[ad_1]

One of the important financing methods featured in the big deal Korean Air acquires Asiana Airlines is equity-linked bonds. If the investment firm does not fail through a “hybrid” investment method with interest-paid bonds and the right to convert into shares, it can eat “pheasants (interest)” and “eggs (shares).”

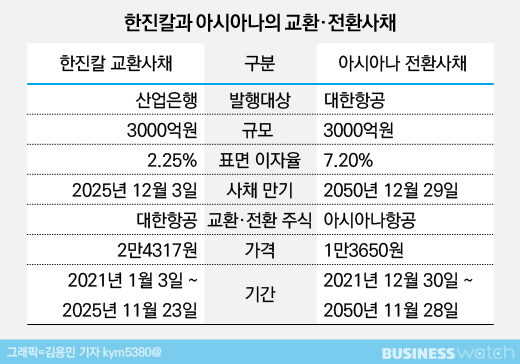

Stock-linked bonds that appeared in this great deal Redeemable voucher (EB)Wow Convertible bond (CB) And so. It is a 300 billion won exchange bond issued by Hanjin Kal to the Korean Development Bank and a 300 billion won convertible bond issued by Asiana Airlines to Korean Air. We look at two equity-linked bonds with the same issue size, but showing differences in convertible stocks and stocks and interest rates.

◇ Saneun’s acquisition of Hanjin Kal’s exchange bond is ‘for the insurance’

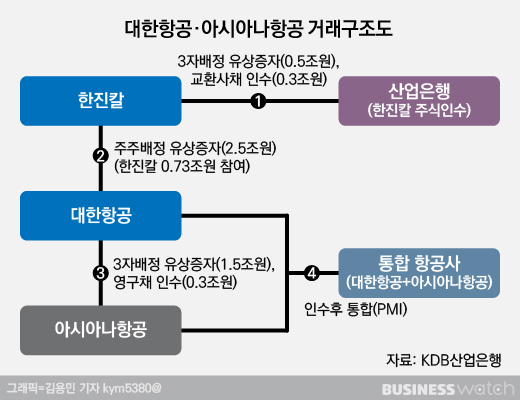

The 800 billion won KDB invested in this great business will flow to Asiana Airlines through Hanjin Kal and Korean Air. ① First, the KDB invests a total of 800 billion won, including 500 billion won in Hanjin Kal’s capital increase and 300 billion won in exchange bonds. ② Hanjin Kal pays 730 billion won of KDB’s investment as raise in Korean Air. ③ Korean Air transferred 1.8 trillion won (1.5 trillion won in paid capital increase, 300 billion won in convertible bonds) to Asiana Airlines by combining the capital increase from KDB and general shareholders.

In this process, the method of financing through equity-linked bonds to increase capital appears twice. It is the time when KDB invested 800 billion won in Hanjin Kal, and Korean Air transferred 1.8 billion won to Asiana Airlines. The bigger question is why equity-linked bonds were used in this great business.

First, when KDB designed Hanjin Kal’s financing structure, it tied capital-increased exchange bonds to reduce investment risk. KDB will acquire new shares worth 500 billion won for 7,800 won per share from the Hanjin Kal capital increase. The protection period is one year, and if Hanjin Kal’s share price falls below 7,800 won a year later, he will lose money.

The problem is that the bubble in Hanjin Kal’s share price, which is experiencing a dispute over management rights, may be extinguished. The stock price, which was trading in the 30,000 won range in November last year, is currently trading at 74,800 won. Furthermore, it is noted that if the Bank of Korea has a 10% stake in Hanjin Kal, the dispute over management rights will run out and the share price will plummet. In preparation for this case, it was designed with an increase in “safe” convertible bonds that can be converted into Korean Air shares.

In an online conference held on the 16th, Sang-Hyun Choi, Vice President of Sang-Eun, said, “San Eun will acquire 500 billion won of new shares issued by Hanjin Kal through the allocation to a third party, and will acquire 300 billion won of exchange bonds using Korean Air shares as the underlying asset to offset the risk of loss of common shares, “He said.

On the other hand, convertible bonds issued by Asiana Airlines were introduced for “capital expansion”. Korean Air will take over Asiana Airlines by investing 1.5 trillion won in the Asiana Airlines paid-in capital increase. Although 1.5 trillion won is transferred to Asiana Airlines, this is a very insufficient amount given that the company’s debt ratio exceeds 2,291%.

Convertible bond issuance is the method of choice to replenish insufficient capital. The convertible bonds issued this time are permanent bonds whose maturity date of the bonds reaches 2050 and the issuer can extend the maturity of the bonds without a limit of number of times. For accounting purposes, it appears to be classified as equity rather than as liabilities. Vice President Choi Choi explained, “Asiana Airlines will issue new shares worth 1.5 trillion won to Korean Air through a third-party allocation method, but will issue permanent bonds worth 300 billion won to increase capital.” .

◇ Asiana is three times more dangerous than Hanjin Kal?

As explained above, exchange bonds and convertible bonds are a type of bond linked to stocks, but there is a big difference in terms of which stocks they are entitled to receive. Exchange bonds issued by Hanjin Kal can be exchanged for Korean Air shares, while convertible bonds issued by Asiana Airlines have a “conversion right” to receive Asiana Airlines shares. When conversion bonds exercise the right of conversion, they receive shares of the company that issued the bonds and exchange bonds receive shares of other companies held by the company that issued the bonds.

The fact that you have the right to convert into shares does not mean that you are exercising all these rights. When issuing bonds linked to shares, the price that can be converted into shares is determined. When converting shares, the share price must be higher than this price to make a profit.

The exchange price of the exchangeable bonds issued by Hanjin Kal is 23,317 won, and the exchange period is from January 3, 2021 to November 23, 2025. During this period, if Korean Air’s share price is higher than the exchange price, it is possible to buy shares at a lower price. For example, if the price of Korean Air shares rises to 40,000 won in the future, KDB will be able to purchase Korean Air shares worth 40,000 won for 24,317 won by exercising a trade voucher.

The conversion price of the convertible bonds issued by Asiana Airlines is 13,650 won. Compared to the current Asiana Airlines share price (5,220 won), the conversion price is higher, reflecting the current capital reduction effect (capital reduction). Asiana Airlines is in the process of a free reduction from three to one on the merger of 2,2323,5294 common shares into 74,41,174,64, but as the number of shares decreases, the price of a share will increase even more. . Reflecting this, the conversion price was also set high.

Korean Air may exercise the right to convert and acquire shares at a price lower than the market price if the price of Asiana Airlines shares exceeds 13,650 won within the transition period (December 30, 2021 to November 28, 2050).

Even if the share price is lower than the conversion or exchange price in the future, it is not a loss-making business. You can earn the same interest every year as Altoran. The surface interest rate on Hanjin Kal’s foreign exchange bonds is 2.25% and the maturity rate is 4%. KDB receives 2.25% interest from Hanjin Kal each year, and when held to maturity (December 3, 2025), the final interest rate of 4% is guaranteed.

Convertible bonds issued by Asiana Airlines have higher interest rates. The superficial interest rate and the maturity rate reach 7.2%. This reflects the risks for Asiana Airlines in a liquidity crisis. In addition, to this convertible bond an annual interest of 2.5% is added two years after its issuance (December 29 of this year). Starting five years after the issue date, the interest rate gradually increases by 0.5% per year. However, as Korean Air acquires Asiana Airlines and furthers integration, it is unlikely that Asiana Airlines’ interest burden will increase indefinitely.

Looking at the interest rate, you can see that in this great deal, KDB invested in Hanjin Kal, which is relatively safe, and Hanjin Kal, who received the investment from KDB, invested in high-risk Asiana Airlines through Korean Air. . This is not good news for the general shareholders of Korean Air, who have to pay for the acquisition of Asiana Airlines through a capital increase.