[ad_1]

Starting today (3rd) to run the Kyochon Chicken brand for two days Kyochon F&BSubscription to a public offering on the stock exchange before 20 October ‘[공시줍줍]Honeycombo Listing Challenge … I analyzed the stock report submitted by Kyochon F&B to the Financial Supervision Service through the article ‘Understanding Kyochon Chicken’.

This time, on the 2nd, Kyochon F&B submitted to the Financial Supervision Service.[기재정정]I will analyze the ‘investment prospect’.

The investment prospectus contains various information about the company. In particular, [기재정정]Investment prospectsIt is that the content of the results of the demand forecast for institutional investors is the key point! It is a revised and announced announcement that Kyochon F & B’s final offering price was determined through the demand forecast from institutional investors. So the analysis begins in earnest.

#Offering price of new Kyochon F&B shares per share 1alone2300won

Investment prospectus1part Ⅰ. General information about hiring or sales 1. Competition Summary

In October, when Kyochon F&B filed a stock report, it announced that it would like to sell the company’s shares for between 1,600 and 12,300 won per share (desired public offering price). Subsequently, the demand forecast for institutional investors was made for two days from October 28 to 29, and based on this, the final public offering price was determined. You can buy Kyochon F&B public stock for 12,300 won per week.

Shares that Kyochon F&B will sell through public offeringSilver pistol 580Manchuria(new stock 406Manchuria+savior174Manchuria). Is If 5.8 million shares are sold for 12,300 won per share, Kyochon F&B can secure a total of 71.34 billion won. This is an increase of 9.86 billion won more than the amount calculated based on the low of 16,600 won (6.18 billion won), the low of the last desired public offering price.

However, KRW 21.4 billion of funds guaranteed by the sale of 1.74 million shares of Europe belong to the individual, not to the company (Kyochon F&B), but to former chairman Kwon Won-gang. Therefore, 48.1 billion won (excluding various fees) excluding this amount is exclusively funded to Kyochon F&B.

#Institutional Investor Demand Forecast Competition Rate ‘999.44: 1’

Investment prospectus1part Ⅰ. General hiring or sales information (13) Result of demand forecast

Let’s look at the results of the institutional investor demand forecast. Demand forecasting is a price verification system. It is a process of asking if the desired public offering price of 1,600 to 12,300 won, which is established in consultation with Kyochon F&B and the securities companies that monitor the listing, is the correct price.

What is the outcome of Kyochon F & B’s demand forecast for institutional investors? Competition rate 999.44: 1. 1109 domestic and foreign institutional investors, including 851 domestic institutional investors such as asset managers, investment traders and brokers, pension funds and banks, and 258 foreign institutional investors participated in the Kyochon F&B demand forecast.

The number of public offering shares that they announced they would buy was 3,478,835,000. The amount allocated to institutional investors is 3.48 million shares. The amount that institutional investors offer to buy is much higher than the amount allocated. However, it is lower than Big Hit Entertainment, which previously contested the listing (institutional investors require a predicted competition rate of 1,117.25: 1).

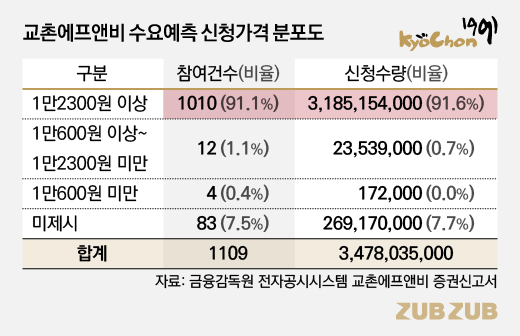

How much did institutional investors prefer prices? The proportion of institutional investors offering to buy public Kyochon F&B shares priced at 12,300 won or more was overwhelmingly high, 91.1%. The proportion of institutional investors who want to buy Kyochon F&B shares at any price is also no small number, 7.5%.

On the other hand, the proportion of institutional investors who want to buy between 1,600 and 12,300 won is quite low, 1.1%. Only 0.4% of institutional investors said they would buy it for less than 1,600 won.

Kyochon F&B may raise the price by more than 12,300 won, but has not confirmed the final bid price at a price that exceeds the desired bid price range.

#Percentage of Institutional Investors Committing Mandatory Withholding 3.9%

The next thing to keep in mind is the commitment to keep.

The mandatory tenure commitment is a voluntary promise that institutional investors who participated in the demand forecast “will not sell the public offering received for a certain period of time.” The higher the mandatory retention commitment ratio, the smaller the volume of shares that institutional investors will sell immediately after listing.

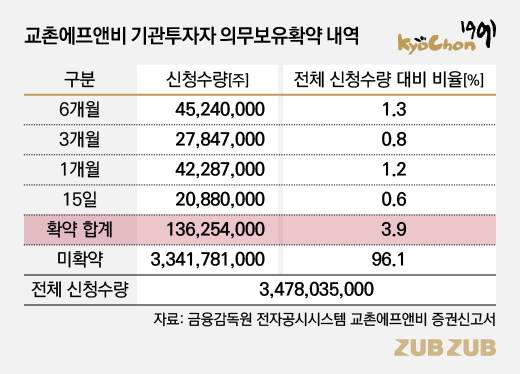

<표>If you look at the details of Kyochon F & B’s obligation to maintain institutional investors, 3.9% of the total number of institutional investors (3.487 billion 35,000 shares) (136,254,000 shares) promised not to sell public offerings for at least 15 days and up to 6 months.

The fact that the number is very low is easy to see when compared to the mandatory holdings ratio (43.85%) for Big Hit’s institutional investor demand forecast.

Summarizing the results of the demand forecast, Institutional Investors Interested in Kyochon F&B Public Offering Shares(1alone2300won)I thought it was appropriate, It means that there is no desire to hold or sell public offerings for a long time after listing.!

Especially! The low percentage of institutional investors committing mandatory shares means that there is a large volume of products for sale immediately after listing.It is important to note that yes. In other words, 96.1% (3,341,781,000 shares) excluding 3.9% are likely to be sold immediately after listing.

For reference, about a third (1.2%) of the number of applications that promised to commit mandatory retention said they would not sell shares for just one month. The remaining 1.3% promised not to sell for 6 months. The proportion of the number of applications that have not been sold for 3 months is 0.8%.

However, at this time, the mandatory retention commitment ratio is not analyzed based on the final amount allocated to institutional investors, so the index may change later. The final results will be announced later. Securities issuance performance reportCheck it out!

#Percentage of circulating quantities immediately after listing 18.5%

Let’s find out how much of the total issued shares will be released after listing.

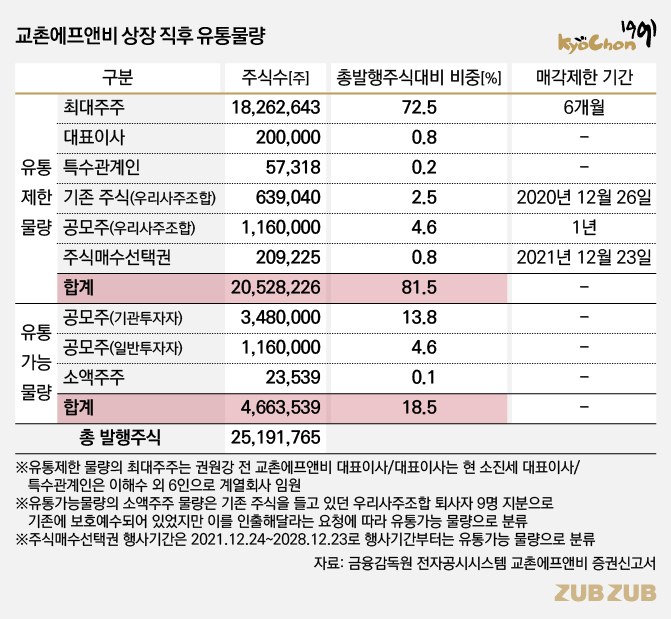

Including the 5.8 million public offering shares issued through this listing, the total number of Kyochon F&B shares outstanding is 25,191,765 when all existing shares are added. Of these, the percentage of distribution available after listing is 18.5%. The figure is lower than Big Hit’s available distribution ratio, which was included first (25.45%).

The largest shareholder, Kwon Won-gang, former CEO and president Kwon Won-gang, owns 18.26 million shares, current CEO So Jin-se, 200,000 shares, and the six executives of Kyochon F&B subsidiaries own 57,318 shares for 6 months after going public. Also prohibited is the sale of 1.16 million shares that will be allocated to the association of owners of employee shares for 1 year after listing.

However, there is the possibility of bombs everywhere! First, 630,000,040 shares of the employee stock owners association that held existing shares, not public offering shares, can be launched on the market as of December 27 this year. The sale limit is until December 26 of this year.

In addition, 23,539 shares of stock held by retirees of the company can be distributed immediately after listing.

In addition, when 3.48 million public offering shares are allocated to institutional investors in the future, we must also consider the amount of distribution available. As a result of the forecast demand from institutional investors, the mandatory share ratio dropped considerably by 3.9%.

#Subscription margin fifty%…The refund is elevenmonth 6Automatic deposit per day

The subscription period for Kyochon F&B is November 3-4. If you are preparing for this subscription, prepare a Mirae Asset Daewoo Securities account! No other brokerage firm participates in this offer.

We allocated 1.16 million shares, 20% of the total publicly offered shares (5.8 million shares) to ordinary investors. General Mirae Asset Daewoo clients can subscribe up to 50,000 shares per person, and preferred clients can subscribe up to 100,000 shares. Of course, as we have seen in many cases, the competition rate is high, so you can receive much less than the subscription limit per person.

The subscription margin rate is 50%, so if you subscribe for 10 million won, you need to prepare at least 5 million won when you request the subscription. If the public offering shares are not allocated as much as the subscription amount due to high competition, the remaining amount will be automatically reimbursed to the Mirae Asset Daewoo Securities account on November 6. ‘Payment date = refund date’

next [공시줍줍]It will analyze the results of the general investor subscription that will come out after the subscription of Kyochon F&B public offering shares. Pay a lot of attention!

*[공시줍줍]Y [공시요정]’Newsletter Joop Joop’ is the first to visit by email. There are also special contents that only appear in the newsletter. If you liked the content, subscribe to the email (free).

Subscribe to the newsletter (free) ☜Click

* Information and comments from readers are welcome. Send us any questions or wrong information. We will work hard to cover and verify.

Send Feedback ☜Click