[ad_1]

The currency was practically stable and only rose $ 0.16. However, there are more signs of a global economic revival

Carlos Gustavo Rodríguez Salcedo

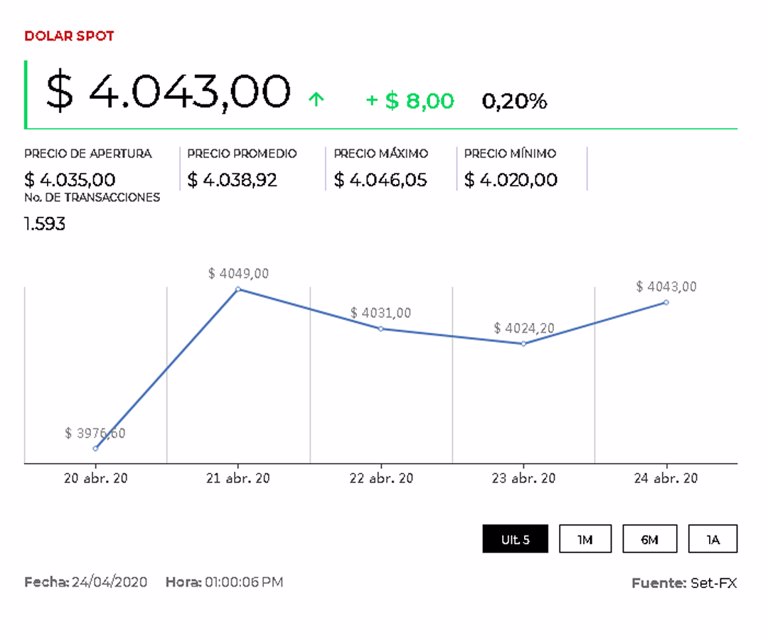

This Monday, the dollar registered an average trading price of $ 4,040.03, which is a slight increase of $ 0.16 compared to the Representative Market Rate (TRM), which is located today at $ 4,039.87.

The currency opened the day with a price of $ 4,030, a minimum of $ 4,020 and a maximum of $ 4,064. The amount negotiated during the day was US $ 915 million in 1,376 transactions.

Internationally, the search for risky assets increased as countries eased the containment measures to deal with covid-19. In the United States, more states announced their plans to ease trade restrictions, while countries in Europe continue to relax bans. In the case of Colombia, flexibilities for the construction and manufacturing sectors are beginning today, although in Bogotá the mayor Claudia López announced that today she will start a registration process so that companies can function.

At around 1:00 p.m., the WTI barrel for June delivery lost 20.07% to US $ 13.54. In the case of Brent, a benchmark for the Colombian economy, it was above US $ 20, with a loss of 6.72%.

Oil prices reacted to excess supplies, as demand continues to collapse due to the restrictive measures imposed by governments around the world, to the point that it has caused 30% to collapse due to the pandemic.

“The market is very concerned that a negative price will repeat as storage and delivery capacity in Cushing is becoming saturated,” Harry Tchilinguirian, global oil strategist at BNP Paribas in London, told the Reuters Global Oil Forum.

According to Reuters, crude oil inventories in the United States grew to 518.6 million barrels in the week ended April 17, close to a record high of 535 million barrels recorded in 2017. The city of Cushing, delivery point WTI was 70% full in mid-April.

In the case of the stock markets, around 7:10 in the morning, the Ftse 100 in London gained 1.71%; the German DAX rose 2.64%; the CAC 40 in France had a variation of 1.99%, and the Eurostoxx 50, which represents the performance of the 50 largest companies in 19 sectors in Europe, rose 2.29%.

Stock markets advanced at the same level as industrial metals, following the announcement by the Bank of Japan in which it unveiled monetary stimulus measures and promised to buy an unlimited amount of bonds to keep borrowing costs down.

In addition, they received the news that, in Europe, Volkswagen resumed its activity in the group’s largest factory. “The Chinese factories have been resuming their operations and now we have some European plants as well, so if everything goes according to plan, and if we have already seen the peak of the closings, we should also have bottomed out in terms of the demand for metals” Carsten Menke, an analyst at Julius Baer, told Reuters.

In the case of gold, it fell due to a greater appetite for risk and fell 0.6%, to US $ 1,716.33 an ounce, while gold futures in the United States traded with little change, at US $ 1,735.90 an ounce. “We are seeing a positive trajectory in coronavirus cases in Europe and the United States. We are beginning to hear more about the reopening of economies and an attempt to return business to normal, and that seems to be raising confidence,” he said. Craig Erlam, analyst at Oanda.

At the local level, the market is waiting for both the Federal Reserve and the Banco de la República de Colombia meeting, where they will analyze whether more monetary stimulus measures are taken.

By registering you can personalize your content, manage your topics of interest, schedule your notifications and access the cover in the digital version.