[ad_1]

I want to sell it for the transfer tax

“In the future, the sale price will also increase due to taxes”

The emergence of apartment complexes in Songpa-gu and Gangnam-gu, Seoul. Yunhap news

As the deadline for paying the comprehensive real estate tax approaches, fears about next year’s possession tax are spreading. Experts point out that the increased tax burden can induce sales in the market, encouraging higher home prices rather than lower them. This is because if there is no withdrawal to sell and the tax becomes a constant that cannot be paid, it will eventually melt into future transaction costs.

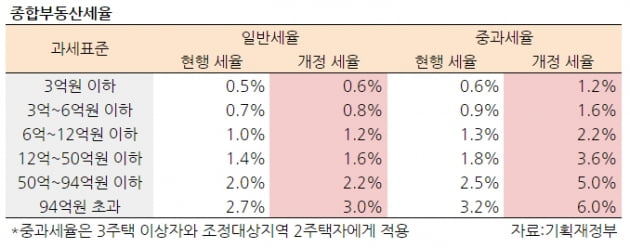

According to the National Tax Service on the 10th, the deadline to pay the tax is until the 15th of this month. This year, the amount of tax reported in the final tax was 4.26 trillion won, an increase of 920 billion won (28%) compared to last year. The number of owners who received the invoice also increased by 149,000 (25%) to 744,000. It is likely to increase further next year. This is because the market price reflection rate and the fair market price ratio of published prices, which determine the taxable base of the final tax, increase and the tax rate also rises to the double maximum level.

Homeowners who have to pay taxes on possession, such as property taxes and taxes, generally sell their homes up to the tax base date (June 1 of each year). This is because the owner pays the entire property tax for the year from this day on. Due to the increase in the number of items for sale in March to May of each year to reduce the property tax, the market has solidified in the housing market for several years to be up and down (fall in the first semester, rebound in the second semester).

However, experts are concerned that different patterns could emerge from next year. This is because there is a possibility that the burden of a high tenure tax is no longer accepted as an unavoidable constant. Even after a tax rate hike was announced as a result of ‘measures 12/16’ last year, house prices have risen steadily. That is why the analysis shows that it shows a change in the market perception that the tenure tax is no longer a variable.

Professor Kim Kyung-min from Seoul National University (Graduate School of Environment) pointed out that the property tax could be more of a mechanism to increase the price of a house. Professor Kim said: “Some owners who don’t have cash will sell them, but there will be a lot of people who think it is a price increase in the future.” He explained.

The government is raising the property tax burden in all directions in order to induce sales by putting pressure on people with multiple households. The calculation is that those who cannot pay the tax must sell their houses to get the house price. However, it is not easy for people with multiple homes to sell houses. This is due to the high tax on capital gains. Multiple homeowners in areas subject to adjustment are subject to a high tax rate of up to 62% when selling their homes. It will go up to 75% starting June 1 of next year. We have no choice but to hesitate to sell.

Lee Sang-woo, CEO of Invade Investment Advisory, noted: “As the acquisition tax, transfer tax and possession tax are increased at the same time, the tax has been tolerated rather than a reduction of taxes. did.

As the price of the house increases, the number of apartments that must pay the tax increases, even if they only have one. 1 Apartments that exceed the publicly advertised price of 900 million won, which is the tax standard for the owner (unique name), represent 11% (280,000 households) of all apartments in Seoul. This is an increase of 80,000 households compared to the previous year. In Gangnam-gu (53%, 88,000 households) and Seocho-gu (51%, 63,000 households), more than half of the apartments are taxed.

Reporter Hyungjin Jeon [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution