[ad_1]

Korea saving rate of 10.2% this year

Higher after the financial crisis

Close your wallet to high house prices

Family spending on ‘Get My Home’ is reduced

Photo = Yonhap News

There is a warning that the Korean economy may fall into the so-called “ savings paradox ” suggested by British economist John Maynard Keynes. This is the result of clear signs that households are closing their wallets and increasing their savings to prepare for an uncomfortable future and skyrocketing home prices. Lowering spending will improve household savings in the short term, but as aggregate demand declines, the possibility of a long-term recession increases.

Consumption trend ↓ Savings rate ↑

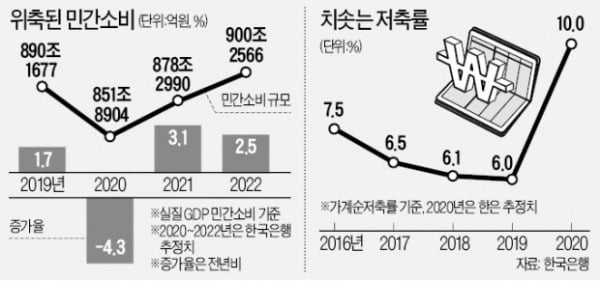

According to the Bank of Korea on the 13th, the household saving rate this year is estimated to be 10.2%, 4.2 percentage points more than last year (6%). It is expected to reach the highest level after 1999 (13.2%), just after the financial crisis. The savings rate refers to the share of the amount of savings in the ‘disposable income (disposable income)’ that households can use to live.

The savings rate in Korea has decreased to 8.4% in 2015, 7.5% in 2016, 6.5% in 2017, 6.1% in 2018 and 6% in 2019, but has increased considerably this year. The savings rate in Korea has been higher than in major developed countries since before Crown 19. In 2018, Korea’s savings rate (6.1%) was higher than Japan’s (4.3%) and the eurozone (5.9%), which is said to have a high tendency to save.

The increase in the savings rate means that consumption has decreased when looking backwards. The average consumption trend (consumption in income) for the first to third quarters of this year was 68%, 4.2 percentage points less than the average of last year (72.2%). Accumulated private consumption (based on real and gross affiliates) during the first to third quarters of this year was 632 trillion out of 683.5 billion won, 4.4% less than in the same period last year (661 trillion 6608 billion won).

House prices are overheating and household spending is hungry

Economic experts cited the uncertainty of Corona 19 and the overheating of house prices as a backdrop for household savings. This means that households have increased ‘preliminary savings’ as the economy is uncertain due to Corona 19 and future earnings may not be so cold. Lee Yong-dae, manager of the BOK Office of Investigations, analyzed that “social distancing has weakened and concern about infection has increased and, as a result, consumption has been contracted by abstaining from going out and eating.

Some analysts say that rising house prices are a factor that inhibits spending. Analysts say consumption is restricted to drive home prices higher as prices rise or to increase interest charges on home loans. In a report prepared by the BOK in 2018, “ Recent causes and implications of the increase in the household saving rate ”, it was calculated that when real investment (real estate investment) increases by 1 percentage point compared to the product gross domestic (GDP), the household saving rate increases from 1.3 to 3.6 percentage points. . This means that the higher the house price, the higher the household saving rate. This is a conclusion that reverses the so-called “ wealth effect ” that if the value of a home increases, assets increase and consumption also increases.

Kim Hyung-seok, deputy director of the research bureau, who wrote the report at the time, said: “The movement of homeless households to cut spending to raise house prices outweighed the ‘wealth effect.’ “To promote private consumption, a policy is necessary to stabilize house prices in the medium and long term. I suggested.

Concerns about low consumption and low growth

Household debt is also a variable that limits spending. According to the International Finance Association (IIF), the ratio of household debt to gross domestic product (GDP) was 100.6% at the end of the third quarter, exceeding 100% for the first time in history. Fears of “debt deflation” also increased. This is because the real interest rate (nominal interest rate-expected inflation) increases as inflation is expected to remain in the 0% range for the time being.

As Keynes warned, one analysis suggests that rising savings rates will lead to a prolonged recession. As savings increase and consumption decreases, inventory accumulates in corporate warehouses. There is the possibility of a vicious cycle of reducing employment for businesses and further reducing household spending.

There is also a high signal that the ‘savings paradox’ phenomenon will tighten, such as a prolonged downward trend in the savings rate. Corona 19 uncertainty persists and house prices continue to rise.

Reporter Kim Ik-hwan [email protected]