[ad_1]

Chrysafi ”for early retirement test fictitious years. They open the door to retirement by establishing an entitlement for the insured, while increasing the expected amount of the pension. Typically, the insured can earn up to 10 years of fictitious years of insurance by redeeming them by early retirement.

“TA NEA” for the most complete information of its readers registers the 15 secrets for the current regime of the fictitious years:

The recognition and redemption of fictitious years of insurance provided by law is an option not only to be able to retire earlier, but also to increase the amount of the pension you will receive. The fictitious times recognized for amortization are taken into account for the increase in compensation (they affect replacement rates but also the amount of pensionable remuneration) and for the formation of the national pension (in the case of years of insurance between 15 and 20 years). Non-amortization times only refer to the end of the insurance time required for retirement.

2. The presentation of claims for the acquisition of fictitious years especially benefits the following categories:

- Parents of minors in the State who use them to retroactively establish themselves in 2010, 2011 or 2012.

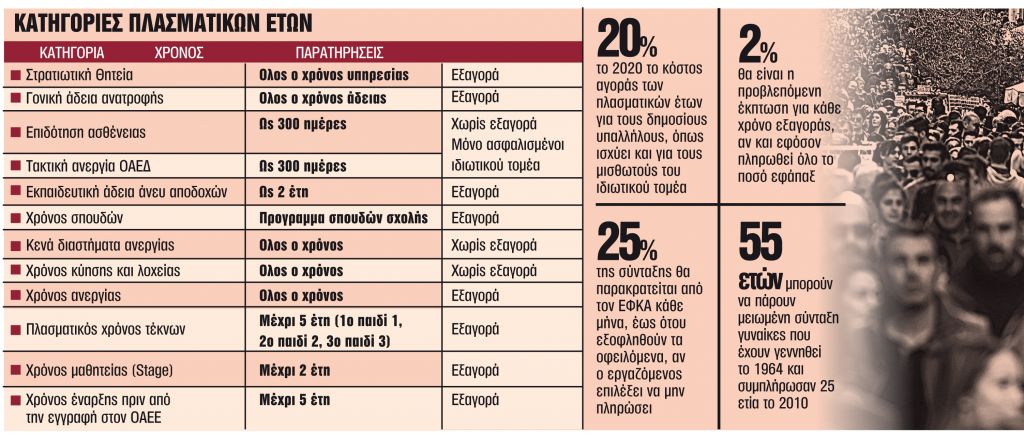

- Mothers of minors in IKA who complete with the acquisition 5,500 days retroactively in 2010 or 2011 for the constitution of the right.

- Mothers of minors at DEKO – banks turning 25 in 2011 or 2012.

- Male officials to turn 35.

- Men insured with IKA and OAEE who complete 35 years with the acquisition (10,500 days of insurance) until 12/31/2012.

- Insured with EBRD or OAEE for turning 35 retroactively in 2011 or 2012.

- Insured for all Funds that are 40 years old with the acquisition.

- Farmers who can “roll over” years from the additional leg to the main line of insurance by buying back their debts and obtaining up to 10 years of insurance.

3. Until 2022 (and with the use of fictitious years) there are possibilities for more favorable age limits if some pension and insurance rights have been secured. As of 2022, we have 67 age limits for 15 years of insurance and 62 for 40 years of insurance. However, given that there is confusion regarding the abolition, as of 1/1/2022, of the transitory limits for the granting of pensions, the following should be clarified:

A. Policyholders who have established a right to retirement until 12/31/21 (i.e. age limit and years of insurance) are not affected by the regulations imposed by current legislation and can retire after 1 / 1/2022 at any time without restrictions. .

B. The abolition affects those who have not established the right to retire until 12/31/2021 (age limit and years of insurance)

4. The choice of fictitious is mainly advantageous for those who complete 40 full years of insurance with fictitious and at the same time complete the 62nd year of retirement, as well as for parents in the public and private sector who are retroactively established with a minor and provisions 2011 and 2012, so that when they complete the respective age limits in 2019 they leave.

5. The fictitious ones mainly concern those who can, with the additional years, establish the right to retirement retroactively with the provisions of 2010, 2011 and 2012, to go beyond the respective age limits. Caution is needed for private sector policyholders as the use of fictitious must combine foundation and pension increase. The recognition cannot be done just to increase the pension and in this case, that is, if they cannot be used for the foundation, the money paid for the recognition of fictitious is lost and not returned. On the contrary, for the insured of the State, the redemption can be done only to increase the pension and especially in the cases of three children it is an option that is considered especially advantageous.

6. For public officials from January 1, 2020 onwards, the reimbursement cost for fictitious years was formed on the basis of 20% of pensionable income. This means that this year the required expense for fictitious insurance time increases by 3.34 percentage points or 19.97% compared to what was valid until the end of 2019.

7. The most common identification cases are:

- Military service of an insured.

- Parental permission.

- Educational license.

- Retired military service.

- Insured’s military service -30% (foundation 2011-2014).

- Military service of a retired candidate -30% (foundation 2011-2014).

- Studying time.

- Identification of children.

8. Which new people are entitled to recognize fictitious years of insurance. This is the category of insured young people (that is, those covered by insurance for the first time as of January 1, 1993), who establish an old-age pension just upon turning 62 and completing 40 years or 12,000 days of safe.

9. The corresponding application for recognition may be submitted to the competent services of the EFKA at any time, before or after the year, whose conditions the insured wishes to ensure, even at the same time as the application for retirement, but in no case after date of said request. (if withdrawn from an application) or at a time after the insured retired (if the criteria for initiating retirement is not the time to submit a retirement application).

10. The right to recognition of military service is abolished only by those already retired and in the event of death by the relatives of the deceased.

11. The recognition is made through the payment by the insured of all the contributions of the pension branch (employer and insured) for each month of validity of the recognized insurance, at the rate in force at the time of presentation of the redemption request .

12. On the basis of what income are the contributions calculated? Based on the insured’s income during the last month of employment prior to the month of filing the claim for reimbursement. In the event that employment is not full, it is reduced to full employment and is calculated on the corresponding salary.

13. Payment of the redemption amount is made:

a) Unique, within three months of notification of the recognition decision with a 2% discount for each year of acquisition. The exchange of time of less than one year is not deductible.

b) In equal monthly installments, according to the number of recognized months (as many installments as recognized months). In case of delay in the payment of a fee, the amount of the same will be charged with the additional fees provided.

c) In case of constitution of a pension right or increase in the amount of the pension, the redemption amount is withheld monthly from the pension until the payment of an amount equivalent to 25% of the amount of the pension.

14. A basic condition for one or one of the insured to acquire the right to recognition – the redemption of fictitious years of insurance is to have completed at least 3,600 days (12 years) of real and / or optional main insurance.

15. For the self-employed and professional farmers in each month of insurance, the contribution chosen by the insured is paid during the year of presentation of the application for recognition. That is, type of insurance during the months of acquisition.

[ad_2]