Path?

Vladimir Simisek / Agence France-Presse / Getty Images

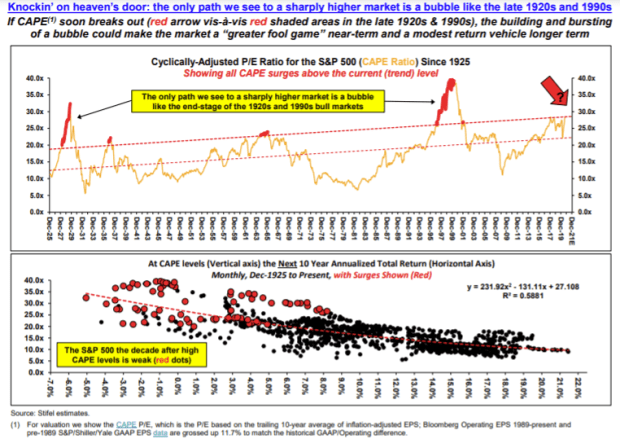

If a popular valuation move continues to press the press to compete in the late 1920s and early 1990s, the stock market could be in the hands of another “big idiot” kicking the bubble, warns the Street Street giant. That vigilance of the march is called the market rally.

Barry Bannister, head of Steffel’s Institutional Equity Strategy, noted that the cyclically adjusted earnings, or CAPE, ratio was seen in the last two years of the 1920s and 1990s rallies. The cap ratio, formulated by Nobel laureate economist Robert Schiller, measures the price of the S&P 500 SPX,

Divided by average corporate earnings over the past decade. After taking such a long look, its proponents argue that it simplifies cyclical variation and gives a better view of where the assessment goes against history.

Related: Tech stocks and the rest of the market are very expensive – but for 2 ‘completely different reasons’

“The bubble building (and inevitable bursting) of the Capai eruption poses a ‘big fool game’ challenge to the market in the near term and the modest return vehicle pushes investors’ optimism in the long run. See chart below).

Stifel

The “big flower theory” is used to describe bubble markets in which investors buy assets regardless of the basic fundamentals, believing that they can later sell “even bigger fools” at a higher price.

As the Federal Reserve moves toward capturing bond yields, the equity risk premium – the additional return demanded by risk-free treasuries to hold risky equity – is under pressure. The last peaks through the S&P 500 index over the past 100 years have been linked to a rise in equity risk premiums, Bunister said, noting rallies have been held as investors are willing to earn more for every dollar earned – P / E multiple.

If the Fed can maintain real yields for 10 years, the S&P 500 could rise, Bannister said.

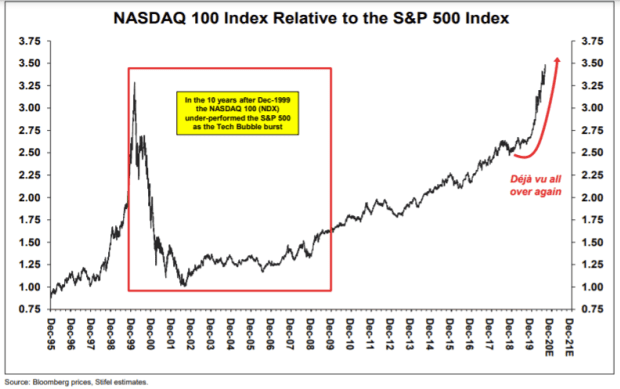

But after the peaks comes the pain. Bannister pointed to the future of the tech-centric Nasdaq-100 NDX,

After the tech bubble burst in 2000 and the so-called Nifty 50 stocks – a group of large-cap stocks that helped propel the bull market in the late 1960s and early 1970s – only decades after the opacity campaign.

While the Nifty 50 recorded good earnings per share growth between 1972 and 1982, offset by a reduction in the price-to-earnings ratio or P / E contraction, with investors paying less per dollar of earnings. Similarly, in the 10 years since the peak of 2000, the Nasdaq-100 has suffered a painful unwinding as its P / E ratio has declined more than earnings per share, Bannister said (see chart below).

Stifel

Tech stocks on Wall Street led the second phase of heavy losses on Friday, a day after suffering their biggest one-day drop by major benchmarks since June.

The quick run-up by large-cap tech stocks and other fast-moving Megac app names helped drive Nasdaq Composite COMP,

The March epidemic-driven stock market has seen nearly 30% annual advances and more than 70% growth from the bottom, while the S&P 500 returned to record territory last month with gains by tech and other popular sectors.

Just before the S&P 500 hit its March 23 low, BNister asked stocks to call an aggressive bonus. But he warned on Aug Gust on that “extraordinary P / E-led bullish market” was moving from the March low due to liquidity in the market and low real yields.

Bannister, in its Friday note, observed that investors have drawn a distinction between the recent up-and-coming dot-com bubble in tech-led stocks, leading to higher earnings fundamentals for today’s tech giants.

But Bannister argued that “price and fundamentals are separate issues.”

Now despite the understanding of the sounder tech fundamentals, “the way of price is exactly the same: an ‘ascending curve’, in which all attendees have risk and reward,” he said.

.