[ad_1]

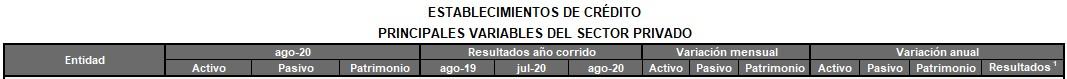

Despite the fact that the total financial system reported improvements in its accumulated earnings between January and August 2020, the balance sheets of the banks saw an acceleration in the fall of the utilities.

In the case of Colombian capital banks, Figures as of August show that earnings fell 44.5% annually to total $ 3.35 billion when a year ago they were $ 6.04 billion. As of July, this variation was 32% per year, that is, there was an acceleration in the fall in profits between both months.

When comparing the figures reported by Colombian banks to the Financial Superintendency, it is evident that most of them saw the negative variation in their earnings grow between July and August.

The ranking

The count of the 16 local banks indicates that only one of them (Coopcentral) shows losses as of August, while Banco de Bogotá continues to lead profits, reaching $ 1.4 trillion (-18% annually) followed by Bancolombia with $ 970 thousand million (-57% annually) and by Davivienda with $ 305 billion (-64% annually).

The case of Banco Credifinanciera continues to stand out, which, despite the crisis, increases its annual earnings by 718% to levels of $ 26 billion.

The foreigners

The outlook for foreign capital banks operating in Colombia is a bit darker. Its earnings fall 92% as of August 2020 compared to a year ago. A year ago they made more than $ 1 trillion and now they barely make $ 87 billion.

Among those most affected by this situation are the Itaú Corpbanca Colombia bank that, due to an accounting effect, now loses $ 702 billion when a year ago it earned $ 134 billion.

Another of the foreign banks that reported losses as of August 2020 was Scotiabank Colpatria with $ 112 billion. Since June, its president Jaime Upegui had anticipated adverse results for the entity as a result of the crisis situation due to coronavirus.

–