[ad_1]

The secret to choosing a real public offering is

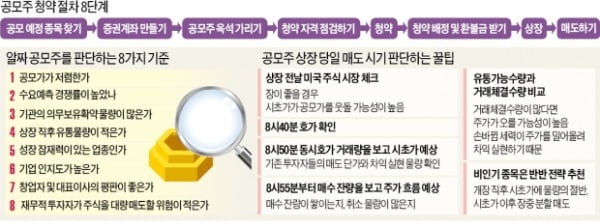

(1) Is the public offering price appropriate? Need for business value analysis

(2) Check the institutional demand forecast … Commitment rate confirmation

(3) Understand the amount of profit-making that spills out immediately after listing

(4) A highly recognized company … Attention to promising next generation industries

Warren Buffett, chairman of Buckshire Hathaway, hasn’t invested in public offerings for a long time. “Investing in public stocks is no different from buying a lottery ticket,” his long-held opinion. This means that public offering stocks are less likely to make a profit. Then President Buffett began investing in public offerings. In September, it invested $ 730 million (about 860 billion won) in the IPO of cloud-based software company Snowflake. The result was “great”. On the first day of trading, it made $ 820 million (about 960 billion won) more than the investment.

The enthusiasm for investing in public offerings was also very strong in the Korean stock market. In the next year, large fisheries such as Kakao Bank (373,000 -0.27%) are lined up and investment is expected to continue. The proportion of public offering shares allocated to individual investors is also expected to increase. However, if you follow him blindly, you may lose money. You need to know how to properly choose and invest in real public offerings.

Subscription to 6 public offering shares this week

It is difficult for people to expect big profits from public offerings. For popular stocks, the underwriting competition rate exceeds 1000: 1. Even if you put hundreds of millions of dollars as margin, the number of shares you can receive is less than a few weeks. Instead, it is considered a safe investment with low risk of loss. This is because there are not many cases where the stock price falls below the public offering price. Of the 49 companies that were listed this year (excluding SPEC and REIT), only 8 (16%) had their initial prices below the public offering price. Public offering stocks can make a profit even when the stock market is bad. The average annual return on investing in public offerings has never been negative over the last 20 years. When the stock market is booming, the market gains that can be made from public offerings increase.

At the end of the year, last minute subscriptions for public offerings are scheduled. This week, six locations, including Myungshin Industries, Quanta Matrix, Engenbio, Enbio, TLB, and ESR Kendall Square, are receiving general subscriptions. Next year, big companies like Krafton, SK Bioscience, Kakao Pay and HK Innoen are scheduled to appear.

Complication analysis is essential

However, you should not subscribe unconditionally. Among this year’s public offering shares, BBC (18,700 + 0.27%), Wonbang Tech (43,850 -2.56%) and NPD (4,160 + 2.21%) fell 10% below the public offering price immediately after listing. . The closing price on the first trading day was also 30% lower than the offer price.

To avoid losses, it is necessary to analyze whether the offer price is adequate for the business value before subscribing. In the electronic disclosure system of the Financial Supervision Service, the report of shares of a company that is expected to be an IPO details the value of the company, the method of calculating the offer price, the discount rate and the estimated market capitalization . Some companies inflate the ransom by selecting competitors with high stock prices as comparison companies. Then, a 30-40% discount rate is applied to make the sale price appear low. You should compare how publicly traded companies in the same industry, such as public offerings, rank on the market. The offer price should consider the overall corporate value rather than the price per share.

Catch up with the biggest investors

It is also useful to observe the movement of institutional investors. Public offering shares are determined by forecasting demand from institutional investors prior to blanket subscription. Promising stocks are highly competitive in forecasting demand due to the participation of many institutions. However, institutional competition is not directly related to the rate of return. People Bio (50,600 -2.50%) (40 to 1) (40 to 1) Go Bio Lab (39,300 + 2.48%) (64 to 1) Baxel Bio (98,600 -1.10%) (94 to 1), which did not reach the box office worked. This is because companies that do not reach the box office in forecasting demand set cheaper bid prices.

The percentage of mandatory retention commitments requested by organizations can also be an important indicator. A commitment to keep is a promise not to sell shares for a certain period of time. If you make a commitment, you can get a higher amount. If the commitment ratio is higher than 30%, it can be considered as a company that the institutions evaluate in an attractive way.

The prices traded on the OTC market are also data that can measure the price of the shares after the listing. It’s hard to be completely confident, but if the OTC price is higher than the public offering price, it can be said that investors in public offering stocks are likely to make a profit.

You have to check the amount of profit taking

After listing, not only the number of subscriptions, but also the amount of profit-taking, such as shares of existing shareholders, can be extended. Therefore, it is safe to invest in public offerings with a small number of shares released immediately after listing. The volume of circulation can be judged by the number of shares that are not subject to mandatory withholding between sales of old shares, public offerings and shares of financial investors. Generally, the sale of CEO shares, stock options and employee shares held by employees is prohibited for 6 months to 1 year. In the case of Big Hit (178,000 + 1.14%), share prices plummeted as financial investors held a large number of shares at once. On the other hand, Kyochon F&B (22,800 + 0.44%), which was listed on the 12th, has a small volume of distribution of 18.5% of the total shares, and there are no financial investors to sell large amounts, so the price of the shares is kept at double the public offering price.

The type of business of the public offering company is also a factor in determining the success or failure of the box office. This year, Corona 19 diagnostic companies became popular. Secondary battery companies, artificial intelligence (AI) and big data are also attracting attention. Corporate awareness also has a huge impact. Choi Woo-sik, CEO of Bright Investment, said: “The IPO market is sensitive to market conditions and trends.” “Companies that belong to promising next-generation industries, such as the Fourth Industrial Revolution and the sharing economy, will do well in the public offering market next year.”