:quality(85)//cloudfront-us-east-1.images.arcpublishing.com/infobae/QXTBF2UCDJHJJB53AVRCJHX44U.jpg)

[ad_1]

:quality(85)//cloudfront-us-east-1.images.arcpublishing.com/infobae/QXTBF2UCDJHJJB53AVRCJHX44U.jpg)

This Thursday during the presentation of forecasts of the Monetary Policy Report, the manager of the Banco de la República, Juan José Echavarría, once again put on the table the discussion of removing three zeros from the Colombian peso.

Echavarría assured that, if he continued as the Issuer’s manager, he would like to convince Congress to make this change in local currency.

He said that one of the issues that he missed celebrating and seeing during his tenure was the elimination of the three zerosAn initiative that the official hopes will become a reality for the commemoration of the 100 years of the Bank of the Republic, which will take place in 2023.

Grass: Prosecutor already has in his hands the investigation against the ‘eternal magistrates’ of the Superior Council of the Judiciary

“I would like to convince Congress to finally remove the three zeros from the bills. That would be a nice celebration of the new central bank and the low inflation that Colombia has, ”the manager highlighted.

Faced with unemployment, the manager highlighted that “It has always been high, that is a mole that we have. We are always seeing how we return to one digit, we have to go down to 5% or 6%, which is what the countries of the region have “.

Echavarría explained that the interest rate has been lowered more than most countries in the world, “it is an expansive monetary policy. There are many developed countries that have not lowered rates in the pandemic ”.

“The Banco de la República continues to generate confidence and if we have the support of Colombians, we will be able to continue doing our job as we have done so far”, Echavarría said.

What was the proposal to remove three zeros from the Colombian peso?

The Bank of the Republic indicated in 2018 that, once the project completes its processing in Congress, it will support the initiative as long as the conditions to execute it are in place.

At that time it was considered that the transition period, during which banknotes will circulate simultaneously and currencies of the current and the new monetary unit, must be three years.

The banknotes of the new monetary unit would maintain the design and security elements of the new family. The word MIL would be replaced by the word NUEVOS in the new monetary unit to refer to the new pesos.

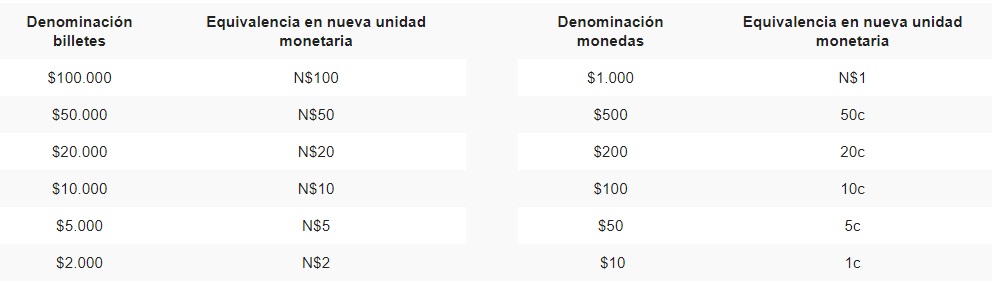

The following table shows the equivalence between the current and the new monetary unit for denominations from $ 10 to $ 100,000:

The total cost of the project for Banco de la República would be around $ 400,000 million, 0.04% of GDP, if one takes into account that part of the metal in existing currencies can be recovered by reconversion of metals.

Grass: Tropical wave approaching the country has an 80% probability of reaching the category of tropical cyclone

It should be remembered that in June 2018, this initiative reached a second debate, in the Congress of the Republic; however it did not prosper and ended up shelved.

At the time, the center for economic studies Fedesarrollo, recommended that the process of eliminating the zeros from the banknotes be done gradually, so as not to create trauma.

[ad_2]