[ad_1]

|

The movement restriction measure to prevent the spread of Corona19 is violating the constitutional right of “freedom”, and criticized it strongly as fascism, the kingdom of the dictatorship.

The next day, he bombarded Twitter the next day saying, “Tesla’s shares are too expensive.” In a negative word from the CEO, Tesla’s stock price fell nearly 11%.

I first introduced a word from the Musk CEO because I thought this better reflects the reality of our global economy, especially the stock market.

|

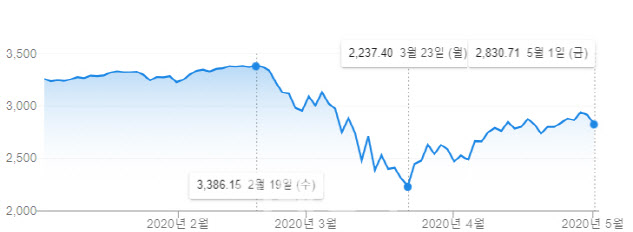

At the end of February, the Standard & Poor’s (S & P) 500 index fell 33.8% over 34 days, recovering to half the level (15.2%) for 39 days through May 1.

On the other hand, what about corporate performance?

Based on financial data from the QUICK data company, the January-March results for US-listed companies. USA They showed an average decrease of 36% compared to the same period last year. It is said to be more terrible in April-June. In fact, many experts have a bleak outlook until the third quarter.

In this situation, the stock market is a part of the Federal Reserve’s unprecedented monetary policy, government stimulus measures, the belief that the economy will recover when Corona 19 ends, and the expectations of an industry that will return to arise from the crisis in Corona. I stopped.

|

Tesla was no different. Tesla’s share price, which topped $ 900 on February 19, fell in the mid-$ 300s in mid-March, but recovered to the $ 800 level in late April.

In fact, Tesla’s share price has been controversial as it was cheap and expensive before Corona19, but let’s leave history aside and consider Tesla’s stock to have recovered to 80% from its previous peak.

But what is reality like? The Fremont plant in the United States is due to close in mid-May, and the battery plants in Nevada and New York are also closed. Tesla broke market expectations in the first quarter of Corona 19 and posted a surplus for three consecutive quarters, which is a very frustrating position for CEOs to “row when they enter the water.”

“We have the capacity to deliver 500,000 vehicles this year,” said Tesla. “It is difficult to predict when the assembly process and parts supply will normalize due to crown regulations.” He also said that the delivery of some vehicles could be delayed next year.

The stock price has risen, driving future gains, but starting this week we will see that the reality may be even colder. When cities were blocked around the world, it was possible to increase the share price with the expectation that economic activity would resume.

However, starting this week, when economic activity resumes in the United States and Europe, the market is likely to have time to confirm whether these expectations were too high or whether economic activity did not normalize.

Starting in May, the United States has announced plans to allow or allow the resumption of sales activities for some companies beginning in May. American automakers, such as Ford and GM, will also begin operating in the middle of next month.

In Europe, Italy said it would resume factory and construction activities on the 4th, and France lifted restrictions on the move from the 11th. Spain says it plans to gradually reduce the city blockade in four phases by June.

But clearly there is confusion here. The German government has allowed small shops with an area of less than 800 m2 and has allowed classes in some schools since 20 last month, after which a person infected with the virus transmits the virus to another person, that is, the Reproduction index (R) is set to 1 again. It’s over. This means that more than one infected person can transmit the virus to more than one person.

After that, the German government decided to postpone the schedule to discuss the opening of the school on the 6th and the resumption of sales activities, such as kindergartens and sports clubs. India also extended the country’s blockade, which was slated to end the third, for two weeks until 17. Singapore, once considered an exemplary defense country, decided to maintain a high-resistance containment policy until June 1. after Corona 19 was extended again.

In an interview with the Wall Street Journal (WSJ), Professor Ashsi Harvard School of Health said: “The question is not when to open the economy. I can keep it open. It is good that the second pandemic has ended with a trend this fall, but how is the market reacting to reality? In the first week, when economic activity resumes, the market is likely to watch closely.

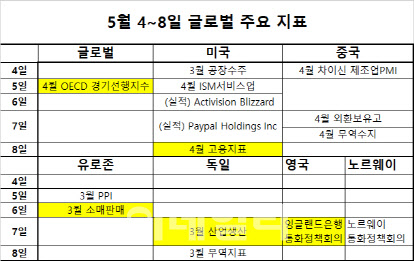

The main economic indicators to consider are the PMI index for manufacturing in April on April 4. On 5, the leading economic index of the Organization for Economic Cooperation and Development (OECD) comes out, and on 8, the US employment index for April. On the 7th the Bank of England monetary policy meeting will be held.

|