[ad_1]

▲ An aerial view of Hanam Gyosan district, the third new town. Photo = Ministry of Lands, Infrastructure and Transport

As a result of the KB Real Estate survey, the increase in house prices in 2020 last year was 8.35%, the highest level in 14 years. The survey result from the government-affiliated Korea Real Estate Agency is also different, but is 5.5%, the highest level since 2011.

The intention to block speculative demand was good, but the failure of real estate policy, which only suppressed demand without sufficient supply, is pointed out as a key cause.

Some point out that the leasing law, which came into force with the intention of protecting tenants, in turn exacerbated chaos in the jeonse market and encouraged ‘panic buying’ by the homeless.

◇ Is there a limited increase in commercial prices? Jeonse Market Riots Continue

The Korean Institute for Building and Construction Policy (Keon Jeong-yeon) predicted that the sale price of homes nationwide would increase by 2% this year. Although the uptrend will continue, the momentum has softened rather than last year’s surge.

It is analyzed that the price increase will be limited since the house price already rose significantly last year, and this year, the demand for house purchase has decreased and the price increase power weakened due to the supply plan government.

However, with the release of 50 trillion won in land compensation including the third new city, the funds are expected to return to the real estate market until next year and next year.

As the Corona 19 pandemic drags on, there are many concerns that low interest rates will inevitably continue for the time being, and such liquidity will remain intact for real estate.

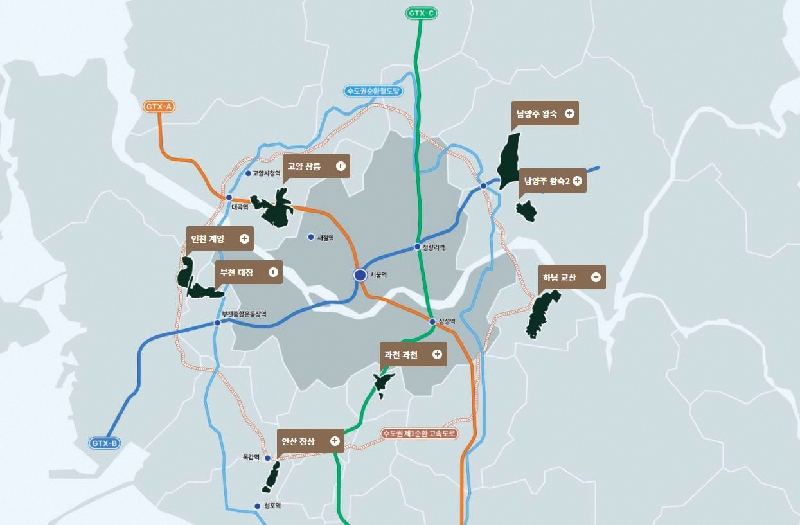

▲ Map of the third new city. Photo = Third New Town Home Page

Magnified view of the image

Contrary to the commercial market outlook, the outlook for the cheonsei market is also uncertain this year. Due to the leasing law, disputes arose between landlords and tenants, and as the lockdown phenomenon on jeonse properties intensified, the jeonse market was hugely unstable.

In particular, as of June this year, the ‘Jeon Months Reporting System’ is applied in which the leasing contractor reports the lease deposit and contract information to the government office where the rental contract is located. lease within 30 days when taking out a housing lease such as jeon or monthly rental transactions. The power of the tenant grows stronger.

It is noted that further confusion will be unavoidable if the cheonsei rental reporting system is implemented even in a situation where the jeonse market is intensified only with the previous 2 lease law.

Jeonse’s monthly price change rate rose 0.1 ~ 0.4% until June, before the leasing law was enforced, but it rose to 0.51% in July after the leasing law was enforced. In November, it registered 1.02%, the highest since October 2011 (1.10%).

One real estate expert said: “The government believes too much in the goodwill of the market when making real estate laws.” “More than what the government thinks, landlords and tenants focus on their own interests, It is so,” he said.

However, with the improvement of the three laws of leasing, Chang-hum byunclose Chang-hum byunCollect items The minister has expressed his willingness to push the policy forward.

Chang-hum byunCollect items The minister has expressed his willingness to push the policy forward.

Minister Byeon said in response to a staff hearing presented to the National Assembly last year: “The Third Leasing Law is necessary to guarantee the tenants’ right to live.” “If I take over as Minister of Lands, I will compensate for the problems in implementation and resolve the system early.” .

The lack of occupancy is also expected to fuel market uncertainty. According to the Real Estate 114 survey, the number of apartment occupants nationwide this year was 2,65594 households, a decrease of 26.5% (9.5726 households) from last year.

Park Won-gap, a senior real estate expert at KB Kookmin Bank, said: “There is a word to ask the jeonse market about the price of the house next year.” “If the price of the house is not stable, the increase in the price of the house is difficult to calm.”

Senior Expert Park predicted: “If the demand to avoid cheonsei breakout turns into the purchase of mid-to-low priced apartments, the commercial market, which had shrunk sharply due to regulatory effects, will reactivate and a market will be formed. with a lead on the sale, and house prices are likely to rise again. “

◇ Despite the strong will of the government to expand supply, could not wait … Severe supply cliff is expected this year

In 2020, despite the government’s strong commitment to ‘expand supply’, the housing market only supplied 282,214 households, which was only 90% of the original target of 314,000 households.

The “yield on home building permits,” a leading indicator of housing supply, is also declining. According to e-Nara statistics, the number of housing permits has continuously decreased from 765,000 units in 2015 to 726,000 units in 2016, 653,000 units in 2017, 554,000 units in 2018 and 488,000 units in 2019..

Last year, the figure was 32.6237 through October, which was also a decrease from the same period last year, 35.3972.

To make matters worse, the shortage of housing supply in the metropolitan area, where the population is concentrated, is aggravating.

According to the National Report on Territorial Affairs of the National Institute of Territorial Research, “ Perspectives and implications of the housing supply in the medium and long term, ” the performance of housing completion is expected to continue to decline until 2022, considering the supply lag (2 to 3 years) in the performance of housing permits.

The performance of home completion has gradually increased since 2011 after the global financial crisis, but due to the decline in the performance of home licenses, 2018 has peaked and turned into a downward trend .

As a result of the housing supply forecast of the Korean Institute of Land, Infrastructure and Transportation, it is anticipated that between 2023 and 2027, an annual average of 287,000 units will be supplied in the metropolitan area, and an annual average of 820,000 units in Seoul.

This uncertainty in the housing supply in the metropolitan area is expected to be resolved only after 2023, when the housing supply in public housing areas in the metropolitan area is completed as the 3rd new city.

Therefore, the Korean Institute of Land, Infrastructure and Transportation said that “it is very important that the housing supply plan is carried out smoothly.” It is suggested that there is a need to provide quality housing through continued public housing security ”.

As a result of the survey on the real estate platform, the estimated number for sale in 2021 is approximately 233,000 homes, but some construction companies have not yet established a sales schedule, so the offer is expected to be further expanded. expected apartment in 2021.

Large complexes with more than 2,000 homes sold in 2021 were primarily remodeled and rebuilt. The upper limit on the sale price of private residential land will apply on July 29, 2020, and most of the apartments in large complexes, which did not reach an agreement on the sale price between HUG and partners, have been postponed until 2021.

Since the large-scale sale of the pre-sale price cap system was implemented, there were many trading sites that were unable to set a schedule, but the pre-sale market is expected to continue to gain popularity as pre-sale prices come out cheaper than the market price.

However, caution is required as there are changes in the pre-sale market, such as underwriting and early subscription system changes.

In particular, in January, special supply requirements for newlyweds and the first of their lives are eased. Average monthly income will change from 100% (double income 120%) to 130% of average monthly income (140% double income).

The income standard for first-time special supply is also lowered to 130% or less for public housing and 160% or less for private housing. In addition, from the complex requesting hiring approval after February 19, the residence period of the limited sale price limit in the metropolitan area applies.

In the case of public housing, less than 80% of the market price (sale price in the neighborhood) is 5 years, 80% to 100% of the market price is 3 years, and for private houses less 80% is 3 years and 80-100% of the market price is 2 years. This happens.

Currently, there is a mandatory period of 3 to 5 years of residence only for land of public housing and public housing, which has been extended to private housing and public housing.

◇ Will the government’s ‘treasure card’ be a signal to expand the offering and pre-subscribe to the third new city?

Of the 59,539 units scheduled to be sold in the second half of this year, 24,400 are pre-subscription apartments for the third new city. In the second half of 2021, pre-subscription is expected to proceed in earnest.

The pre-subscription for the third new city is the government’s trump card to reverse public opinion on the “lack of housing supply.” In fact, many eyes see it as one of the hottest potatoes on the presale market this year.

Starting with Gyeyang in Incheon in July-August, advance subscriptions are scheduled for Namyangju Wangsuk, Goyang Changneung, Bucheon Daejang, and the Gwacheon District.

Compared to neighboring apartments, the quantity on offer is cheap and since a significant part of the total quantity is supplied as a special offer, it is expected that the opportunities for the homeless in the metropolitan area will be expanded.

The government is operating a ‘subscription notification service’ through the third new city website. The ‘Subscription Notification Service’ is a service that informs the requester of the district’s subscription schedule by text message 3-4 months before registering the contact information and the district of interest.

Feedback such as the desired area entered when requesting the subscription reminder and the district’s preference reason of interest are also reflected in the district’s plan.

All pre-subscribed public apartments in New Third City are subject to the maximum sales price system.

As the average underwriting competition rate for apartments applying the presale maximum price system among presale apartments in the metro area in 2020 was high, the competition rate for early underwriting is expected in the third new city. be tall.

However, pre-subscription winners must maintain the free housing requirement until the time of this subscription, or they cannot request pre-subscription for other pre-sale housing.

Reporter Jang Ho-sung [email protected]

[ad_2]