[ad_1]

President Cho Won-tae also extended loans

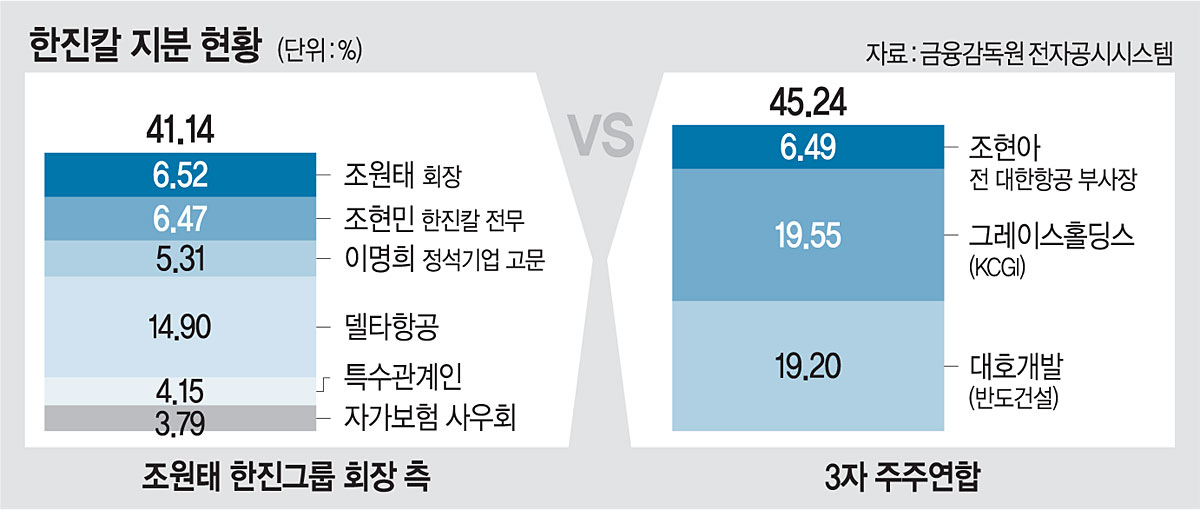

The dispute over management rights between Hanjin Group Chairman Cho Won-tae and the tripartite shareholders association (Hyeon-ah Cho, former Vice Chairman of Korean Air, KCGI and Bando Construction) has entered the ‘second round’ . When Korean Air began taking control of Asiana Airlines, the trilateral shareholders alliance convened an extraordinary general meeting of shareholders and began preparing a “real opportunity” to secure an additional stake in Hanjin Kal. The tripartite shareholders’ association is launching a general offensive, such as proceeding with a lawsuit against the issuance of new shares, which may defeat the acquisition itself.

According to the Electronic Disclosure System of the Financial Information Service on the 23rd, Grace Holdings, a subsidiary of KCGI, a private equity activist fund (PEF) that has faced President Cho over the management of Hanjin Group, entrusted 5.5 million Hanjin Kal’s shares as collateral in Meritz Securities on the 12th. He announced that he had received a 130 billion won loan. As for the background, KCGI did not give an official response. However, it is being interpreted by the related industry as a way to prepare for a paid-in capital increase in the process of acquiring Asiana Airlines by Korean Air in the future.

Former Vice President Cho also launched into fundraising. It received a loan from Woori Bank (300,000 shares), Korea Capital (23,000 shares) and Sangsangin Securities (30,000 shares) as collateral for Hanjin Kal shares on 29-30 last month. It is presumed that it will be used to pay inheritance tax on the property inherited from the death of former Hanjin Group Chairman Yang-ho Cho, but there is also the possibility of investing it in the Hanjin Kal capital increase. KCGI and former Vice Chairman Cho own 6.49% and 19.55% of Hanjin Kal, respectively, at the time of disclosure.

President Cho also extended 10 billion won and 2.7 billion won in loans received from Hana Bank and Hana Financial Investment on the 5th. However, opinion is predominant in opinion as a follow-up procedure carried out. carried out by the Korean Development Bank holding Cho’s stake as collateral as a condition for participating in Hanjin Kal’s capital increase.

Separately, the Korea Development Bank released data that day and refuted the point of criticism that “ Korean Air is not investing in Hanjin Kal rather than Korean Air to act as an alliance for President Cho in a situation in which a management rights dispute is occurring. The Korean Development Bank said: “To successfully integrate the two major airlines and restructure the aviation industry, investment in common shares in Hanjin Kal is necessary.” “Participate directly with Hanjin Kal as a shareholder to support the implementation of the restructuring work, It is necessary to act as a monitor of ethical management.”

Reporters Kwak Sun-mi and Min Jeong-hye