[ad_1]

Photo = Yonhap News

‘8,200,000 won (January 1) → 132.29 million won (October 19) → 20 million won (November 19).’ The price of Bitcoin is skyrocketing without hesitation. It was up 50% in a month and jumped 2.5 times compared to the first day of this year.

The interpretation is divided. Overall, the analysis agrees that “abundant liquidity” and the “influx of institutional investors” lit up the market. The ‘digital currency’ is imminent by the People’s Bank of China, and follows the ‘grand’ interpretation of the pro-virtual currency policy of the US government Joe Biden. Hong Ki-hoon, a professor at the Hongik University Business School, analyzed that “the global capital market lacks high-risk, high-return assets.”

The views are extremely varied. The prospect that the price of bitcoin “will exceed 300 million won in one year” (Citibank) and that “it is uncertain whether the inflow of funds will continue” (Wall Street Journal) will coexist.

Bitcoin, which failed to establish itself as a ‘digital currency’, this time changed its packaging into a ‘digital asset’. It is for this reason that Bitcoin transactions are led by big players, not individuals. So far, it is a “successful transformation”. In terms of performance, Bitcoin took first place this year, outperforming all assets like stock bonds, gold, silver, and copper.

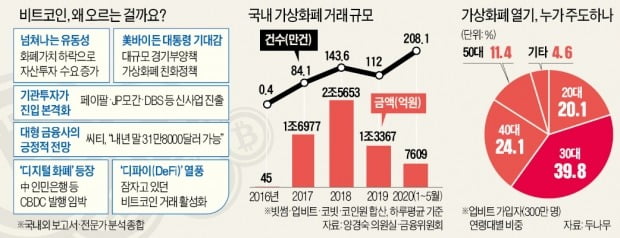

Although the ‘currency craze’ has disappeared for three years, there is still a considerable amount of virtual currency trading in Korea. According to the Financial Services Commission, the average daily volume of cryptocurrency transactions of the four major national exchanges (Bitsum Upbit Cobit Coinone) fell from 2,565 trillion won in 2018 to 7,609 billion won this year. During the same period, the number of transactions increased from 1,436,000,000 to 2.81,298.

Tracking Issues: Bitcoin Surpassed 20 Million Won

“It’s different this time.” “It’s a bubble this time.”

With the price of bitcoin surpassing 20 million won in 2 years and 10 months, various analyzes are spilling over into ‘why is it increasing’ and ‘where will it increase?’ Park Sang-hyun, Researcher at Hi Investment & Securities, said: “This rally reflects the fact that bitcoin is gradually attracting attention as an asset” and “there is a mixed view of the position and price of bitcoin going forward.” .

“The reason to get up is full and overflowing”

Comprehensive analysis by domestic and foreign experts, the cause of the ‘Bitcoin Rally’ can be largely summed up in four reasons. First of all, the cryptocurrency made a reflective profit from the “ indiscriminate money release ” brought on by Corona 19. The presence of bitcoin is said to have increased relatively as the value of the coin declines due to liquidity overflow in the market.

The growing number of companies and institutions entering the digital asset market also served as a big boost. PayPal will launch payment services compatible with Bitcoin, Ethereum and Litecoin starting in the new year. JP Morgan in the US and DBS in Singapore have also entered new businesses related to digital assets. The People’s Bank of China is the world’s first central bank to issue digital currency (CBDC). This is news that increases the expectation that the virtual currency will be closer to the real economy.

According to an analysis, it has also affected the spread of ‘DeFi’, a new service that receives deposits in virtual currency and pays high interest rates. This is because the cryptocurrency that was sleeping on exchanges and personal wallets was re-executed. DeFi worldwide deposits increased from $ 8.9 billion in September to $ 13.6 billion.

There is also an expectation that if the US Biden government uses a large-scale stimulus package, the value of the dollar will fall further. Dae-hoon Han, a researcher at SK Securities, explained: “Concerns about the increase in the Biden government’s share transfer tax are also prompting the influx of Bitcoin funds.” The ‘materials’ that will lead the bull market are overflowing, as JPMorgan and Citibank recently released a report stating that “Bitcoin has emerged as an investment vehicle to replace gold.”

“Are there safe assets with rising prices?”

The objection that it is nothing more than speculation without substance remains strong. The Wall Street Journal drew a line, saying, “It is unclear whether funds will continue to flow,” saying that “Bitcoin is attracting attention as a hedging asset as concerns about inflation (inflation) grow.” Ray Dalio, CEO of Bridgewater Associates, which is a ‘hedge fund loan’, also criticized that “Bitcoin is too volatile to be suitable as a wealth storage medium.”

Hong Ki-hoon, professor of business administration at Hongik University, said: “Bitcoin, which was not recognized as a ‘currency’ as a medium of exchange, has been repackaged as a ‘digital asset’. People who buy bitcoins They bet on high volatility to get high returns, but Professor Hong explained that to be treated as a “ stable financial investment asset, ” these characteristics must be abandoned.

Those many ICOs are not news

Financial authorities maintain a conservative stance on cryptocurrencies. The Financial Services Commission said: “There will be no official recognition of businesses related to virtual currency as a financial business or incorporation into institutional sectors.” Cryptocurrency Disclosure (ICO), which was popular with startups during the coin craze, is still banned.

Most of the ICO projects that have been rushed are stalled. Player One, a gaming data services startup, announced that it plans to establish a virtual currency ecosystem ‘Player One Coin (PLO)’ in 2018. Users share data and personal information related to the game, such as game time and favorite games, and game developers give PLO as a reward. To this end, Player One held an ICO in late 2018 and raised billions of dollars in funding. However, after raising the funds, there has been no news of Player One’s business. Watcha, an Internet video services (OTT) company, also raised around 9.7 billion won by conducting an ICO through of the ‘Content Protocol Project’, but stopped suddenly in February.

Kang Hyun-jung, a member of the advisory committee of the Korea Blockchain Association, said: “While various companies have conducted ICOs, they have developed countless visions, but it’s hard to see a place that has done well so far.

Reporter Lim Hyun-woo / Gu Min-ki [email protected]