[ad_1]

40% DSR regulation applied to mortgage loans above KRW 900 million

DSR applied to credit loans over 100 million won for people with high income of 80 million won

Receive more than 100 million credit loans and recover the housing amnesty in one year

[앵커]

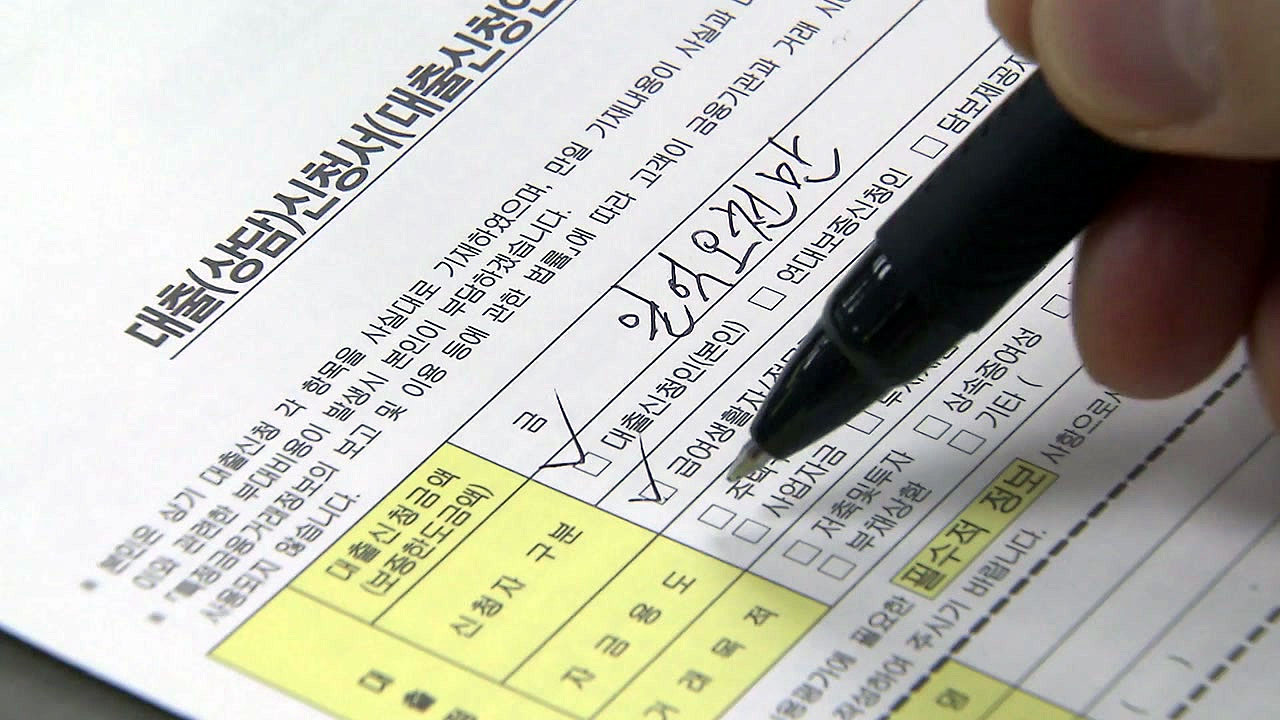

As money flooded the market for assets like real estate and stocks, household debt increased in a short period of time and the government took action. As of the 30th, if the total amount of credit loans received by high-income people with an annual income of more than KRW 80 million exceeds KRW 100 million, the DSR, that is, the total debt repayment ratio , will be limited to 40%. Reporter Park Byung-han reports. The asset market is overheating as more people are buying homes or stocks attracting credit loans. The Financial Services Commission decided to strengthen management, as household debt, which is growing rapidly, could be a burden on our economy. Currently, the DSR, or 40% of the total debt repayment ratio, is applied to mortgage loans for new homes with a market price above KRW 900 million in speculative or overheated areas. DSR says you can only borrow up to 40% of the principal and interest repayment on all home loans divided by annual income. This regulation will also apply to credit loans in excess of 100 million won for high-income individuals with annual income of 80 million won or more as of the 30th. Also, if a person who received a credit loan of more than 100 million won purchases a home in a regulated area within one year, the credit is recovered. The reason the government took action against household debt is that the rate of increase in household loans from August to October was 6.2%, 6.8% and 7.1%, respectively, compared to the same period last year. In particular, during this period, the growth rate of credit loans continued to increase by 15%, 16.2% and 16.6%. The Financial Services Commission plans to announce a roadmap for advanced household debt management in the first quarter of next year, which includes steps to strengthen DSR management standards in stages. However, as the Corona 19 crisis continues, the Financial Services Commission said the goal is to regulate the clamps so that funds do not flow into real estate while maintaining the supply of credit for ordinary people and homeowners. of small businesses. This is YTN Park Byung-han.