In the years following the brick-and-mortar meltdown, the epidemic. Desperate action is needed now.

By Wolf Richter for Wolf Street.

Simon Property Group and Brookfield Property Partners obtained bankruptcy court approval this week to buy Jesse Penny’s retail and assets operating assets, which he filed for bankruptcy in May. Simon is the most mall REIT [SPG] U.S. In Brookfield Property Partners is an entity of Brookfield Asset Management, a large complex Canadian asset manager and PE pay firm with numerous companies. Brookfield Properties became a huge mall landlord when it acquired REIT GCP, the second largest mall building in the U.S. in 2018. In 2010, General Growth Properties, as it was known, filed for bankruptcy, with Brookfield raising funds in exchange for an equity stake. In 2018, when the GCP was on the verge of bankruptcy, Brookfield bought the remaining બાકી 15 billion from RIIT.

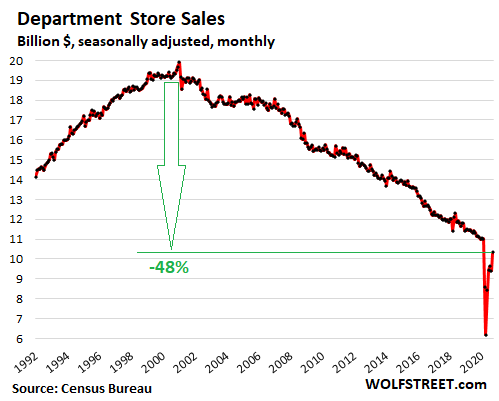

But one of the top 10 ecommerce sites in the U.S. for commercial-type purchases sold in malls has seen a massive shift to online online platforms, including mall retailers’ plat online platforms like Macy’s. No group has been hit harder than brick-and-mortar department stores, which make essential anchors in malls. This started 20 years ago, when department store sales peaked. Sales fell 45% from December 2000 to February 2020, following a series of department store bankruptcies including the # 1 department store chain Sears Holding. As of September 2020, sales were down 48% from that peak:

So now, Simon and Brookfield, as well as other mall RITs, are buying retailers out of bankruptcy court to keep stores open so they can pay rent and otherwise fill vacancies, and create some foot traffic and attract a few shoppers. Other stores, so they too can continue to pay rent and prevent the mall from turning into another zombie mall.

If Simon and Brookfield had not taken the step, Jesse Penny would have been hit. This would have closed 60,000 or so remaining jobs and 650 remaining stores – about 90,000 jobs and 800 stores were down before filing for bankruptcy.

Simon’s Mall has Jesse Penny stores, and his malls in Brookfield also have Jesse Penny stores. These are anchor stores. If those stores close, it will be difficult to find new tenants who are willing to pay what department stores pay. Anchor stores are magnets that attract foot traffic.

Without anchor stores, there won’t be enough foot traffic to keep other stores open, and one by one they will close. This has happened many times before the epidemic, and the epidemic is accelerating the process. Each of these Jesse Penny stores needs to stay open and attract shoppers to keep the mall alive.

A joint venture between Spark, Simon and Authentic Brands – in which PE firm BlackRock became the largest investor last year – has acquired other collapsed retailers, including Brooks Brothers, Forever 21 and Lucky Brand. He has a portfolio of more than 50 brands in Thantic brands. In November last year, he bought some pieces of Berries New York out of bankruptcy.

Now the idea is that some of those brands will be given to J.C. Entered some stores, including Penny – and people will come, or whatever.

Simon focuses on the moles in the best places, and he resents the mall-year pre-epidemic brick-and-mortar melt mel better than other mall homeowners. Some landlords have already filed for bankruptcy, including two real estate companies last Sunday: CBL and Associates Properties and the Pennsylvania Real Estate Investment Trust. And things are getting difficult for Simon too.

Vaccine Monday, SPG’s peat down shares rose 27.9%. But then Simon reported quarterly results, which were rough. Revenue plunged 25% in the third quarter, and business fell to 91.4% on September 30, from 94.7% a year earlier and the lowest in many years. By Wednesday, the SPGA vaccine had dropped nearly half of Monday’s gain.

Buying your own crumbling tenants out of bankruptcy, while their entire business model has been dying for two decades – ignoring the epidemic for even a moment – is a sign of frustration to keep stores open, otherwise it will close and empty the mall. .

In a way, in the short term, that’s a good thing: keep some jobs, stop dropping business rates, and keep turning moles into zombies.

But even Simon doesn’t want Americans to give up ecommerce. This is a structural shift in how Americans buy. Mall retailers are the bull of what e-commerce is all about. The damage began years ago. I have been documenting brick-and-mortar meltdowns since at least 2016. This structural shift is not a new development, although mall homeowners have publicly idolized the phenomenon at every turn.

Simon has already distributed several malls, including sending jingle mails to creditors. Simon, for example, walked away from the mortgage of a 1 million square foot super-regional mall in the suburbs of Independence Center, MO, Kansas City. When the mall was sold in a mortgage sale in April 2019, it caused a loss of 150 150 million to investors in commercial mortgage-backed securities. CPBS Trapper, who is keeping an eye on it, called it “the biggest loss ever by a retail CMBS loan.” This was only part of a regular brick and mortar meltdown and lasted for a year before the epidemic. And now the process – including jingle mail – has accelerated.

At the time of securitization in CMBS a few years ago, the loan-to-value ratio was very low due to inflated collateral values. Then hit the trouble. Reading Jingle Mail tortures commercial mortgage-baked securities as property values

Have fun reading Wolf Street and want to support it? Using ad blocs – why do I get it perfectly – but want to support the site? You can donate. I really appreciate it. Click on a beer and iced tea mug to find out how:

Would you like to be notified by email when Wolf Street publishes a new article? Sign up here.

![]()