[ad_1]

ABC on how to check the balance of Solidarity Income in Bancolombia, one of the banks that most supports in the delivery of this economic aid.

The social program of Solidarity Income, which includes the delivery of $ 160,000 pesos per month until June 2021, relies on several banks to make the delivery to the more than 2.9 million beneficiaries with economic aid.

BancolombiaBeing one of the largest banks in the country, it has many clients with savings accounts and beneficiaries of Income Solidario. That, precisely, is one of its services.

The banks have agreements with the National Government for the delivery of the Solidarity Income. There are rates established for such services.

Only by Nequi or Bancolombia A La Mano

Bancolombia previously paid the Solidarity Income to the beneficiaries who had their savings account there. There are also those who received the subsidy through digital products such as Nequi or Bancolombia a La Mano. The last two are digital account products (simplified procedure).

So far, all clear. The unbanked assigned to Bancolombia enroll in the indicated digital service. On the other hand, those who were on a savings account received their subsidy directly in the savings accounts.

This was how it worked until September, when Bancolombia made the determination to make all Solidarity Income payments only through nequî the On hand. It means that beneficiaries with traditional accounts must create an account in one of these products, as indicated by the financial institution.

The measure also covers those who were with the payment of the Solidarity Income through the transfer modality, to collect it at the window.

Digital account services for the unbanked

There are two products for people who have not entered the banking system. The payment of the economic aid is made, if it is via Bancolombia, with platforms type nequî the Savings at hand.

Nequi is a virtual wallet service, similar to Movie the Daviplata. Same functions, download the application, fill in the data and already have the account ready to receive the Solidarity Income. Some of its features:

- SEND MONEY TO ANY BANK OR OTHER PEOPLE WHO ALSO HAVE NEQUI.

- PAY BILLS ONLINE

- SAVE MONEY AND SET SAVINGS GOALS

- WITHDRAW MONEY AT ANY BANCOLOMBIA ATM OR CORRESPONDENT IN NEQUI.

Savings at Hand it is very similar, but with a difference. The accounts of this product can be created from a phone with SIM Card, in case you have a device without data access.

https://www.youtube.com/watch?v=loEmgc-OERw

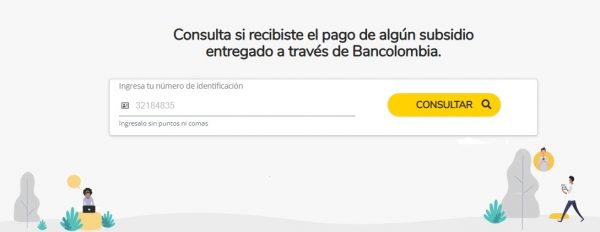

Bancolombia consultation link for Solidarity Income

The bank has an additional option for all its clients. A exclusive inquiry form for people with financial products in the bank to check if they are beneficiaries of the Solidarity Income. If so, know when the balance will be available for withdrawal.

[ad_2]