[ad_1]

Stocks on the New York Stock Exchange closed lower for the second day in a row today after a volatile session in which names that would benefit from the reopening of the economy tried to offset another sharp drop in technology.

The Dow Jones Industrial Average closed 159.42 points lower, or 0.6%, at 28,133.31. At one point, the 30-share average fell to 628.05 points, or 2.2%. The Dow was also higher for a moment on Friday.

The S&P 500 fell 0.8% to 3,426.96, but closed its session low well. The overall market index was down 3.1% at its session low and briefly traded positive for the day. The Nasdaq Composite fell 1.3% to 11,313.13, but also closed well above its low for the day.

Boeing shares rose more than 1%, while bank shares rose widely. JPMorgan Chase and Citigroup were up 2.2% and 2%, respectively.

Bank of America was up 3.4%. Wells Fargo advanced 1.1%. Cruise operator Carnival rose 5.4% and United Airlines advanced 2.2%.

Shares of the main technology companies closed mostly lower.

Facebook, Amazon and Alphabet lost more than 2%. Netflix fell 1.8% and Microsoft fell 1.4%. However, Apple ended the day up 0.1% after falling as low as 8.3%. Tesla also erased a drop of more than 8%, ended the session with a rise of 2.8%.

The S&P 500 tech sector fell more than 1% a day after its worst session since March. In the week, the sector fell more than 4%. The technology selloff came after the space drove most of the overall market return from coronavirus lows.

Both Tesla and Apple recently rallied after announcing stock splits.

Japan’s SoftBank reportedly bought billions of dollars in individual stock options at large tech companies over the past month, increasing volumes and contributing to a trading frenzy. Many analysts credited the increased options trading activity with adding foam to the stock market.

″We consider the orlast settlementOhn as a profit taking afterit iss of a strong streak“said Mark Haefele, CIO of UBS Global Wealth Management.

Related: Perfect storm in financial markets? Several indicators launch alert

The technology crash this week prompted the S&P 500 and Nasdaq to break their respective five-week winning streaks. The S&P 500 fell 2.3% this week and the Nasdaq was down 3.3%. The Dow Jones fell 1.8% this week.

Colombia

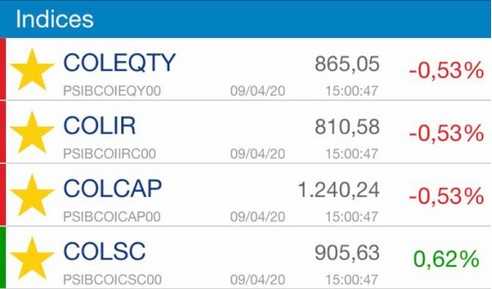

The Colombian Stock Exchange (bvc) reported that the Colcap index ended the week with a decline after posting a variation of -0.53%.

The shares of Grupo Energía Bogotá (GEB), ISA and Nutresa saw their prices fall to a greater extent, while those that gained the most today were Cemex Latam Holdings (CLH), BVC and Preferencial Davivienda.

(With information from Cnbc and E-bvc)

–