[ad_1]

After the blanket subscription to the public offering shares of Big Hit Entertainment, which is famous as BTS’s agency, the big banks have deepened their agony.

Big Hit’s general subscription held on the 5th and 6th received 58 billion won, the second-largest ever. The bank’s negative passbooks (limited loans) and frequent deposit and withdrawal savings accounts also lost large amounts of money. Banks are concerned that funds that were not advertised may not return to the bank.

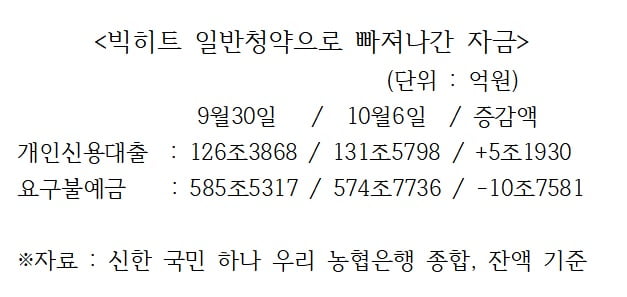

According to the banknotes on the 9th, the balance of personal credit loans for the top five banks, including Shinhan National Hana, Woori Nonghyup, was 131 trillion 578.9 billion won. It increased by 5.193 trillion won from the 126 trillion of 3.868 billion won at the end of last month.

The credit balance of the top five banks increases and decreases by approximately 1 percentage point each month. In August, when the demand for funds triggered by Corona 19 and low ‘all-tier’ interest rates overlapped, the loan balance of the top five banks increased by 470 billion won per month, hitting an all-time high with a monthly increase. However, this month it has increased by more than 5 trillion won in just six days, outpacing the increase in August.

The banks explained that the rapid increase in bank loans was due to the general underwriting of Big Hit’s public offering shares. People are said to have returned money from the negative passbook they had already opened and deposited it into a brokerage account. On the 5th, the general subscription to the Big Hit competition was evaluated as somewhat slow.

However, before the deadline on the 6th, BTS ARMY’s fan club etc. was also added, showing the heat. The final competition rate reached 607: 1. This means that more than 500 times the public offering amount of 966.2 billion won was raised. Shinhan Bank’s credit loan balance increased by 1,472 trillion won in just one day. Kookmin, Woori, and Hana Bank also generated loans of 800 billion to 1.1 trillion won each on the same day.

It is estimated that a considerable amount of money has been withdrawn from securities companies even in accounts payable by bank claims, such as occasional deposit books and withdrawals that rarely pay interest. As of September 30, the claims balance of the top five banks was 585,531.7 million won. In six days, they dropped 10.758 trillion won.

People who participate in the Big Hit subscription receive 2 weeks for every 100 million subscription margin. Margins for remaining subscription failures will be returned the same day (8 days) two business days after the general subscription ends. The home trading system (HTS) and mobile trading system (MTS) of most securities firms leave it to your individual decision whether to keep the redemption amount in the stock account or to redeem the previously paid account when it is Enter the subscription reservation.

In recent years, due to the boom in the stock market, securities companies have explained that more and more cases are used to invest leaving returns in securities accounts. A similar phenomenon took place at SK Biopharm and Kakao Games, which had general subscriptions prior to Big Hit. Only about 10% of the people who previously subscribed to Samsung Securities’ Kakao Games are known to have designated a bank as their redemption account.

Securities companies are well aware of this and are in the business of marketing to collect refunds. Korea Investment & Securities offers additional benefits when consumers participating in public offering stocks invest in funds and close accounts. Samsung Securities is also holding an event that awards up to 3 million won in gift certificates through a lottery. An official at a securities company said: “We see underwriting margin as a holding fund for investment in the equity market and we are actively trading.” Savings banks also offer special short-term deposits that grant the promised interest even if they are paid in half, with the aim of obtaining a refund of the subscription.

Banks are particularly concerned about whether this will lead to an increase in credit lending. This is because the phenomena of ‘debt investment (investing in debt)’ and ‘young drag (charging souls)’ are intensifying this year, and financial authorities have demanded a ‘credit rate adjustment’. A commercial bank official explained: “After about a week, it will be difficult for a person to decide how much to return the refund to a negative passbook.”

Reporter Kim Dae-hoon [email protected]