[ad_1]

The financial staff extends until the end of February the payment and deposit of the plates, making a “gift” of 2 months of fees …

Until February 26, 2021 vehicle owners will be able to pay them Traffic rates 2021 how the Ministry of Finance extended your refund and at the same time license plates for anyone who wants it.

In turn, a two-month “gift” was given to those who wanted to present the plates for 2021, since they will be able to move their vehicle until the end of February WITHOUT paying the 2021 transit fees …

READ HERE: Online the Traffic Fees 2021: Where to find them and how to save them!

Temporary immobility

So by your decision Deputy Minister of Finance Mr. Apostolos Vesyropoulos, the deadline for vehicle location in voluntary immobility, until February 26, 2021.

As noted in a statement by Mr. Vesyropoulos: “The government is complete perception and awareness of difficulties, but also the special conditions created by pandemic. The extension for payment from road tax it is tax, facilitate citizens and allow everyone to fulfill this obligation. “

the Ministry of Finance he points out that there will be no new extension and the payment of traffic fees must be done by February 26, 2021.

READ HERE: Finally the exhaust control cards

Where to find 2021 traffic rates

Published in Taxi network the Traffic rates 2021 they are unchanged compared to their 2020 counterparts. monthly installments.

Car owners with 1st Marketing authorization until 10/31/2010 they are asked to pay for 22 euros to 1,380 euros depending on the type and year of registration.

Vehicle owners with 1st traffic license after November 1, 2010 pay traffic fees in accordance with CO2 emissions.

The state expects to collect approximately 1,100 million euros since Traffic rates 2021.

AADE: easy payment with QR code

This year’s notice, available starting today for vehicle owners to pay road tax 2021, includes one QR code. By scanning this code, taxpayers can easily pay rates, through mobile banking, without writing payment code and the amount.

THE ΑΑΔΕ advises those responsible to follow this procedure, avoiding visits to bank branches and Hellenic post. But even citizens who are unfamiliar with the Internet and visit banks to pay can make use of it. QR code in automatic payment machines.

THE ΑΑΔΕ The range and quality of its digital services is constantly evolving with the aim of simplifying, speeding up payments and facilitating taxpayers. In this sense, it is recalled that there is always the possibility of payment through web banking, which from this year is made by RF code, for even greater convenience.

Fines

Traffic fees must be paid by 02/26/2021 or have license plates until the previous period. Otherwise, the delay entails a fine of 100% of the Traffic Taxes corresponding to the vehicle.

You pay in detail:

Equal amount of fees, if the vehicle is a two-wheeler / tricycle or a passenger car

the half the fees, if the vehicle is a DX passenger or truck or bus

Zero charge if the road tax is less than 30 euros.

How to print traffic rates

Vehicle owners will need to log into their special electronic application to print the notice in code to pay the tolls. Taxisnet, when it will be available and follow these steps:

Visit email address https://www.gsis.gr. In Citizen Services, select “Vehicles”.

Here are two options:

If you select “Traffic rates with codes on Taxisnet“:

The obligor enters a username and password in order to open the application and complete their data.

If you select “Traffic rates without Taxisnet codes“:

After clicking on it “ENTRY”, you will be directed to the online form where you can enter the VAT number and the registration number and selecting “SEARCH FOR” find charges for your vehicle |

Once the search is finished, the person in charge must deliver the print order to show the notification with the 2021 traffic rates.

Quantities for Traffic rates 2021 depends on the age of the car, the cubic but so do they pollutants.

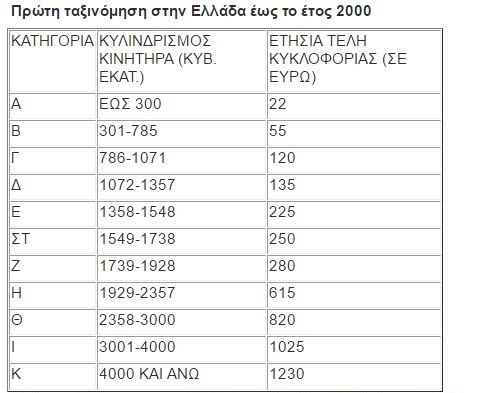

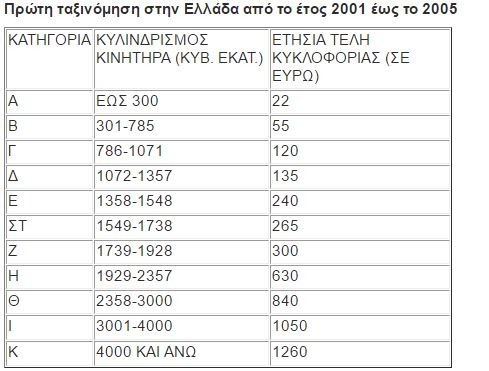

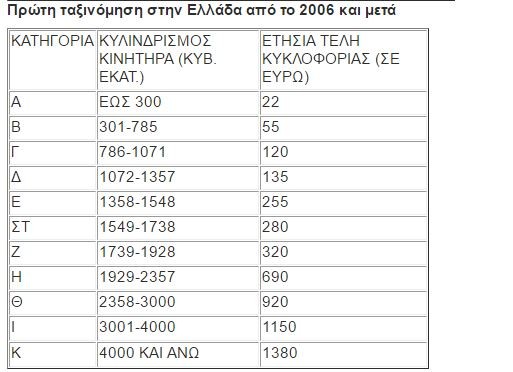

In particular Traffic rates 2021 for vehicles with 1st marketing authorization until 10/31/2010 calculated with based on displacement engine and vehicle age:

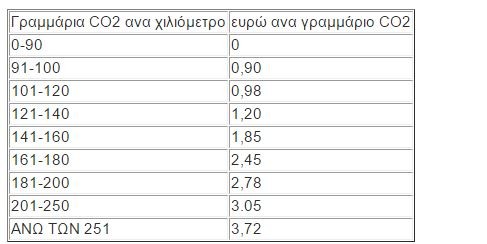

Passenger cars registered for the first time in Greece by 1.11.2010 onwards, solely on the basis of carbon dioxide emissions (grams of C02 per kilometer). The carbon dioxide emissions that are taken into account in the vehicle license are taken into account as follows:

For EIX trailers, semi-trailers (caravans): 140 euros.

New 2021 traffic rates for those registered after January 1

Zero will be the Traffic fees in cars that emit up to 122 grams of CO2 by kilometer what will be classified next January 1, 2021 according to the new law recently passed in Parliament, which fully confirms the Newsauto.gr report

In particular, the 2021 traffic rates for all vehicles registered after January 1, 2021 are:

2021 Traffic Charge Table for New Vehicles

Price of CO2 emissions (euro)

0-122 0

123-139 0.64

140-166 0.70

167-208 0.85

209-224 1.87

225-240 2.20

241-260 2.50

261-280 2.70

Over 281 2.82

Who are exempt

Of the obligation to pay Traffic rates 2021 specific categories of vehicle owners are exempt.

In particular, the right to exemption from Traffic fees from minors with disabilities, may be granted to the person who exercises parental authority or has his / her guardianship disabled minor. The granting of the right to exemption from Traffic fees valid until the year of the disabled adult and only for one vehicle, even if the person to whom it is granted exercises parental authority or guardianship over more than one disabled minor.

In the case of a minor with a disability, when the right to exemption from road tax has been granted to the person or persons exercising parental authority or guardianship, these persons must not be in possession of another vehicle for which they are has granted the exemption. The exemption of traffic taxes is granted, only, with the issuance of a relevant decision by the Head of the competent Tax Agency. and refers to the years following its issuance, with the exception of new vehicles that will be exempt during the first year of registration.

Finally in case of death of a disabled minor, in whose name the mentioned persons were exempted from road tax, road tax is due from the calendar year following the death of the disabled person.

Disabled people who have:

To Greek citizens and citizens of other member states The European Union with residence in Greece who are people with intellectual disabilities with IQ below 40 or are they people with autism, provided it is accompanied by epileptic attacks the Mental handicap the organic psychosis, that because of these diseases have become disabled with total 67% disability rate and upstairs cannot work and need help or suffer from Mediterranean anemia or suffer from renal the hepatic the lung failure final stage or is it kidney patients the liver disease the heart transplant patients or suffer from congenital hemorrhagic mood (hemophilia) or cystic fibrosis the homozygous hereditary hypercholesterolemia that due to these diseases have been disabled with 67% total disability rate and above are unable to work and need help.

Also vehicles with engine cylinders up to 1650cc, which belong to:

aa) to war invalids, officers and hoplites.

ab) to the handicapped and hoplites of the three branches of the Armed Forces, to the officers and men of the Security Forces, to the officers and men of the Coast Guard and Firefighters, to the men of the Agricultural Guard, as well as to the employees of the Customs Service.

ac) to citizens who were disabled during the period between 21.4.1967 and 23.7.1974, as a consequence of their action against the dictatorial regime. Note Exceptionally, passenger vehicles for the above cases of paraplegics and disabled with a 100% disability, may have a cylinder capacity greater than 1650 cc.

ad) to the disabled combatants of the National Resistance.

ae) to disabled combatants of the Democratic Army.

In disabled citizens, who present complete paralysis of the lower extremities or bilateral amputation of the same, with a disability rate of 80% or more, they are exceptionally exempt from automobile tax up to 2650 ml and for a disability rate of 100% up to 3650 kg. since.

The above disability exemptions are granted if:

Ownership of the vehicle belongs 100% to the disabled person, as it results from the registration of the vehicle. In the case of a minor with a disability, the right to exemption from road tax may be granted to whoever exercises parental authority or guardianship until one year of age.

The condition suffered by the disabled person is included in the above provisions.

The disabled person does not own another vehicle that has been exempted from road tax (as evidenced by a relevant responsible statement).

In the case of a car belonging to a deceased disabled person that has been exempted from road tax due to their disability, the corresponding heirs will owe road tax from the day following the death of the inherited calendar year.

In the event of the death of a person who has been granted the right to a road tax exemption on behalf of a minor with a disability, the right to a road tax exemption may be re-granted to the person designated as commissioner or to another person who can exercise parental authority until adulthood of the disabled.

How to get rid of traffic fees and articles

Only with to deposit from license plates Can a landlord “escape” his payment? exorbitant traffic fees but also thorns life items.

The shipment of plates this year is done electronically through the application MyCAR by AADE which will be put into operation soon and without the need for the vehicle owner to appear before Tax office the dishes Y Marketing authorization.

Read also:

The “thorns” of … Micromobility!

When are duties on imported used cars reimbursed?

Declaration of real estate: Fine of € 30,000 and withdrawal of diploma for 3 years