[ad_1]

Ten days before implementation, he said, “registration on the Internet is possible” …

You must visit the registry in person in the middle of Corona 19

You must register for the rental home before the end of the year to apply the special long-term deduction. 2 years shortened

In July, members of the “Encounter for the relief of victims of the retrospective application of the June 17 Regulation” and members of the “Promotion Committee of the Leasing Business Association” held a demonstration to condemn the government’s real estate policy. The backlash is growing as the government enforces a law that is not prepared for rental companies. / Photo = News 1

While the government has proposed measures to put pressure on rental housing companies every day, they have changed their words on the measures to be implemented and are again intimidated by rental tenants. This is because on the same day the change of the accounting record (additional information), which is mandatory from the 10th, from ‘Available online / offline’ to ‘Only offline’ was announced. It is noted that the burden on the owner has only increased by implementing policies that have not been prepared. Violation of the obligation to record the accounts is subject to a fine of 5 million won or less.

On the 13th, on the website of the Internet registry office of the court, an information window appears that says: “In relation to the application of the private rental housing accounting register, electronic application is not allowed because the Rental company registration information is not subject to the joint use of administrative information, it means that applications can only be made by visiting the registration office in the jurisdiction where the rental accommodation is located.

Actually, when I asked the Civil Service Center of the Court, the guide staff also explained: “Please visit and apply for registration in person, as shown in the information on the website”, and “Registration on the Internet is impossible because the administrative information network cannot be shared. ” This means that even if you own a rental business that has a rental home in an area other than where you live, you must visit the corresponding registry.

Website of the Internet Judicial Registry. There is a notice that the private rental housing accounting record will only be received offline. / Source = Internet court record

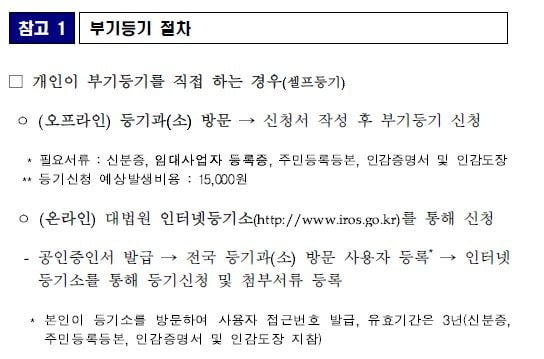

This contradicts the press release issued by the Ministry of Land, Infrastructure and Transport on the 30th. The Ministry of Land, Infrastructure and Transport explained the main contents of the Special Law on Private Rental Housing in force since December 10 in a statement entitled ‘The right to knowledge and protection of deposits for registered tenants for rent will be strengthened’. On page 8 of these, it is stated that you can submit your application through the Supreme Court online registry.

It was on June 9 that the government announced the introduction of mandatory registration of registered rental homes. The intention was to strengthen the tenant’s right to know and protect the right. For registered rental homes, the rental service provider required additional registration periods and rent increase standards in the property registry so that anyone, including potential renters, could get to know the home. In case of violation of the obligation to record the accounting, a fine of 5 million won or less is imposed.

Rental housing registered after the application of the Law will be registered without delay (in the case of registration of conservation of property after registration, it must be done at the same time as registration of conservation). Private rental houses that had been registered for property preservation prior to law enforcement were nailed to register for accounting within two years of law enforcement. In the end, while the rental business is obliged to bear the risk of fines in six months, the government has not even prepared online filings.

A press release issued by the Ministry of Land, Infrastructure and Transport on the 30th. There is a notice that it is possible to apply online, but it is not possible. / Source = Ministry of Lands, Infrastructure and Transport

Also, when registering a new rental home, a more difficult situation arises. This is because the government shortened the period of application of the special long-term deduction (special deduction for long-term holdings) by modifying the tax law. At the end of the year, you must register an 8-year rental home to receive a special 50-70% deduction. Even this was previously until December 31, 2022, but the timeline was shortened when the government included a preview of the ‘2020 Tax Law Amendment’.

With just 10 days left in the year, the hassles from home rental companies have increased. It is also different from the basic position of the government, which emphasizes ‘contact’ and moves between regions due to the new coronavirus infection (Corona 19). In the case of rental companies that refrain from self-isolating or leaving, the accounting recording method has been blocked.

Mr. Kim, who has been in the rental business for more than 10 years, said, “It seems I have to go to Daegu to register things in Daegu.”

On the other hand, on the 1st, a group of registered home rental companies and general home rental companies launched the Korea Home Renters Association. President Sung Chang-yeop said, “There can be no landlord without a tenant, and on the contrary, there can be no tenant without a landlord.” “There is.”

Hankyung.com reporter Kim Hana [email protected]