss paid by government

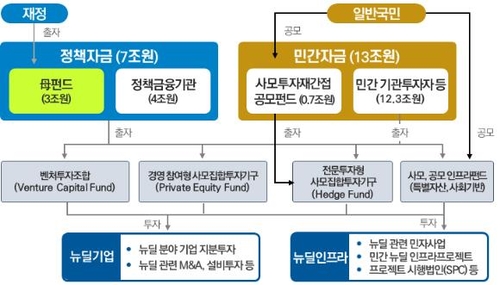

The government is promoting the creation of a total of 20 trillion won in funds between 2021 and 2025.

A parent fund worth 7 trillion won is created through investments from the government and political financial institutions, and the remaining 13 trillion won is formed by contracting private investment funds to form a children’s fund.

Next year, the fund will raise up to 4 billion won.

Of these, fiscal and policy funds represent approximately 35% of the fund’s resources.

In addition to the 510 billion won in the New Deal Fund, which is organized in the government budget for next year, will be raised through the Korea Development Bank and the Growth Ladder Fund.

Some of the private investment funds aim to raise around 140 billion won next year by creating an indirect public offering fund for private equity that the general public can participate in.

In addition, in order to provide stable investment opportunities to the public, it has been decided to increase the subordinated investment ratio in finance by up to 20%.

It means that the government will be responsible for 20% of the loss.

To this end, we plan to announce the recruitment of the children’s fund next week so that the fund creation can begin in March of next year.

Subsequently, after receiving the manager’s proposal at the end of January next year, it was decided to review and select the manager in February.

◇ Intensive investment in six main industries … Invests up to 30% in infrastructure

The fund’s investment resources are allocated and invested in the New Deal and New Deal projects, taking into account political priorities and the use of investment funds.

It was decided to invest 70-90% in corporate equity funds that invest in companies in the New Deal sector and 10-30% in funds invested in infrastructure that invest in infrastructure.

The corporate investment fund operates an ‘investment proposal fund’ that invests in six major industries and a ‘growth fund’ that supports corporate expansion through mergers and acquisitions (M&A) and R&D. Plans to induce an allocation of more than 50% to medium investment proposal type funds.

The top six industries are ▲ DNA ▲ green mobility ▲ ecological green industry ▲ new agreement service ▲ SOC and digitization of logistics ▲ smart manufacturing and smart farm.

◇ Promotion of participation in private investment … Strengthening of incentives

In order to induce private equity participation, the government allowed long-term investments, provided incentives, and created a structure to mitigate and support investment risk.

In the case of investing in the New Deal field with low industrial maturity and a long payback period, the operating period could be extended compared to general policy funds (7 to 8 years).

The fund management period is allowed for up to 10 years, but areas that require long-term investment can be configured for up to 20 years.

Additionally, fund managers proposing or attempting new investments in areas where the burden of private funds is actively involved are preferred due to high investment risk.

When evaluating the investment need and the degree of risk, it was decided to increase the investment ratio of the policy funds to 45% and reduce the standard rate of return, which is the basis for paying performance commissions, from 7% to 4-6%.

“The most important feature is not the artificial allocation of funds, but the market-driven funds,” said Do Gyu-sang, vice president of the Financial Services Commission. It will provide an attractive chance to be found. “

/ yunhap news