[ad_1]

① Yellow “Bitcoin speculative assets, important regulation”

② Governor of the Bank of Boston “Bitcoin won’t last long”

③ Bury “The government will crush Bitcoin”

United States Secretary of the Treasury Janet Yellen. Photo = REUTERS

When the market capitalization of Bitcoin, a representative virtual asset, exceeded $ 1 trillion (about KRW 1104 trillion), the United States Central Bank (Fed, Federal Reserve System) began to send out a ‘warning’ . Financial experts interpret this as ‘downward pressure’, which is that the US government is starting to crush Bitcoin, which could be a rival to the dollar.

According to CNBC on the 20th (hereinafter local time), the United States Secretary of the Treasury, Janet Yellen, told the media on the 18th that “Bitcoin is a very speculative asset.” “Regulate the institutions that handle bitcoin and maintain their responsibility. It is very important to do so.” Earlier, Minister Yellen said last month: “I know that many cryptocurrencies are used primarily for illegal finance. We need to consider ways to reduce such use and prevent money laundering.” The “ warning ” from the US Secretary of the Treasury was immediately followed when Bitcoin’s market capitalization settled at $ 1 trillion on the 19th in local US time.

Yellen wasn’t the only person in the government to send out warnings about the ‘high price of bitcoin’. On the 19th, the governor of the Federal Bank of Boston, Eric Rosengren, told The New York Times: “If digital currency is available, I don’t know what is the reason why people use bitcoins in addition to the shadow economy.” “I don’t think Bitcoin will survive long because central banks have the potential to create alternative cryptocurrencies themselves.” Rosengren supported the claim that “Bitcoin will strengthen the shadow economy,” which early virtual asset pessimists often pose.

Bitcoin surpassed $ 1 trillion in market capitalization for the first time on the 19th. This is the first time since the creation of individual cryptocurrencies. Bitcoin’s market capitalization is more than twice that of Samsung Electronics (approximately 491 trillion won), which is the number one market capitalization in the national stock market, and Tesla (approximately 820 trillion won), a vehicle electricity company listed on the NASDAQ market. , it is also exceeded. The recent rise of Bitcoin is dominated by the analysis that large institutional investors are jumping into virtual asset investing one by one.

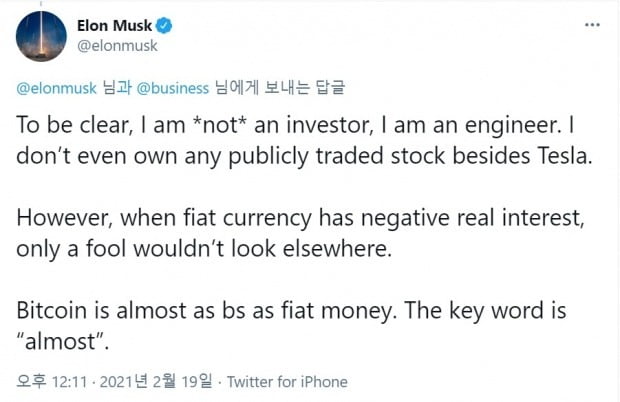

Photo = Elon Musk Twitter screenshot

First of all, Tesla recently announced that it has bought and held about $ 1.5 billion (1.6 trillion won) in bitcoins. Tesla founder Elon Musk tweeted the day before and wrote: “When the real interest rate on fiat money is negative, only idiots (Bitcoin, etc.) don’t look elsewhere.” He said that “having bitcoin is a less stupid act than having cash, and bitcoin is almost like money.”

General Motors (GM), a US automaker, said it is considering adopting virtual assets as a payment method for services and vehicle purchases, and New York Melon Bank announced that it will handle bitcoin in the future. PayPal, the world’s largest online payments company, which recently introduced virtual asset payment, also expressed its stance that it wants to use the rapidly growing market for virtual assets as an opportunity.

Bill Gates, who has been criticizing Bitcoin for its lack of intrinsic value, appears to have recently shifted his position. According to Cointelegraph on the 19th, Gates said, “I don’t have bitcoin, but I also don’t have a skeptical view of bitcoin.” This is in contrast to Gates’s criticism of Bitcoin and shows a negative stance. “We recognize the importance of digitizing money and reducing transaction costs,” he said. “What the Bill and Melinda Foundation is doing in developing countries is digitizing money and reducing transaction costs.”

Michael Bury, founder of Science Asset. Photo = Yonhap News

Some people show negative perspectives. This is Michael Burry, who made billions of dollars predicting the 2008 subprime mortgage crisis and betting on the collapse of the housing bubble. He is also known as the main character in the movie ‘Big Short’. In an article posted on Twitter the day before throwing it away, he warned: “Be prepared for inflation” and said: “In the midst of the inflationary crisis, the United States government will try to crush bitcoin and gold, they could be rivals to the dollar. “” In the 1920s, Germany issued a framework to cover the war debt deficit, “he said, criticizing the current US government, which is printing dollars in response to Corona 19.

Global companies remain negative about investing in Bitcoin. According to Bloomberg News, a survey by US market research firm Gartner of 77 financial executives, including 50 corporate chief financial officers (CFOs), showed that 84% of respondents expressed negative intentions about investing in bitcoin. Only 16% of respondents said they are willing to invest and only 5% said they intend to invest in the year. Gartner Research Director Alexander Vant said: “Financial executives will not want to undertake any speculative ventures. As a corporate asset, Bitcoin has many unsolved problems, so it will be difficult to distribute investment quickly.”

Reporter No Jeong-dong Hankyung.com [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution