[ad_1]

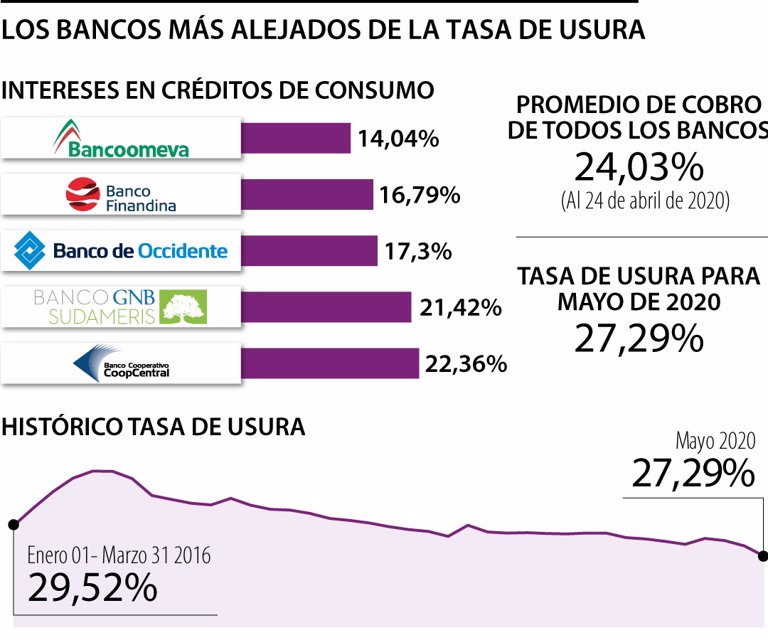

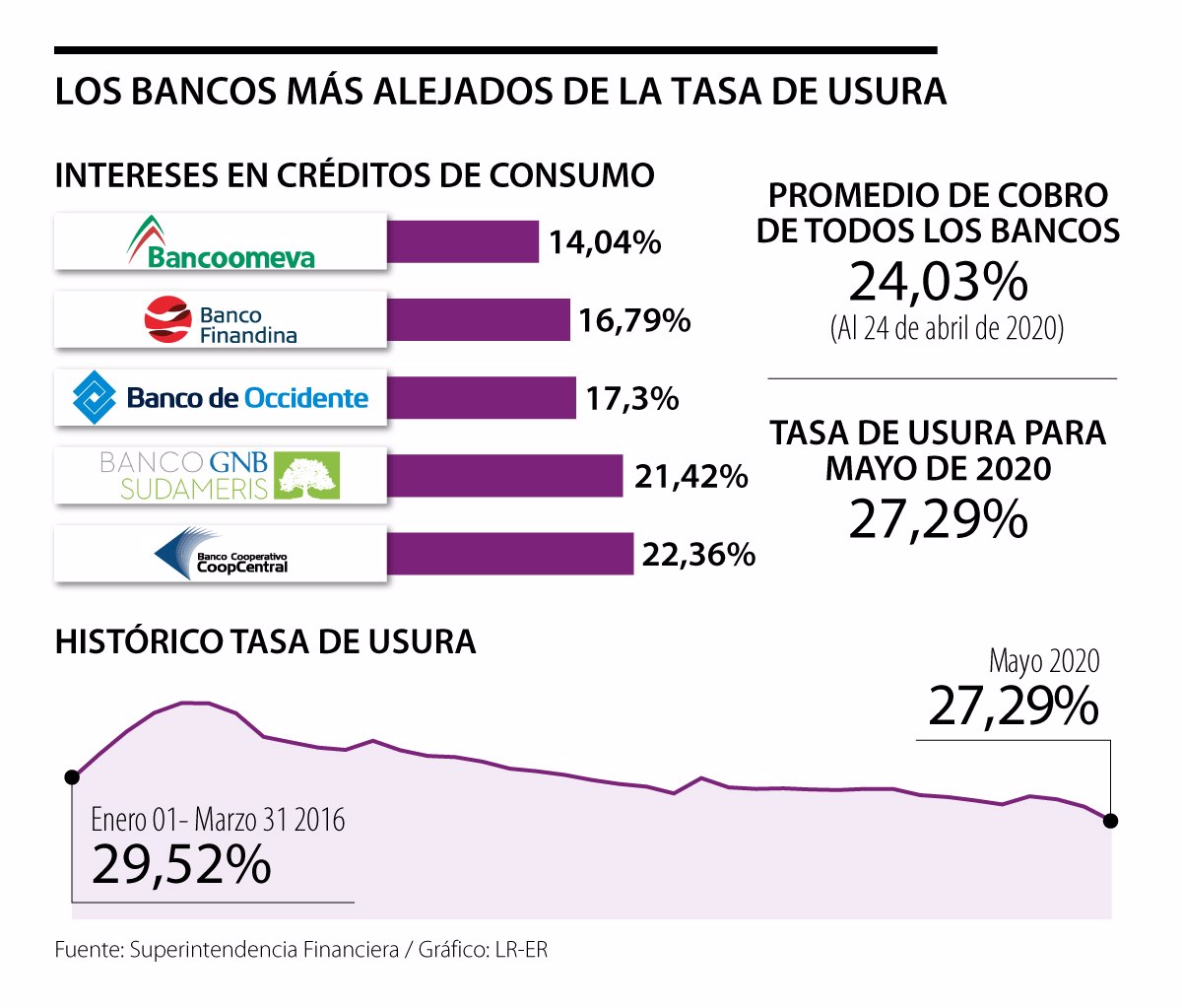

For May, this index (the maximum that a bank can charge for consumer loans) fell 75 basis points to 27.29%

The Financial Superintendency certified that the usury rate for May will drop to 27.29%. This rate is the maximum interest that a bank or a lender You will be able to charge your customers on a consumer and ordinary credit, such as credit cards.

This means that the usury rates fell 75 basis points when compared to April, the month in which the index ruled at 28.04%.

As of April 24, the average collection of banks In interest on consumer loans it was 24.03%, 326 points below the current usury. Coomeva, with 14.04%, is the bank with the best offer and the farthest from the maximum index; followed by Finandina, with a rate of 16.79%. Banco de Occidente continues, with 17.30%; GNB Sudameris, with 21.42%; and Coopcentral, with 22.36%.

Meanwhile, the highest interests are held by Scotiabank Colpatria (27.89%); Serfinanza (27.42%); Banco Popular (25.46%); Caja Social (25.35%); and Banco Agrario (24.80%).

In the midst of the LR Forum ‘The banking sector and its commitment to businessmen’, the presidents of Bancolombia, Juan Carlos Mora; from Davivienda, Efraín Forero; and from Scotiabank Colpatria, Jaime Alberto Upegui, stated their positions regarding the usury rate and their role during the conjuncture.

“I have always mentioned that I disagree with the usury rates, because Colombian banks have very intense competition and, in order to go looking for customers, we are very aggressive and look for the best formulas,” Upegui.

“When you put a ceiling on the price of competition, competition is distorted and can cause certain segments of the population to be underserved. My recommendation would always be: let’s eliminate those kinds of price controls that are unnecessary, ”added Upegui.

“The usury rate has some connotations that affect the market, but for microcredits it has enough space for these loans to flow,” said the president of Bancolombia.

For his part, Forero stressed that they have always “been opposed to the usury rate, but I do not think that at this time it would be convenient to deal with that issue.”

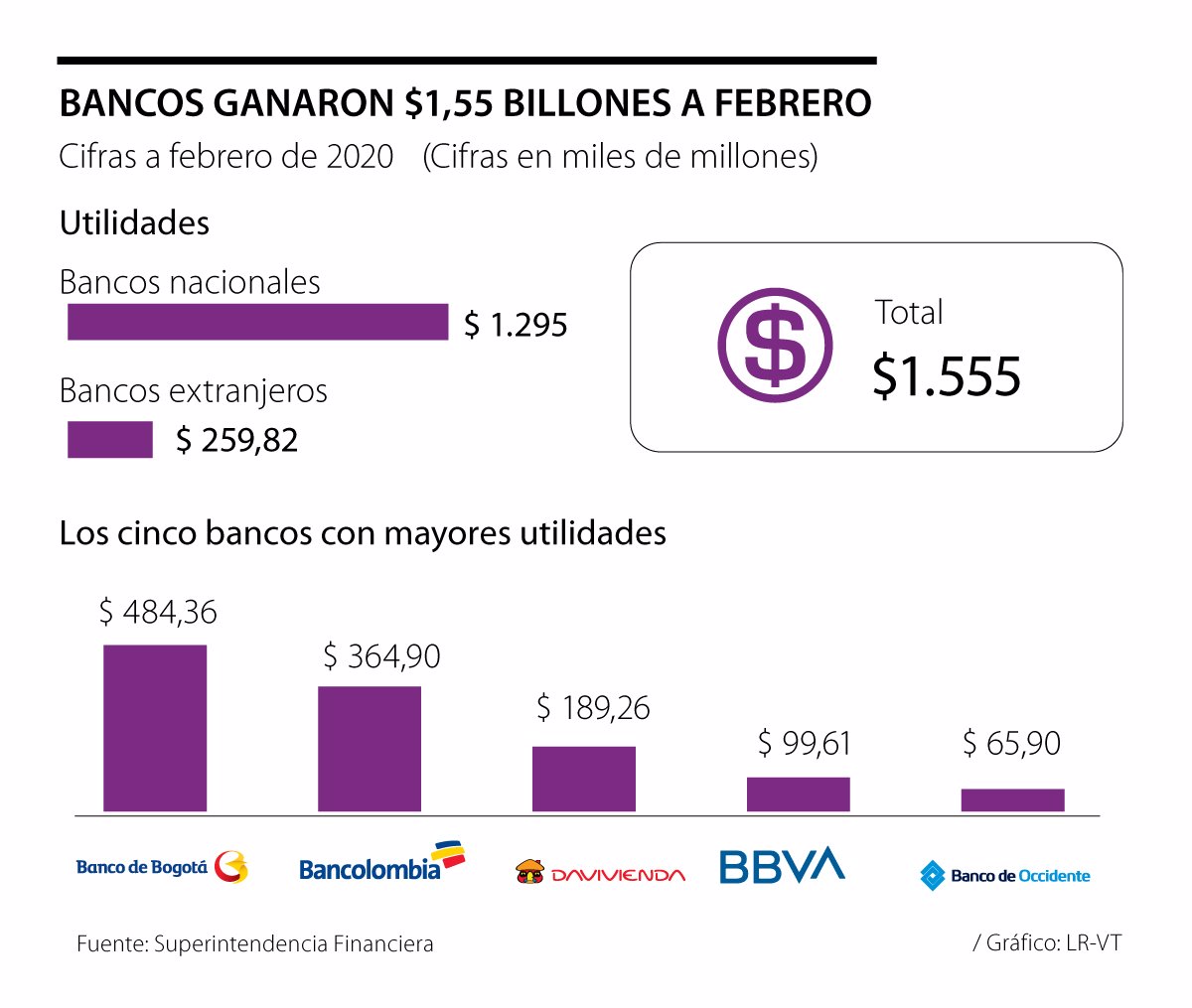

As of February, banks earned $ 1.55 trillion

According to the Financial Superintendency, in the first two months of 2020 (January-February), the 25 national and foreign banks operating in Colombia reported profits of $ 1.55 trillion, which represented an annual reduction of 2.28%.

The 15 national banks generated profits of $ 1.29 trillion, which meant a decrease of 1.14%. The 10 foreign companies earned $ 259,824 million, with a reduction of 7.56%.

Banco de Bogotá, the main subsidiary of Grupo Aval, had $ 484,367 million in profits as of February and an annual increase of 23.3%, which positioned it as the entity with the best results in the entire banking system.

In that order, Bancolombia continues, with $ 364.9 billion. However, the national bank showed a reduction in its yields of 17.3%.

The third bank with the most profits was Davivienda, with $ 189,260 million, but it also obtained a drop of 10.6%.

After the three national banks that lead the ranking of yields, the Spanish Bbva continues, with $ 99.61 billion in profits and a slight decrease of 2.6%.

The fifth place is occupied by Banco de Occidente, also from Grupo Aval, with $ 65,907 million and a drop of 17.7%.

These five big companies alone add $ 1.20 trillion in profits, that is, 77.4% of the total for the entire sector ($ 1.55 trillion).

The four Aval banks (Banco de Bogotá, Banco de Occidente, Banco Popular and AV Villas) add profits of $ 633,289 billion (40.7% of the total).

By registering you can personalize your content, manage your topics of interest, schedule your notifications and access the cover in the digital version.