[ad_1]

Photo = News 1

Finance Commissioner Eun Seong-soo said on the 14th that “ a soft landing plan is necessary to allow time for adaptation ” regarding the loan maturity extension and the deferred interest payment measures that have been implemented. delayed from March next year to overcome the damage of the new coronavirus infection (Corona 19). This is a comment with the intention of making it possible to repay the money loaned to the financier a little later. Regarding the improvement of the stock short sale system, Chairman Eun suggested a plan for professional investors to participate in the short sale first, rather than allowing all individuals.

On that day he held an online year-end conference at the government office in Seoul and said, “I agree with the plan for a soft landing related to financial support for Corona 19.” I think it is necessary to give them ”. The Financial Services Commission issued a loan maturity extension and interest payment delay for six months in all financial sectors for SMEs and small business owners who suffered from the Corona 19 crisis in March. The policy to allow the loan principal to be repaid later has been extended once more since March next year. President Eun said: “Starting next January, we will gather opinions from the financial sector, industry and experts to make a decision.”

Seongsu Eun “Short selling, allowing professional investors first and then expanding to individuals”

Correct Sloped Yard … Corona Financial Support Soft Landing Required

Finance Commissioner Eun Seong-soo (pictured) stated that she has a task to fulfill three conflicting demands in current financial policies. In response to the spread of Corona 19, it is necessary to release money into the market, but it is impossible to let the rapidly growing home loans come to a halt. If home loans tighten heavily, it will be difficult for ordinary people to find a home.

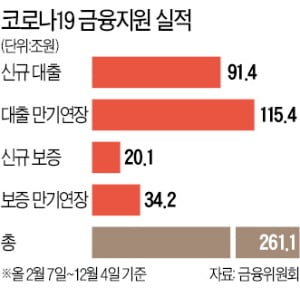

Loan maturity length exceeds 115 trillion won

President Eun thought that topping Corona 19 was the first priority. He said: “Of a great trend, now is to provide funds flexibly,” he said. “It can not be helped”. The loan maturity extension made in the financial sector to the 4th of this month exceeds 115 trillion won. The amount of collateral that policy financial institutions have delayed to maturity also exceeds 34 trillion won. However, President Eun left room for a soft landing rather than a full maturity extension, as there are concerns that the strength of financial companies will deteriorate if the loan cannot be recovered.

It did not actively deny the application of the total debt principal repayment ratio (DSR) to all home loans, but said it would decide when it came up with a plan to advance home loans in the first quarter of next year. President Eun said, “The growth rate of household loans, which was in the last 4% range at the end of last year, has risen sharply to 7% in October and November this year,” and said: “We will tackle the household debt problem with a long-term respite of 2-3 years.”

After notifying clients that some insurance companies could increase the indemnity health care premium by more than 20% next year, President Eun said, “I thought that the public nature of (ineligible loss insurance) also should be considered, so the insurance industry decided at a reasonable level. I am looking forward to it. “Regarding criticism that the financial holding company actually leads the management of its subsidiaries but does not adequately take legal responsibility, he said:” We will continue to review whether there is a need for additional legal amendments to improve the responsibility of the president of the financial holding company “.

Full supervision of 17 private equity managers

Relating to the stock market, short selling, which has emerged as a ‘hot potato’, expressed the view that individuals should expand their short selling opportunities. The Financial Services Commission is promoting a plan to promote individual short selling by establishing a system that allows people to easily borrow shares for short selling (K-Land Share System).

President Eun said, “We are trying to open an opportunity for people to participate in short selling, which is a playground.” I’m thinking in the direction of allowing and expanding those who can. “

Regarding criticism that the Financial Services Commission has given up on establishing a system that can monitor short sales in general, Chairman Eun said: “By establishing a system that detects illegal short sales after the fact, the intended purpose can be achieved in more than 99%. We will strengthen the related system and shorten the verification period for illegal short sales. “

Chairman Eun pointed to the lack of oversight of private equity funds like Lime and Optimus Asset Management as the most regrettable this year. He confessed: “The fact that many investors have suffered damage from the insolvency of some venture capital funds is painfully accepted above all.” Under the leadership of President Eun Eun, the large-scale investigation of private equity funds, which has been conducted by financial authorities since last August, consists of a ‘double track’, such as a comprehensive inspection of the industry, as sellers , trustees and office managers, and on-site inspections by managers of the dedicated FSS inspection team. Chairman Eun explained, “The full inspection was 40% complete as of the 4th and is expected to be completed in the first quarter of next year.”

The FSS has completed inspections of 17 private equity managers at the end of last month. Chairman Eun added: “For managers found to be incomplete as a result of the inspection, the Financial Supervision Service will take the necessary procedures.”

Reporter Park Jong-seo / Oh Hyeong-ju [email protected]