[ad_1]

The profits of the 25 national and foreign banks operating in the country reached an accumulated $ 3.53 trillion at the end of July this year, that is, 42.5% below the levels registered during the same period of 2019 , when the profits of these entities were located at $ 6.14 trillion, according to data from the Financial Superintendence.

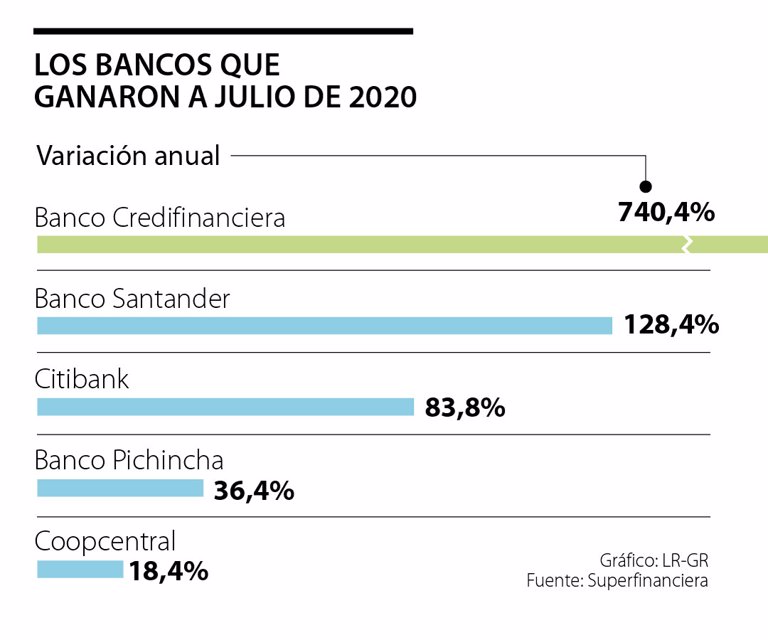

In the midst of this fall in profits, six of the 25 banks operating in the country ended July with growth in their profits: Banco Credifinanciera (740.4%), Banco Santander de Negocios Colombia (128.4%), Citibank (83 , 8%), Banco Pichincha (36.4%), Coopcentral (18.4%) and Banco Serfinanza (2%).

Credifinanciera Bank It is the one with the highest increase in profits, not only within the segment of national banks, but in general. At the end of the first semester, this company was also the one that registered the most an increase in its profits, which occurred after the Superfinanciera approved its creation, which occurred after the union with ProCredit.

While the banks that marked the reduction in profits for the seventh month of the year compared to the same month of last year were Itaú Corpbanca Colombia, with -681.8%; Banco Compartir, with -382.1%; Scotiabank Colpatria, with -150.5%; Banco Multibank, with -100.0%; and Banco Caja Social, with -76.4%.

Next are Davivienda (-58.3%), Bancamía (-48.2%), Banco Finandina (-43.9%), Bancoomeva (-42.0%), Banco de Occidente (-35.4% ), among others.

The previous data led to the fact that between January and June of this year, not only foreign banks registered a drop of 89.9% in terms of profits, but national entities also recorded a decrease in this of 32.4%, from According to the recent report of the Superfinanciera.

Pedro Preciado, leading partner of Financial Services at Kpmg in Colombia, highlighted that the profits of the credit establishments continue to suffer because the income is caused, but their collection is uncertain and the growth of new loans is not close to those budgeted by these establishments previously.

Another reason that is negatively impacting the companies’ earnings has to do with “the payment behavior of the debtors and the grace periods granted by financial entities, which end up affecting the deterioration of the portfolio by increasing the level of provisions. “Added Preciado.

Despite the fact that circumstances such as the previous ones have been hitting the profits of the banking entities in these months, these companies registered a recovery of $ 689,413 million in terms of profits when comparing the consolidated figures of June with those of July of this year, since they went from $ 2.6 trillion to $ 3.58 trillion.

David Nieto Martínez, teacher and coordinator of the financial area of the Faculty of Economic and Administrative Sciences of El Bosque University, highlighted that this improvement in profits as of July is due to the measures adopted by the entities and the different support that the National Government, this has allowed maintaining a stable relationship in terms of compliance with a large part of the obligations acquired by third parties.

In line with this, Alfredo Barragán, an expert in banking at the Universidad de los Andes, assured that the increase in profits could be due to the fact that the entities are taking measures that allow them to recover income from collection of other concepts. However, they have not had significant disbursements that guarantee a relevant increase.

Based on this context, Barragán assured that “it is most likely that this year the banks will not be able to recover. If they were to record notable profits, it would be because a good part of last year’s profits would save this one. They are expected to recover by the end of 2021 ”.

The profits of the financial system

The Financial Superintendency revealed that the general profits of the financial system reached $ 8.5 trillion at the end of July of this year, that is, $ 50.2 trillion less than what was recorded during July of the previous year, when profits were $ 50.6 trillion. .

The sectors that marked this collapse were pensions and severance pay, which recorded a loss of $ 2.8 billion; that of securities intermediaries, with a fall of $ 1.7 trillion, and the Sedpe with a collapse of $ 19,653 million.

While credit establishments reached $ 4.6 trillion at the end of the seventh month of this year. Of this total, 66.2% correspond to the net interest margin, financial services, term operations and investments participated with 4.9%, 8.7% and 18.8%, in their order.

This is how the behavior of collection progresses in the financial system

According to the Superfinancial, “as the grace periods have been gradually ending, the financial entities have reactivated the payments suspended during the economic emergency (…). Thus, as of August 2020, the percentage of the portfolio collected with respect to the gross balance reached 5.33%, a figure higher than that registered at the end of June when it represented 3.76%, although lower than the ratio reached at levels prior to the covid-19 pandemic “.