[ad_1]

Paola Andrea Vargas Rubio – [email protected]

If your income was affected by the crisis unleashed by the covid-19 pandemic and it has been difficult for you to pay your home loan installments, the purchase of a mortgage portfolio could become a good ally to alleviate your cash flow, already that will improve your interest rates and thus reorganize your finances.

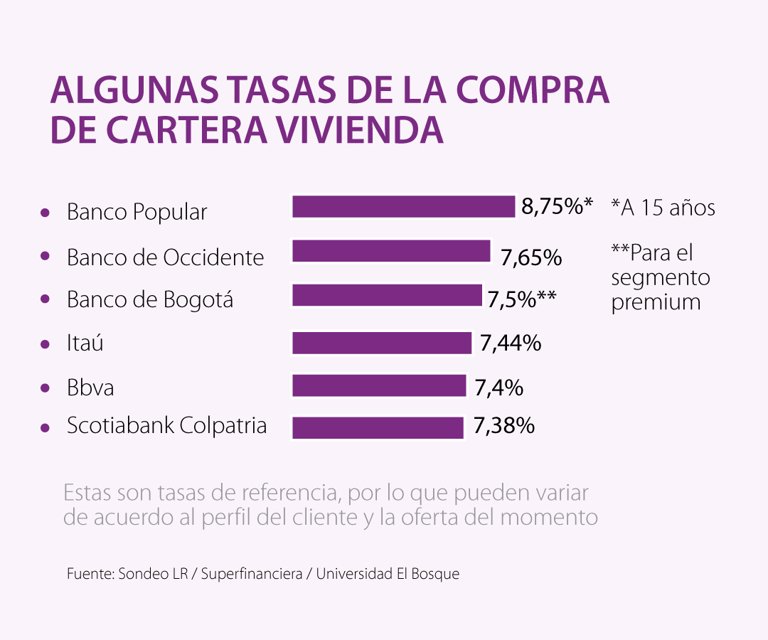

Due to the attractiveness that this possibility could have, LR carried out a survey among some of the credit institutions on what is the rate they offer when buying a mortgage portfolio and it was found that Scotiabank Colpatria offers the lowest rate, among the entities consulted, with 7.38% annual cash (EA).

Danilo Morales, vice president of Scotiabank Colpatria, said that “regarding portfolio purchase issues, the entity observes a higher demand for the mortgage product. In the last three months, the behavior of the purchase of mortgage portfolio rose 34% ”.

The other entity that has one of the lowest rates is Itaú, with a rate from 7.44% EA, for which Hernando Osorio, Vice President of Retail Banking at Banco Itaú Colombia, stated that in the case of the housing segment, “ the entity’s offer includes the purchase of a mortgage loan portfolio and also leasing. This is a differential option in the market ”.

On the other hand, Bbva offers rates from 7.40% effective annual, Banco de Bogotá, 7.5% (premium segment); Banco de Occidente, 7.65%; and Banco Popular, 8.75% (at 15 years). These rates are references delivered by banks, but vary according to the client’s profile and the current offer. Bancolombia said that it did not share the reference rate, because it is not public information, and Davivienda explained that the rate depends on each profile.

Based on these percentages, David Nieto Martínez, professor and coordinator of the financial area of the Faculty of Economic and Administrative Sciences of El Bosque University, explained that users of the system could save up to $ 200,000 each month if they have an initial obligation of $ 140 millions.

Nieto’s calculation is based on a mortgage loan of $ 140 million, at 180 months (15 years), and with a rate of 10% EA, so the monthly payment would be $ 1.46 million in the event that the initial interest, but if the option to purchase the portfolio is chosen, the monthly fee would drop to $ 1.26 million (see graph).

Taking into account the reductions that housing loans could have through this product, Bbva highlighted that “due to the dynamics and current conditions of the economy, the portfolio purchase line becomes a very important tool for clients improve their financial conditions ”.

What could be saved in 15 years

In a $ 140 million 15-year obligation, with an initial rate of 10% EA (excluding insurance), the final value that would end up being paid would be $ 584.8 million. While if you opt for the mortgage portfolio purchase option, you could eventually pay less than $ 430 million, taking into account the reference rates shared by the entities, that is, an average of $ 170 million could be saved in this case , highlighted Nieto. According to the Financial Superintendency, the average interest rate for non-VIS loans is 9.95%. “In all cases, counseling is crucial,” added the teacher.