[ad_1]

According to the Korean Stock Exchange on the 23rd, the KOSPI closed at 2602.59, an increase of 40.09 points (1.92%) compared to the previous trading day, and recorded an all-time high based on the closing price. . On this day, foreigners bought shares worth 9885 billion won, registering him as the sole buyer.

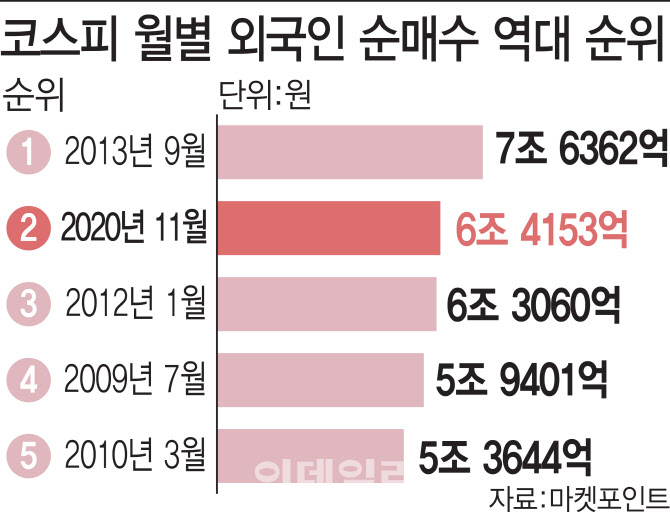

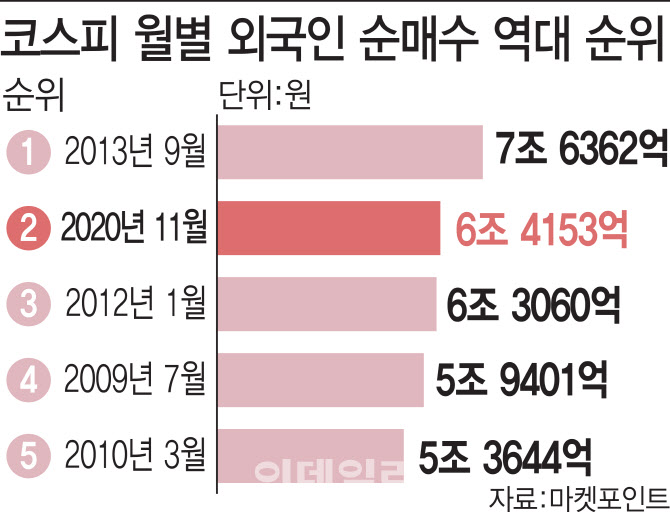

This month, foreigners bought 15 trading days from KOSPI until today, minus one day on 4. The cumulative net purchase amount this month is approximately 6.4149 billion won. This is the second largest on a monthly basis, after the September 2013 record of 7,636.2 billion won. Considering there are 5 trading days left for this month, if foreigners buy stocks of 244.3 billion won or more on average per day, the record could change.

|

If you look at the stocks that foreigners have bought heavily this month, you can see more of their influence. This is because the performance of the large-scale semiconductor and rechargeable battery manufacturers that have been largely purchased is so high. During the same period, it was the first item that foreigners bought the most. Net purchases were found to amount to KRW 2.29 trillion to date, which represents approximately 35.8% of KOSPI’s total net purchase volume. Second place in net purchases was 1,110.3 billion won. Third place was 9794 billion won and fourth place was 3.738 billion won, respectively. Net foreign purchases of the four main stocks amounted to 74.2%, indicating that actual purchases were concentrated in these large domestic stocks. Samsung Electronics rose 22.4%, LG Chem 19.3%, SK Hynix 25.2% and Samsung SDI 19%, respectively, beating KOSPI’s performance of 14.8%.

Kim Ji-san, head of the research center at Kiwoom Securities, said: “With the resolution of the uncertainty about the US presidential elections, the anticipation of vaccines and the weakness of the dollar, foreigners are strongly influencing KOSPI, which has high valuation appeal among emerging economies. He’s focused, ”he explained.

The proportion of foreigners in the KOSPI has increased steadily and, considering the rate of increase, it is analyzed that there is a wide margin for additional purchases. However, the current concentration in semiconductors and secondary batteries is expected to weaken slightly.

Yoo-jun Choi, researcher at Shinhan Investment Corp. said: “The trend line for the foreign ownership index is 37.4% when considered from 2010, but considering it is 36%, there is room for an additional purchase. of 24 trillion won in the future. ” Since the situation is in even greater decline, there is a possibility that foreign purchases will be driven by growth stocks that are favorable for low interest rates. “He added,” The purchase of about 140 billion won in the KOSDAQ on November 20 can be interpreted in the same context. ”

On the other hand, Kim Ji-san, head of the center, said: “There is a possibility that these sectors will rise further as earnings expectations grow in economically sensitive sectors such as chemicals, steel and finance, which have a wider valuation gap compared to growth stocks. “