[ad_1]

Photo = Yonhap News

An estimated one in six homeowners in Seoul will have to pay a comprehensive property tax this year. Last year, one in eight homeowners in Seoul paid a tax stipend, which has increased significantly this year. The criticism comes as a result of insisting on the worst punitive property tax in the world.

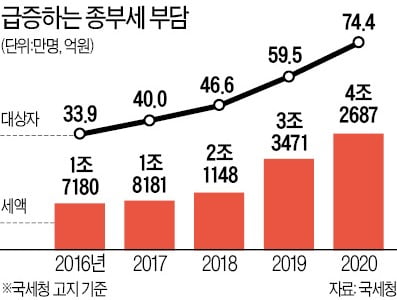

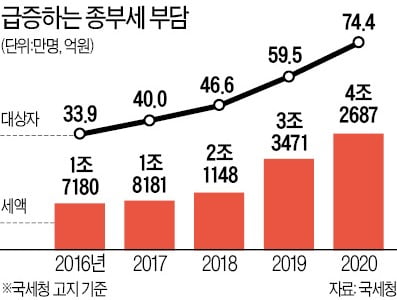

On the 25th, the National Tax Service announced the status of the ‘end of 2020 tax notices’, including these details. The tax payment target this year was 744,000, an increase of 25% over last year (595,000). Among them, 667,000 people paid the housing tax, which represents 90% of the total tax. Seoul was the largest with 393,000 people, accounting for 58.9% of the total housing tax (667,000 people). According to the National Bureau of Statistics, at the end of last year, 15.8% of the 2,483,000 people who owned homes in Seoul paid the tax this year. Compared to last year, it was 12.1%, an increase of 3.7 percentage points. After Seoul, Gyeonggi (147,000 people), Busan (23,000 people), Daegu (20,000 people), etc.

This year, 740,000 people … 120% increase in cultural government

‘Bomb Bill’

According to the ‘State of Comprehensive Notification of Real Estate Taxes 2020’ announced by the National Tax Service on the 25th, the number of taxpayers increases every year. The number of people subject to the tax was 595,000 last year, an increase of 27.7% over the previous year, and this year it rose again by 25% to 744,000 people in one year. This year’s tax notice amounted to 4.2687 million won, 27.5% more than last year (3.3471 million won). Compared to 2016 (1.718 trillion won), before the inauguration of Moon Jae-in’s government, it increased by 148.5%. In 4 years, the number of taxpayers increased by 119.5%.

Looking at the total tax for housing, which is 90% of the total tax, by metropolitan governments, Seoul accounted for 65.4% of the total tax amount at 1.18 trillion won. Compared to the previous year, Jeju was the highest with 244.1% in terms of the tax increase rate. This year, the tax target for the Jeju area was 5,000, similar to last year, but the tax amount was 49.2 billion won, an increase of 244.1% from 14.3. 1 billion won from the previous year. During the same period, Daejeon’s final tax amount also doubled from 8.9 billion won to 17.8 billion won.

Daejeon also ranked first in the country in terms of the taxpayer increase rate for the end-of-life tax (57.1%). They were followed by Gangwon (50.0%), Gwangju (40.0%), Jeonnam (33.3%) and Sejong (33.3%). Seoul also reached 31.9%, beating the national average (28.3%). On the other hand, Ulsan was the only country in the country that the final amount of the tax this year (6.3 billion won) decreased from last year (9.1 billion won).

The National Tax Service introduced a service that allows you to calculate tax liens online from this day on, as the amount of the tax burden increased rapidly. In the ‘Services by Tax Type’ section of the National Revenue Service Hometax, click on the ‘Complete Real Estate Tax Simple Tax Calculator’ window to use it.

Previously, the final tax amount could only be calculated for the corresponding taxable year, but from now on, it was possible to calculate the final tax for three years, including the year and two years later. It is now possible to directly look up the published prices of taxable homes and entry areas subject to adjustment and whether or not to reduce property tax. Here, you can check the amount of tax paid by entering the period and age of your household.

However, the National Tax Service explained that the actual amount of the tax applied and the amount of the simplified calculation may be different because it does not reflect the ‘upper limit of tax burden’, which prevents it from not exceeding a certain percentage of the tenure tax from the previous year.

Reporter Jeong In-seol [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution