[ad_1]

In the first quarter it closed with 5.1 million digital accounts

Carlos Gustavo Rodríguez Salcedo

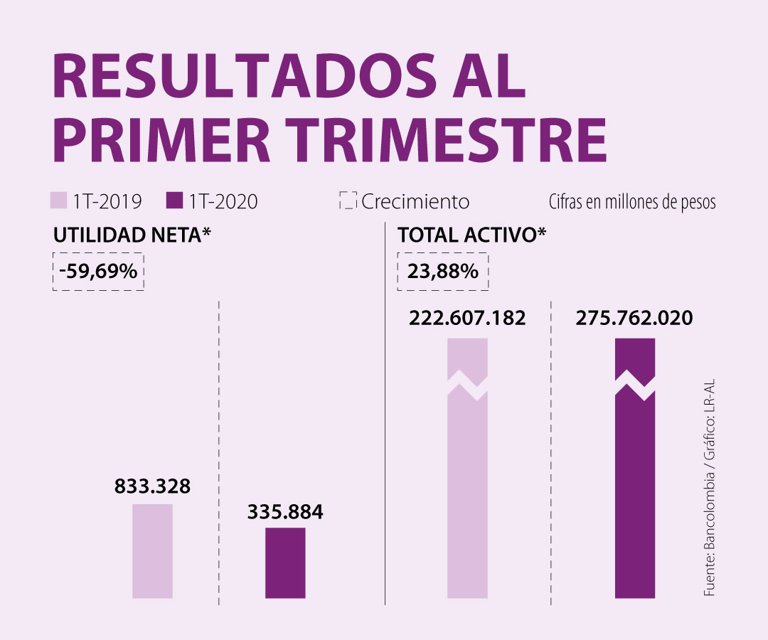

Bancolombia announced that during the first quarter net profit fell 59.6% and reached $ 335,884 million. In the report, it was also highlighted that the consolidated gross portfolio grew 16.7% compared to the first quarter of last year, while the portfolio in pesos presented an increase of 10.4%.

Regarding the reliefs he has granted in the midst of the covid-19 situation, he recalled that, to date, more than two million clients have benefited from a portfolio of more than $ 55 billion.

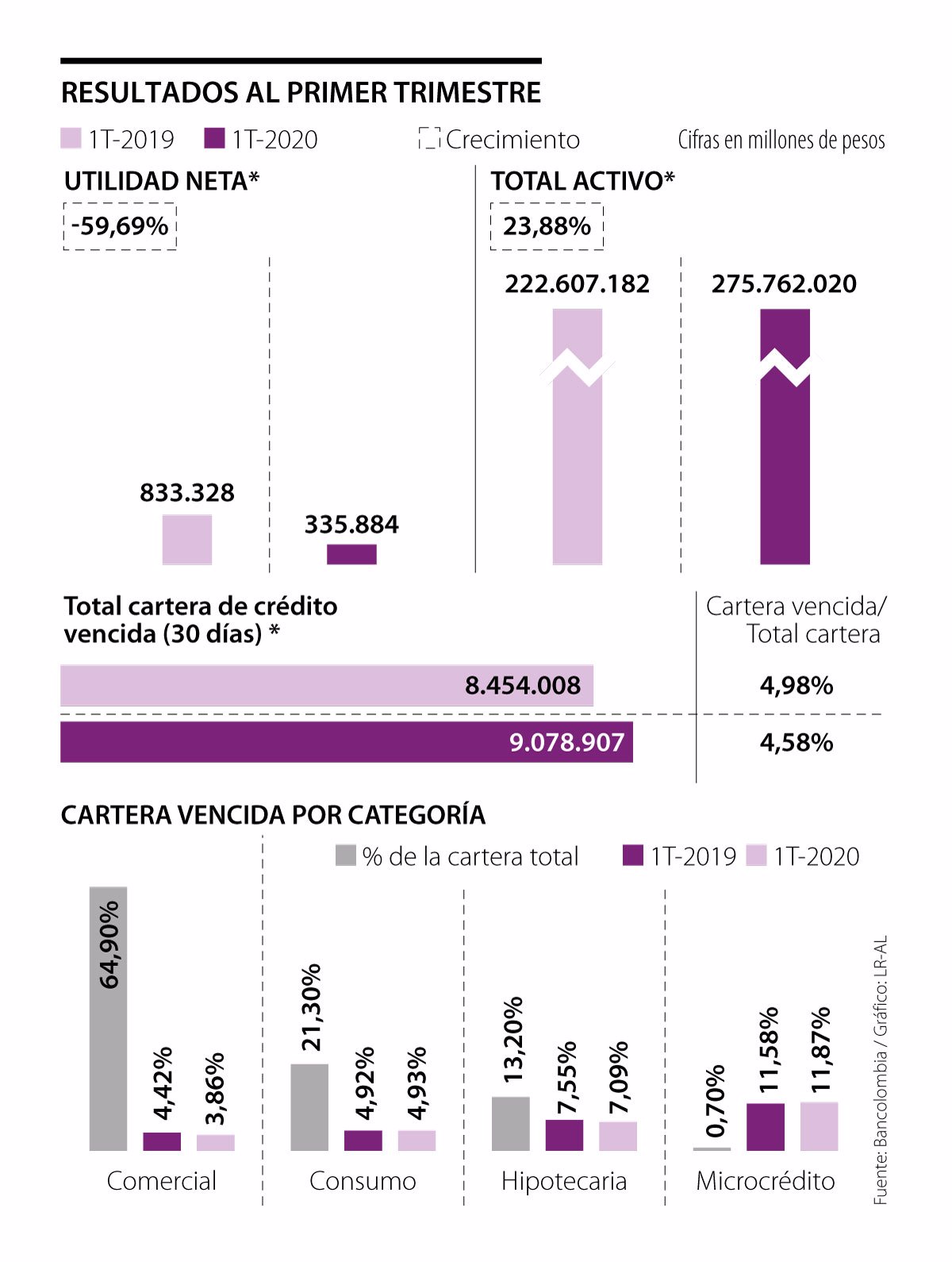

The quarterly report shows that the total past due loan portfolio (30 days) reached $ 9.07 trillion, while the past due loan indicator stood at 4.58%, when in the same period last year there was been 4.98%. If you look at the past-due 30-day portfolio by category, you can see that the commercial indicator, which represents 64.9% of the total, is 3.86%; that of consumption reaches 4.93%, while the mortgage is located at 7.09%.

“Bancolombia maintains a balance sheet backed by an adequate level of past-due loan reserves. Loan portfolio (capital) provisions totaled $ 11.3 trillion, or 5.7% of gross loan portfolio at the end of 1Q20, remaining the same with respect to as of 4Q19 “, highlighted the financial entity.

The bank also highlighted that during the first three months of the year, “it has focused its efforts on maintaining business continuity, on the safety of its employees, on operating service channels efficiently and on structuring credit lines for its clients. “

Additionally, regarding the way in which the covid-19 has been confronted, Bancolombia recalled the uncertainty and interruptions in trade and business worldwide, which will impact the economies where it has a presence. “As a result, the banking sector in general, including Bancolombia, is exposed to changes in the results of its businesses and prospects. The bank is exposed to the deterioration of the portfolio due to impacts on customers and the materialization of losses due to operational risks” , he assured in his report.

Additionally, in its report it reported that in the first quarter it closed with 5.1 million digital accounts: 2.6 million users of Bancolombia a la Mano and 2.5 million users in Nequi. “Primary capital ended at 9.1% as of March 31, 2020, decreasing 95 basis points compared to March 31, 2019. The solvency ratio ended at 12.4%,” added the bank.

By registering you can personalize your content, manage your topics of interest, schedule your notifications and access the cover in the digital version.