[ad_1]

Request for rehabilitation after 2009 due to liquidity crisis

The rehabilitation procedure was delayed for 3 months due to the acceptance of self-organization.

Following foreign financial institutions, Ssangyong Motor, whose loans taken from domestic banks were in default, applied to the court for corporate rehabilitation on the 21st.

This is because India’s largest shareholder Mahindra decided not to make additional investments in Ssangyong Motor, and the amount of delinquent principal and interest in financial institutions reached 165 billion won, which is in a liquidity crisis. .

However, since the Autonomous Restructuring Support (ARS) program applied as a whole was accepted, if negotiations with new investors were completed within three months, there would be no request for rehabilitation.

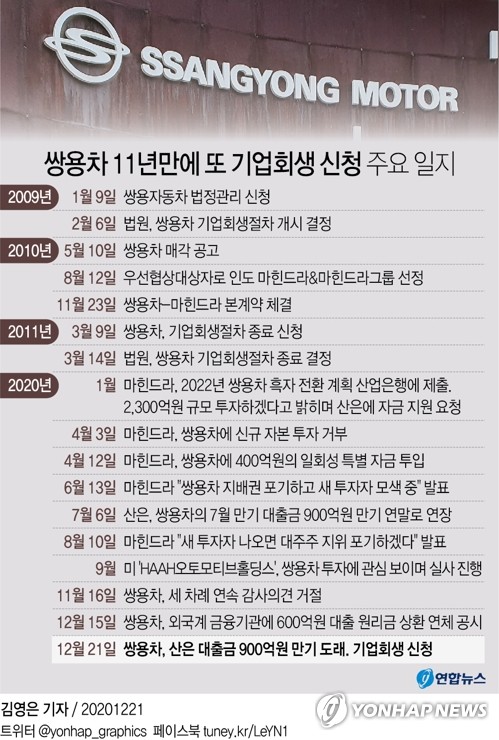

Ssangyong Motor’s application for corporate rehab has been for 11 years since the application was submitted in January 2009 due to severe business difficulties after the global financial crisis caused by the subprime mortgage crisis in 2008.

At that time, Ssangyong Motors’ main shareholder, Shanghai Motors, applied for the legal management (corporate rehabilitation) of Ssangyong Motors, which suffered from mismanagement.

The court decided that a large-scale human restructuring was necessary for the rehabilitation of the company, and Ssangyong Motor decided to lay off 2,600 people, 36% of all employees, in April of the same year.

The so-called ‘Yangyong Motor Incident’ that started here became a symbol of the conflict between workers and management and left a great scar on Korean society.

After graduating from the rehabilitation process in March 2011 and taking over the Mahindra Group in India, Ssangyong Motors once recovered to the pre-legal management level, but the financial structure, etc., once recovered to the pre-statutory level. He fell into the swamp of deficits.

This is because domestic sales performance declined sharply due to intensifying competition in the flagship sport utility vehicle (SUV) market, and export performance deteriorated as exports virtually came to a halt after 2015.

Additionally, the automobile market suffered a general recession in the wake of this year’s new coronavirus infection (Corona 19).

Ssangyong Motor’s capital erosion rate was 86.9% in 3Q.

Ssangyong Motor also received a rejection of the accounting firm’s audit opinion three times in a row, from the first quarter of this year and the semi-annual report through the third quarter of this year.

This time, however, it differs from 2009 in that he applied for the ARS program along with corporate rehab.

The Seoul Rehabilitation Court announced that the ARS program will be implemented in accordance with Ssangyong Motor’s intention.

The ARS program, introduced in 2018, is a system that delays the start of the rehabilitation process for up to three months after the court confirms the creditor’s intention.

If this program is applied, the debtor, namely Ssangyong Motor, can carry out its normal activities as before and consult autonomously with the main creditors, and then withdraw the request for rehabilitation procedures when an agreement is reached between the parties stakeholders, such as obtaining new investors.

In other words, if the negotiations with HAAH Automotive or another new investor currently under discussion and the liquidity crisis can be resolved within a period of up to three months, the request for rehabilitation will be withdrawn through an agreement with the creditors and the request for rehabilitation. will return to the state where they will be.

It is also possible to prevent a kind of ‘stigmatism’ caused by the initiation of the rehabilitation procedure.

Furthermore, since there is no need to repay debts during the waiting period for the start of the rehabilitation process, Ssangyong Motor will be relieved of the burden of repaying principal and interest on loans for the time being.

However, if the restructuring proposal cannot be achieved within the period, the rehabilitation procedure will begin. Therefore, if an agreement is reached on the restructuring proposal, including obtaining new investors within a maximum period of three months, it will be determined whether the rehabilitation procedure will resume after 11 years.

Mahindra said: “We will take responsibility as the majority shareholder during the ARS period and actively cooperate in normalizing Ssangyong’s management by early resolution of stakeholder negotiations.”

HAAH Automotive, which is known to be currently discussing the sale of Ssangyong Motors by Mahindra, is a car dealer based in Irvine, California, USA, and is founded by President Duke Hale, who is over 35 years old. of experience in the distribution of imported automobiles.

The court adopted conservation measures that prohibit the repayment of monetary debt or the provision of collateral, but applied an exception to “commercial bond payments related to normal and continuing business activities” to minimize anxiety for business partners.

Related ministries, such as the Ministry of Commerce, Industry and Energy, the Financial Services Commission and the Department of Small and Medium-sized Enterprises, also decided to operate a support group to avoid the chain shock of spare parts suppliers after Ssangyong Motor’s request for rehabilitation procedures.

As of last year, there were 219 suppliers to Ssangyong Motors, and the amount they delivered to Ssangyong Motors was 1.8 trillion won.

/ yunhap news