[ad_1]

Strengthening the supervision of complex financial companies such as Samsung … Mixed evaluation of judges and deputy experts of corporate countermeasures

The ‘Law of the Three Just Economies’ promoted by the government and the ruling party crossed the threshold of the National Assembly on the 9th.

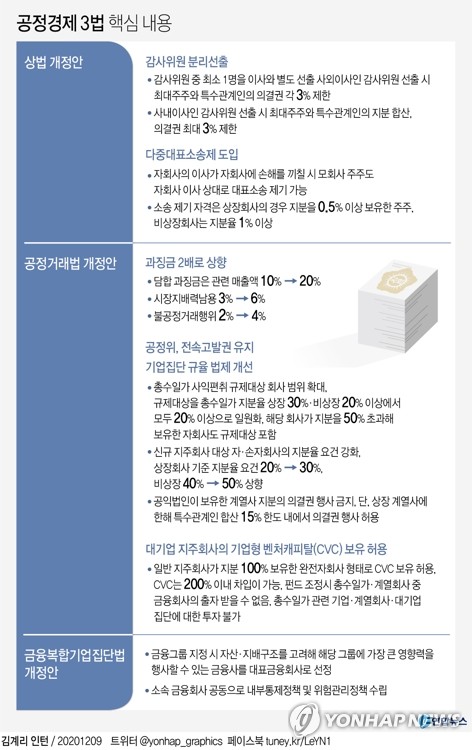

The amendment to the Commercial Law to relax the so-called ‘3% rule’ was first approved in the plenary session of the National Assembly.

The amendment to the Commercial Law, which limits the voting rights of the largest shareholders and related parties to 3% when selecting the members of the audit committee, establishes that when a member of the audit committee who is an external director is selected during In the National Assembly discussion, voting rights are applied up to 3% each without adding the shares. It was relieved.

After the enactment of the Fair Trade Act, the entire amendment bill was also passed in 40 years.

The abolition of exclusive prosecution, which was included in the original government draft, eventually ceased to exist, so the prosecution can proceed to the collusion investigation only after a complaint from the Fair Trade Commission.

In the plenary session of the National Assembly a bill was also approved to strengthen the sound management of financial conglomerates and establish a risk management system.

When the Third Fair Economy Law was passed despite backlash from the business world, companies struggled to prepare measures.

◇ When the member of the audit committee is elected, only 3% of the voting rights are recognized.

The key to the amendment to the Trade Law is to require publicly traded companies to elect at least one of the audit committee members separately from the directors, and to limit the voting rights of the largest shareholder to 3% .

Current business law stipulates that directors are first elected at the general meeting of shareholders and then members of the audit committee are selected from among the directors.

For this reason, there have been criticisms that the auditor, who must monitor the company, is under the influence of the majority shareholder and cannot adequately play the role of auditor.

To improve this reality, an amendment to the Trade Law was prepared.

However, when appointing an external director, the auditor, the majority shareholder and the related person’s shares were not added, and the 3% voting right was individually recognized.

A “multi-representative litigation system” will also be established, allowing shareholders of parent companies to file suit on behalf of shareholders against directors of subsidiaries.

Current commercial law recognizes a representative trial in which shareholders hold directors liable for damages on behalf of the company.

However, when the parent company suffers damages due to the illegal activities of the subsidiary, there are no legal means for general shareholders to hold the subsidiary liable.

The amendment entitles unlisted companies to shareholders with more than 1% stake and listed companies to shareholders with more than 0.5% to file a lawsuit.

◇ Revision of the Fair Trade Law after 40 years … Maintain exclusive high-speed ticketing and strengthen labor control regulations

The FTC’s “exclusive right of complaint” is maintained.

Moving forward, it means that only the FTC can prosecute the fair economy case, and the prosecution can investigate it only if there is a complaint from the FTC.

The government’s proposal was to abolish exclusive accusations only for price collusion and bidding (hard collusion), which has a high degree of social harm, but was omitted from the National Assembly discussions.

The penalty for collusion increases from 10% to 20% of related sales, from 3% to 6% for abuse of market power, and from 2% to 4% for unfair commercial practices, respectively.

Regarding the corporate group disciplinary law, the objectives of regulating the private interests of all households will be expanded.

It means that a large number of companies will enter the regulatory network to further the work of the FTC.

The standards for companies subject to extortion of private interests are unified from the current total number of single-family shares listed at 30% and unlisted from 20% or more to 20% for listed and unlisted companies, and subsidiaries owned by these companies in more than 50% they are also within the regulatory scope.

The amendment also raised the subsidiary and grandchild ownership requirement for new holding companies from 20% to 30% for listed companies and from 40% to 50% for unlisted companies.

In addition, the exercise of voting rights of subsidiaries of public interest companies of large business groups is prohibited in principle, but listed companies are only allowed up to 15% of the total number of specially linked persons, which prevents the “ successful succession ” of the management right.

The criteria for reporting mergers and acquisitions will also be expanded.

Currently, if the total assets or sales of the target company for the acquisition exceed KRW 30 billion, it is not necessary to undergo a business combination review by the FTC, but if the acquisition amount is large, should be reviewed.

The FTC plans to reorganize the related standards through subsequent enforcement ordinances.

Allowing large holding companies to own corporate venture capital (CVC) has been promoted as a separate government proposal, but all fair trade laws have been included in the amendments.

CVC owned by a general holding company can borrow up to 200% of its share capital and, when the fund is created, the full number of households and financial company investments among subsidiaries cannot be received.

Furthermore, it is not possible to invest in family-related companies, subsidiaries or large corporate groups.

◇ Strengthen the supervision of complex financial companies such as Samsung and Hyundai Motors … Strength and risk management

The Financial Complex Business Groups Supervision Bill designates financial complex business groups as the subject of supervision that meet certain requirements, such as asset size and type of business, establishes a risk management system focused on financial companies representative and manages the soundness of the entire financial group. Content is the key.

This target is for business groups that operate two or more financial companies and have assets of more than 5 trillion won.

Currently, six locations, including Samsung, Hyundai Motors, Hanwha, Mirae Asset, Kyobo, and DB, are subject to enactment.

Financial business groups must establish policies and standards for internal control and risk management at the group level.

The Financial Services Commission may order the presentation of a management improvement plan, such as capital expansion, if the result of the capital adequacy assessment of the group of financial companies does not meet the standards prescribed by the Presidential Decree.

◇ Assistant Referee for Corporate Measures … Experts and civic groups have mixed evaluations

Companies that have caught fire right away are scrambling to find countermeasures.

With the approval of the amendment to the Commercial Law, companies that must appoint a new audit committee at the general meeting of shareholders in March next year have an emergency.

The National Federation of Entrepreneurs (ex convulsions) issued an urgent appeal that day and requested that the execution period of the ‘Law of the Three Just Economies’ be delayed by one year to prepare complementary measures such as the introduction of measures to defend the right of management “.

Experts critical of Law 3 pointed out that the Commercial Law and the Fair Trade Law, which broadens the regulations on theft of private interests, will excessively infringe the management rights of companies.

Professor Lee Kyung-mook from Seoul National University said: “How to bother companies with strange content that is not available anywhere in the world. Companies are targeted to create sovereign wealth and create jobs. If these laws increase, the will to start a business will weaken, which will have a negative impact on the overall economy.

Professor Lee said: “In the case of the revised commercial law, if a competing company becomes the second largest shareholder and appoints an outside director, especially an auditor, it can access confidentiality, which is a great threat to the business management”.

On the other hand, while it welcomed the possibility of improving corporate governance, there were voices that criticized it as “a law that is moving considerably away from what was previously discussed.”

Kim Woo-chan, professor at Korea University and director of Solidarity for Economic Reform, said: “The passage of the Third Fair Economy Law is welcome and it is significant that it paved the way to improve corporate governance.”

Professor Kim said: “I was quite disappointed that the law was so weakened in the discussion process.” “With the relaxation of the 3% rule of the commercial law, it became difficult to appoint an independent external director to control the majority shareholders.

He pointed out that it was a violation of the presidential commitment that did not abolish the exclusive prosecution rights, and also showed the pro-chaebol color of the democratic party.

Through a comment, the Participation Solidarity criticized, “The withdrawal of the abolition of the exclusive accusations promised to the public to the public raises questions about whether the scrutiny law to control the prosecution, which is in tension with key officials of the regime, It has worked”.

/ yunhap news