[ad_1]

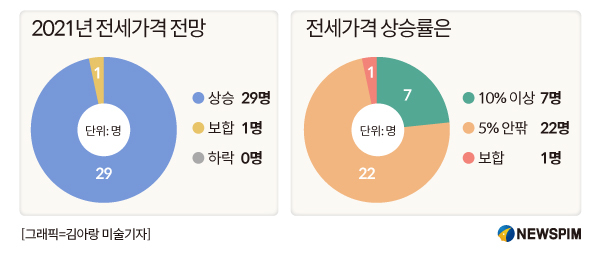

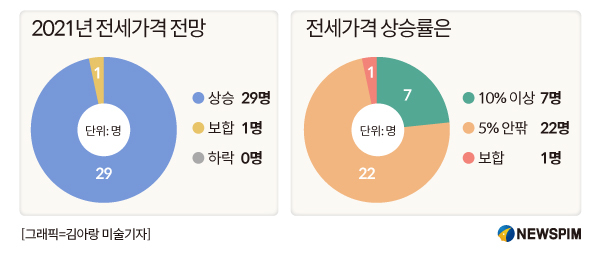

29 out of 30 people are expected to increase, and 23% are expected to increase by more than 10%

Jeonse market riots continue due to storm after leasing law and decrease in occupancy

[편집자 주] Despite strong government regulation of the housing market, house prices in 2020 soared at the highest rate in history. In 2021 low interest rates continue and it is expected to act as a stressor, such as a decrease in the number of occupants and an increase in the number of one or two people. The aftermath of the leasing law is also acting as a catalyst for a rise in jeonse prices. Through 30 real estate experts, we forecast the real estate market in 2021 and the political impact of the new Minister of Land, Infrastructure and Transport Byun Chang-heum.

[서울=뉴스핌] Reporter Lee Dong-hoon = The jeonse crisis caused by jeonse property shortage is expected to continue into the new year. The aftermath of the Leasing Law continues, and the implementation of the monthly rent limit system for leases and the decrease in occupancy amounts are likely to affect market uncertainty.The government’s plan to tackle the jeonse crisis by supplying 110,000 homes for public rental housing over two years will start in earnest from 2021. However, there are many observations that one or two homes are the main targets. , and even in a residential setting, it is less than an apartment and will not have a significant impact on solving the jeonse crisis. As the problem of charter flights continues, demand for mid- to low-priced apartments on the outskirts of Seoul, Gyeonggi-do and Incheon is expected to increase further.

◆ 97% of experts and 5% or more of the increase in the national total price

As a result of a NewsPim survey of 30 real estate experts from academia, research institutes and industry, 29 experts predicted that the national rental price would increase in 2021. One expert predicted consolidation, but there was no opinion that it would decrease.

|

| [[[[ |

Regarding the rate of increase of the total price, 22 experts were the most likely to jump around 5%. Next, the opinion that got more than 10% was followed by 7 people. There was only one opinion.

The rate of total price increase expected by experts is similar to that of 2020, the largest increase in nine years. According to the Korea Real Estate Agency, the rate of increase of national jeonse prices in 2020 (as of December 14) is 6.9%. In the metropolitan area, Incheon was the one that rose the most with 9.42%, followed by Gyeonggi-do with 8.9% and Seoul with 4.19%.

The main reason for the constant instability of the jeonse price was the secondary effects of the application of the leasing law. In fact, since drugs around the world are guaranteed for 4 years (2 + 2), owners are calling the market significantly higher. As the demand for jeonse continued to decline in a situation where the volume of goods declined, the listing price soared.

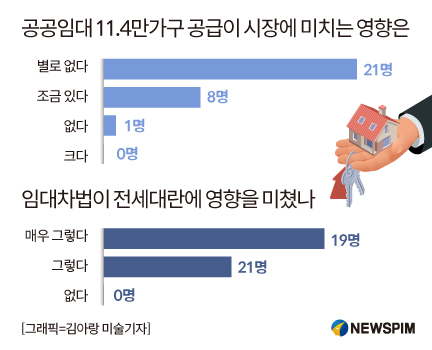

When asked if the leasing law had an effect on the cheonsei market out of 30 experts, 19 answered “very yes.” Eleven people answered ‘yes’, an opinion that had some influence. No one commented that there was no impact.

There were many reactions that the market would be more unstable if the cheonsei rental system, one of the three rental laws, was implemented in June. Compared to the maximum rent limit for cheonsei and the right to apply for contract renewal, the impact on the market is small, but there is room for a higher rate of conversion of cheonsei into monthly rent or reverse tax by the owners, whose tax burden is increasing.

17 out of 30 people (57%) responded that the cheonsei rental system will affect the cheonsei market. There were 10 experts who answered that there was no impact and 3 people thought it would affect them slightly. 67% of experts are believed to believe that the cheonsei market will become more unstable by reporting the rent to cheonsei.

Lee Sang-woo, CEO of Invade Investment Advisory, said: “There is a serious imbalance between supply and demand in the jeonse market, and there is no immediate solution, so the price of jeonse is expected to rise by more than 10%. If the cheonsei system is implemented in addition to the second lease law, the market There is room for further anxiety, “he said.

Lee Chang-moo, a professor in the Department of Urban Engineering at Hanyang University, said: “It will be difficult to avoid the increase in jeonse prices due to the decrease in the number of occupancy and the impact of the leasing law, etc. ” .

◆ Influence on the complete supply of 114,000 homes for public leases is negligible … “Renters on the outskirts”

Since it is difficult to increase the jeonse supply in a short period of time, the opinion prevails that the feeling of anxiety cannot be resolved quickly.

There were many opinions that the government’s plan to supply 114,000 public rental housing units in the metropolitan area by 2022 will not have a significant effect on resolving the Cheonsei crisis.

|

21 of 30 experts expected that the expansion of public rental housing would have little effect on the cheonsei crisis. There was an answer that would not work at all. Eight experts thought it would have a positive effect on solving Jeonse’s crisis.

Public rental housing promoted by the government is to increase the amount using the vacancy of public institutions and the remodeling of hotels / offices. Due to the nature of public leases, most of the scales that one or two people can live in, and the hotel remodel is an opinion that it is not clear whether it will attract consumers due to the relatively poor living environment.

As a result, there have been many observations that the demand for buying mid-to-low priced apartments will continue to surge without being able to overcome the jeonse crisis. In recent years, due to the jeonse price burden, there has been a phenomenon that demand is concentrating on mid-priced apartments outside of Seoul, Gyeonggi-do and Incheon. As demand plummeted, house prices also rose.

28 out of 30 predicted that the phenomenon of renters moving in search of mid- and low-priced properties in the new year will increase from the previous year. Two predicted similar levels, and no expert predicted a decline.

“The number of apartment occupants is expected to decrease by 16% compared to the previous year, and the impact of the Third Leasing Law is significant, making it difficult to solve the problem of the Cheonsei in a short period of time.” . “The demand for mid to low priced apartments will inevitably increase.”

◇ List of 30 survey participants (in alphabetical order)

▲ Sang-cheol Ko, Visiting Professor at Inha University School of Politics ▲ Kang-Soo Kwon, Director of the Korea Real Estate Information Institute ▲ Professor Kwon Dae-jung, Professor at the University Department of Real Estate from Myongji ▲ Kwon Il Real Estate Information Research Team Leader ▲ Kim Kwang-Seok, Real Estate Media Representative at Kim-Sung-rye Research Institute ▲ Home Sales Assessment Team Leader ▲ Kim In-man Kim In-man Real Estate Economic Research Institute ▲ Kim Tae-seop Director of the Housing Industry Research Institute ▲ Kim Hak-Ryeol, Director of the Real Estate Research Institute ▲ Park Won-Kap, KB Kookmin Bank Real Estate Chief Expert Committee ▲ Seo Jin-hyung, President of Korean Real Estate Association (Professor, Kyungin Women’s University-Ra Jga News) ▲, Seong Representative ▲ Song Woong-seop Head of the Sucursa Real Estate Brokers Association l North Seoul ▲ Shim Gyo-Eon Professor of the Department of Real Estate at Konkuk University ▲ Ahn Myeong-sook, Head of Woori Bank Real Estate Investment Support Center ▲ Yang Ji-young, Manager of R&C Research Center ▲ Woo Byeong-tak, Shinhan Bank Ji-Hae Dong Real Estate Investment Advisory Center Team Leader ▲ Hana Bank Real Estate Advisory Center Director Sang-Woo Lee, Invade Investment Advisor ▲ Eun-Hyung Lee Principal Investigator, Policy Institute of Korea Construction ▲ Chang-Moo Lee Professor of Urban Engineering, Hanyang University ▲ Hosang Lee, Director of the Korea Home Construction Association ▲ Byeong-cheol Lim Real Estate 114 Senior Researcher ▲ Geun-seok Auction Team Jang- hoder-se C ▲ Managing Director ▲ Ham Young-jin Jikbang Director of Big Data Laboratory ▲ Professor Hong Chun-wook, Sejong Cyber University