[ad_1]

In the most recent meeting of the Banco de la República de Colombia, the manager Juan José Echavarría announced that the issuer was closing the options to continue with the lowering of interest rates. For Echavarría there is less and less space.

In fact, the issuer’s manager explained that, although the latest decisions of the Board had been unanimous, the outlook would not be the same for future meetings.

Recommended: Inflation in Colombia in August 2020 was -0.01%, revealed DANE

Against this background, the economic research group of Banco de Bogotá delivered a new analysis based on the inflation results presented by the National Administrative Department of Statistics (Dane) last weekend.

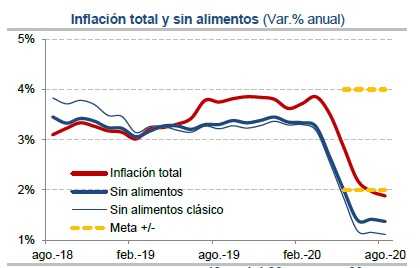

The report says that, with a variation of -0.01% in the cost of living, in the eighth month of the year, Colombian monetary policy has a new window to see a reduction in interest rates.

On this occasion, the forecast would be for a drop of 25 basis points, which is the rate at which the issuer comes. If what was budgeted for, the indicator would drop to 1.75% (reaching a new historical low).

That forecast, the analysis reads, “becomes the central scenario, with inflation and its expectations being the determinants of additional interest rate adjustments in the short term. On the contrary, in the medium term the activity data and the speed of its recovery will be more relevant ”.

Also read: Basic inflation down again in Colombia: Banco de la República

For the rest, the bank’s economic research team expects inflation in Colombia to end at 1.7% in 2020.

Although it makes the caveat that it maintains “a particular concern for the uncertainty which is still in force due to the reversal of public service rates in the coming months ”.

–