Florida 2000: The game of nightmares.

Rhona Wise / Agence France-Presse / Getty Images

Analysts will continue to fill out research reports with guesses as to what a Joe Biden presidency would mean if Donald Trump won a stock market election. But nothing is likely to shake financial markets coming November 4 – the day after the election – quite as an uncertain outcome.

For anyone who has drawn attention to the bitter presidential race of 2020, it is a scenario that is not easy to dismiss.

This year’s election already seems likely to be “the most litigious in history”, wrote Thomas McLoughlin, head of US fixed income at UBS, in a Tuesday note. Plaintiffs have filed 192 lawsuits in at least 41 states stemming from changes to voting procedures in the wake of the COVID-19 pandemic, he said. Combined with other lawsuits that predate the outbreak of coronavirus, the total number of challenges increases to more than 200.

To read: Why the fall of the dollar into a rut could be changed as ‘political annoyance’ continues

Postmaster General Louis DeJoy on Tuesday sought to reassure voters about fears that the U.S. Postal Service could not handle power in the mail-in vote, and announced to the agency to halt operational changes, including removal of mailboxes and sorting machines, for the elections in November.

To look: Postal service chief obliged to receive ‘some volume’ of election post in November

Such moves, which DeJoy had carried out in what the agency said were efforts to cut costs, drew control from Democrats. They accused the administration of trying to delay the delivery of votes in response to President Trump’s opposition to universal post-vote.

Trump, who plays Biden in national polls, has accused that e-mail voting throws up the potential for widespread fraud, although studies have found no such evidence.

A study by the Conservative Heritage Foundation and controlled by the liberal Brookings Institution found less than 50 copies of voter fraud in a sample of the five states that use exclusivity by mail per post, McLoughlin noted.

But a delayed outcome, even with a few added postal service hangups, remains a major possibility given the potential crush of post-in votes this year. After all, it took six weeks to certify results for two congressional primaries in New York this summer, while the outcome of Utah’s close Republican gubernatorial primary was delayed by a few days if absentee votes were counted, the analyst noted.

Meanwhile, if the popular vote in the battlefield states is close, it is likely that some states will count absent votes until the evening of Nov. 3. And the next day, McLoughlin said, noting that a handful of battlefield states, including North Carolina, Iowa, and Ohio, only require that the ballot be postmarked by election day and received shortly thereafter to count.

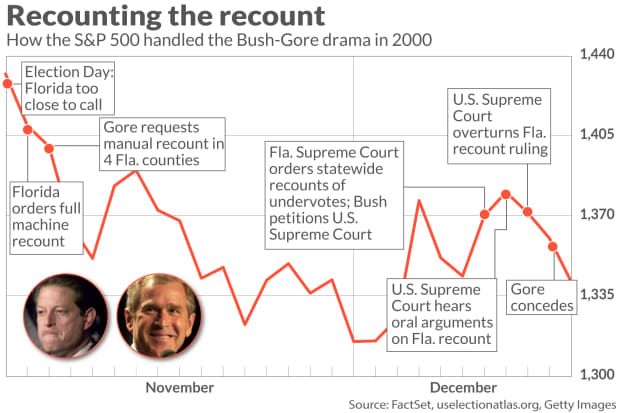

So what happens if the outcome is unclear? Investors can look back on the 2000 presidential election, which was not decided until mid-December when Democrats and surrogates for Democrat Al Gore and Republicans George W. Bush engaged in a battle over Florida bills that saw terms as ” butterfly “and” hanging chads “go into conversation every day.

The S&P 500 SPX,

fell 8.4% between election day on November 7 and December 15, the day after Gore announced in the wake of a Supreme Court ruling ending the recurrence (see chart below).

McLoughlin notes that the Dow Jones Industrial Average DJIA,

fell more than 5% in the two weeks after the election, as litigation “threatens to prolong the uncertainty”, while subsequent academic research indicated that the most negative reaction in the market occurs in the first four days after a unclear election outcome. Gold prices GOLD,

rose in the midst of uncertainty in 2000, but regained its profits in the following weeks.

Investors “should be prepared for volatility in the event of an inexplicable result. “Markets despise uncertainty, so it is reasonable to expect safe havens such as gold and US government security to offer some relief,” he said.

But it is too early to make any portfolio adjustment, he said, while also emphasizing that any initial volatility “should disappear with time.”

.