[ad_1]

Daechi-dong 84㎡ property tax amounted to 10 million won

700,000 people subject to tax … KRW 4 trillion in taxes

“It is a failure of politics, but only taxes are removed”

A view of the Han Riverside Apartment from Building 63 in Seoul. / Hankyung DB

Kim Mo, in his 60s, checked the details of the comprehensive real estate tax notice on the 24th and sighed. A retired civil servant, it is a single dwelling apartment located in an exclusive 84㎡ apartment in Daechi-dong, Gangnam-gu, Seoul. The tax ending 1.26 million won last year has doubled to 2.47 million won this year. Mr. Kim said, “If a couple living in pensions must pay a possession tax of about 10 million won this year, including taxes,” he said.

Moo Yoon, a mid-sized company in his 40s who lives in Godeok Raemian Hillstate’s apartment in Godeok-dong, Gangdong-gu, Seoul, also unexpectedly received a bill. Godeok Raemian Hill State became the first tax payment target this year as the official price jumped to 945 million won. He said, “If you combine the tax and property tax, the property tax is close to 3 million won.”

700,000 people subject to tax … ‘Maximum’ in history

As the National Tax Service announced this year’s final tax bill, taxpayers complaining of a “tax shock” are showing up in various places. The tax burden has increased dramatically as home prices have risen dramatically and the reflective rate of the published price has increased. The site went offline once the day before as tax bills could be viewed in the IRS Hometax before they arrived in the mail.

The final tax is a national tax that is applied to natural and legal persons who own expensive houses or land as of June 1 of each year. The benchmark for expensive homes is 900 million won (one house per household), and if you own more than one home, you will have to pay taxes even if the combined price exceeds 600 million won.

According to the National Tax Service, the number of people subject to the final tax last year was 595,000, and the amount of the tax was 3.34 trillion won, the largest ever. It is estimated that this year the public price has risen and the ‘fair market price ratio’ used in calculating the valuation tax has been raised, so that the number of taxpayers of the valuation tax will exceed 700,000 and the Tax amount will also reach 4 trillion won. This year, the rate of increase in public prices is 5.98% on average nationwide and 14.7% in Seoul. The published price increase rate for high-priced homes with a market price of 900 million won or more was 21.1%.

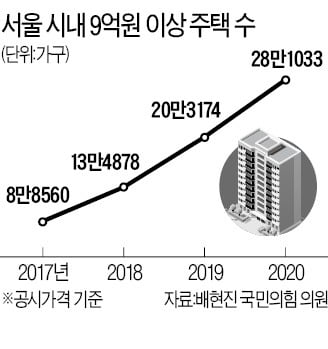

Apartment owners in Seoul’s Gangbuk area, who did not pay the tax until last year, also accepted the tax bill for the first time this year. According to data presented by the Ministry of Land, Infrastructure and Transportation to Representative Hyun-jin Bae, the people’s power, the number of houses with an official price of 900 million won or more, which is subject to tax per household this year, it increased by 38.3% (78.7859 households) to 280,033 households in Seoul alone.

It is pointed out that this year is just a ‘trailer’ about the increase in the tax tax. Since the government is committed to making listing prices for expensive homes a reality, there is a strong possibility that listing prices will rise. According to a tax simulation by Woo Byeong-tak, manager of Shinhan Bank’s Real Estate Investment Advisory Center, the tax incurred by 84㎡ holders of Acro River Park in Banpo-dong, Seocho-gu, increased more than 1.7 times from 28.17480 won last year to 4.948.2 million won this year. This apartment will be close to 10 million won with an estimated tax of 928 million8630 for next year, and will increase to 14,480,680 won next year.

The owner of the 114㎡ Raemian Daechi Palace in Daechi-dong, Gangnam-gu paid 402,4920 won in final taxes last year, but this year he received a bill that increased to 6,944,340 won. The apartment tax will increase to 12.372570 won next year and 2133.4095 won next year. Multiple homeowners are expected to be affected by higher tax ceilings than single-family homeowners.

Single-House Retirees “Should I Owe Tax and Pay Tax?” Sigh

As the burden of comprehensive real estate taxes rise, even single-lodged residents are crying out for it. On this day, in an Internet real estate cafe on the portal, “Why is the government raising the price of a house because of a policy flaw? Why is it giving a tax bomb to individual homeowners? ” Messages were posted one after another, condemning the increased tax burden. In particular, homeowners with no fixed income, such as retirees, complain, “Do I have to pay taxes on a loan?”

A housekeeper who owns an apartment in Jamsil, Songpa-gu, Seoul, appealed, “Starting next year, the tenure tax, including the tax, will exceed 10 million won.” A member of the café said: “It seems that the tax payment is doubling every year.” “Taxpayers are also overwhelmed with paying taxes, but will those who retire?” He collapsed. Another member said, “Most of the apartments in Seoul were close to the expensive housing standard,” and said, “Is the government constantly increasing house prices to ensure tax revenue?”

A post is published in a public brokerage office in Seoul criticizing the government’s real estate policy. / News 1

On the other hand, some pointed out about the end of the fiscal shock: “House prices are increasing by hundreds of millions of won, but if you pay a few million won in taxes, is that a good deal?” A member of the real estate community criticized: “If the tax burden is high, shouldn’t we sell the house?” And “The gains from rising house prices are higher, so homeowners don’t offer their houses.” In this regard, experts pointed out that “taxes must be paid in cash, but as long as they do not sell their houses, there are many retirees who do not have enough cash,” he said. “If they are sole proprietors, it is not easy to have their houses.”

Some argue that instead of increasing the property tax, it is necessary to prepare an “exit strategy” for the owners, such as easing the burden of the transfer tax. In the current situation, the government has greatly increased the transaction taxes, such as the transfer tax, so it is completely blocked from selling houses, so it would be better to pay the tax even if it was a loan.

Some analysts say that the tenant, not the landlord, will eventually be bombarded with a tax bomb. An official at a brokerage in Gangnam said: “The more property taxes are raised, the more the landlord will try to recoup them by increasing the jeon and the monthly rent.” It means they will hold you. “

Ahn Hye-won, Hankyung.com Reporter [email protected]