[ad_1]

|

| Hong Nam-ki, Deputy Prime Minister of the Economy and Minister of Strategy and Finance, announced emergency measures for people’s livelihoods and economy at the 8th Joint Briefing of the Emergency Economy Conference held at the Seoul Government Complex in Jongno-gu, Seoul on the 10th. 2020.9.10 / News1 © News1 Reporter Kim Myung-seop |

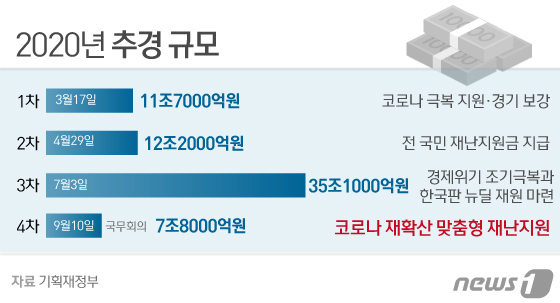

Concerns about deteriorating fiscal strength as the government prepared a fourth supplemental budget (additional budget) worth 7.8 trillion won for owners of small businesses, such as computer cafes, affected by the strengthening of social distancing. It is coming out.

It is noted that this cash aid will lead to a tax increase in the future, as the issuance of government bonds increases the national debt and the blood tax is invested to pay the increased debt.

In addition, a controversy over “populism” is emerging, as a large amount of about 1 trillion won, to be used for 20,000 won for all national communication expenses, is included in the cash aid.

Previously, the government paid the first emergency disaster subsidy and then increased the comprehensive property tax, which faced a headwind of public opinion.

According to the Ministry of Strategy and Finance on the 11th, the government plans to present a fourth supplemental bill worth 7.8 trillion won to the National Assembly on that day.

◇ The fourth complementary visit in 59 years … 119 trillion won financial deficit

With this addition, the government has organized four supplemental supplements one year after 59 years since 1961.

Previously, the government arranged the first supplement of 1.1 trillion won, followed by the second supplement of 1.2 trillion won and the third supplement of 3.5 trillion won. The total size of the three additional supplements was 59 billion won. Including the fourth supplemental supplement, this year’s cumulative supplemental supplement amounts to 6.6 trillion won.

The fourth supplement is covered by the issuance of total bonds, including government bonds of 7.5 trillion won and SME promotion bonds of 300 billion won.

As government bond issuance increases, fiscal strength is expected to deteriorate further. The government predicted that the scale of the integrated fiscal deficit based on the fourth supplement would reach 84 trillion won, an increase of 7.8 trillion won compared to the third supplement.

The size of the managed fiscal deficit after subtracting the social security funds from the integrated fiscal balance is estimated to increase by KRW 7.1 trillion from the third additional KRW 111.5 trillion. The size of the fiscal deficit alone, which has increased due to the four additional administrations, stands at 47.1 trillion won compared to this year’s budget. The relationship between the fiscal deficit and GDP also increased 0.3 percentage points (p) from 5.8% to 6.1%.

With the increase in deficit government bond issuance, the national debt reached 846 trillion and 900 billion won, a jump of 7.5 trillion won compared to the third supplement. The ratio of national debt to GDP is also forecast to increase 0.4% p from 43.5% to 43.9% according to the third supplement.

As of this year’s budget, the national debt, which was 805.2 trillion won, has soared to 81.5 trillion won after the first supplement, 819 trillion won after the second supplement, and 839.4 trillion won. won after the third supplement. The ratio of national debt to gross domestic product (GDP) also increased sharply from 39.8% for the first budget to 41.2% for the first, to 41.4% for the second, and 43.5% for the third.

|

| © News1 Designer Kim Il-hwan |

◇ “The government does not say that you have to pay taxes while giving cash”

As the size of the fiscal deficit increases rapidly and the national debt rises, voices of concern are emerging about fiscal soundness, but the government is in a position that there is an unavoidable aspect of the Corona 19 situation.

On the 10th, Deputy Prime Minister and Minister of Equipment Hong Nam-ki said, “I think the fiscal deficit index is over 6% and there are various intellectuals (relevant to soundness).” I would like to tell you that it was a temporary measure that could not be done. “

“The government is planning to respond during the medium-term fiscal plan so that the fiscal deficit index can be managed within 6%,” he said. “In general, we plan to work on the issue of fiscal soundness.”

However, some point out that this increased debt will eventually lead to tax increases.

“Today’s debt is tomorrow’s tax, and today’s increased national debt belongs to our children and grandchildren, and one day we will have to pay,” said Kim Seon-jeong, president of the Korean Taxpayers Federation. It is considered necessary, but it is an irresponsible and immoral behavior to owe to future generations as a guarantee because it can be something comforting for people (such as communication expenses) “.

This can be interpreted as a sign that populist controversy is emerging as the government decided to support per capita communication spending of 20,000 won to citizens 13 and older through this supplemental administration. Initially, the government decided not to pay communication fees for people between 35 and 49 years old who are active in economic activity, but a day before the announcement of the measures, controversy was generated by expanding the objective. The government has set a budget of 928 billion won to support communication spending of 20,000 won for 46.4 million people.

President Kim said: “(The government) only says good things about welfare and does not make a bitter voice that you have to pay taxes,” he said. “Wellness is not free and it comes at a price. I do it,” he said.

|

| © News1 Designer Choi Soo-ah |

[ad_2]